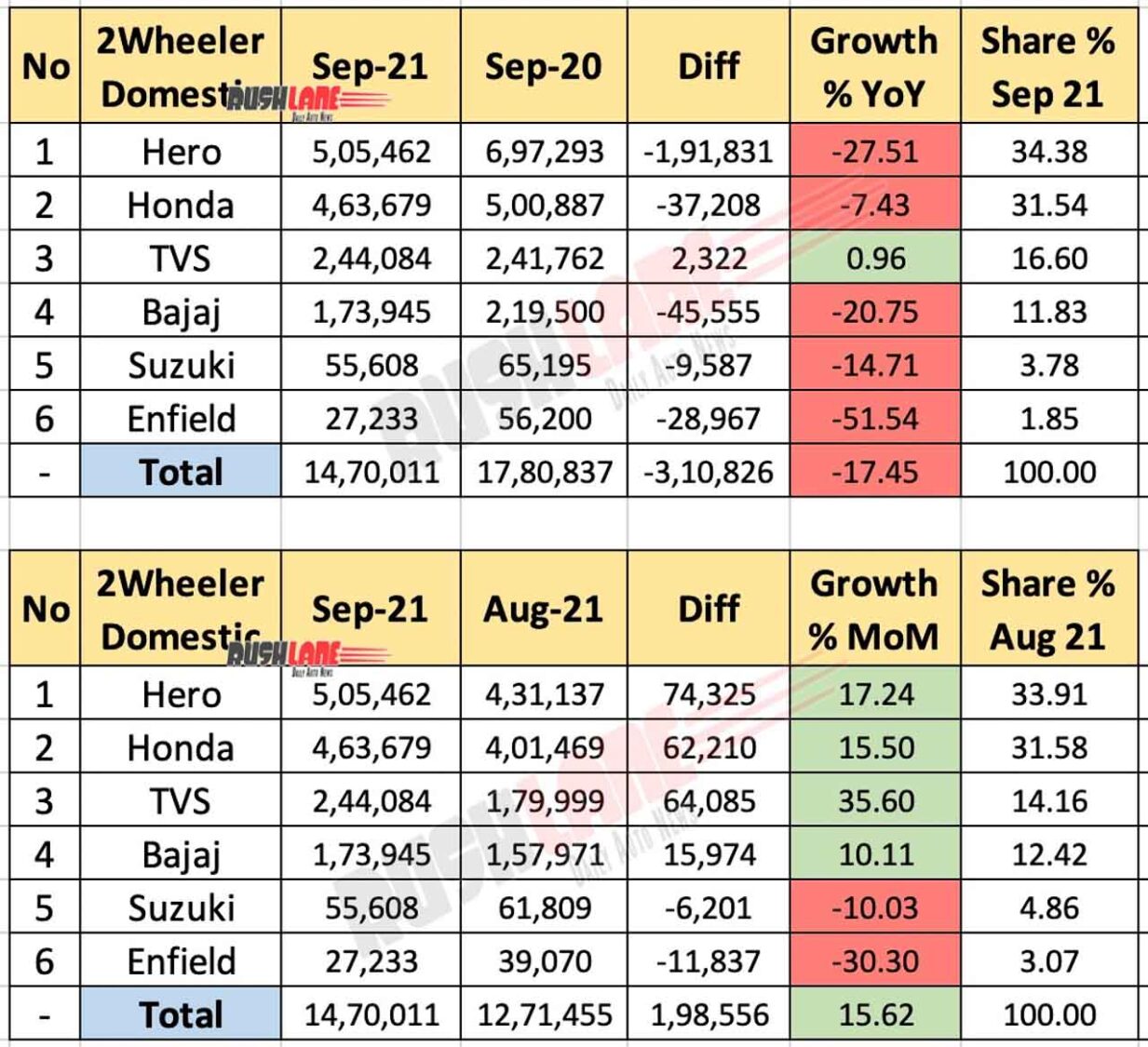

While domestic YoY growth has turned negative in September, MoM numbers have registered double-digit growth

A total of 14,70,011 units were sold in September in domestic market. YoY sales are down by -17.45%, as compared to 17,80,837 units sold in the corresponding period last year. All except TVS have negative YoY growth in September. MoM growth is up 15.62%, as compared to 12,71,455 units sold in August 2021. Only Suzuki and Royal Enfield have negative MoM growth in September 2021. Exports in September are at 3,38,179 units. While YoY numbers are up by 8.42%, MoM growth is down by -1.99%.

Two Wheeler Sales Sep 2021 – Domestic

Hero MotoCorp continues to lead in domestic market, commanding a market share of 34.38%. A total of 5,05,462 units were sold in September. YoY growth is down by -27.51%, as compared to 6,97,293 units sold in September last year. MoM numbers are up by 17.24%, as compared to 4,31,137 units sold in August 2021. Hero relies heavily on its motorcycles to generate volumes. Among the primary contributors are Splendor and HF Deluxe. In September, more than 92% of the company’s sales were contributed by motorcycles.

At number two in the list is Honda with sales of 4,63,679 units in September. YoY growth is down by -7.43%, as compared to 5,00,887 units sold in September last year. Market share is at 31.54%. MoM growth is up 15.50%, as compared to 4,01,469 units sold in August 2021. Unlike Hero, Honda’s top selling product is its Activa scooter. Other key contributors include CB Shine and Dio.

TVS is at number three with sales of 2,44,084 units in September. YoY growth is up by 0.96%, as compared to 2,41,762 units sold in September last year. Market share is at 16.60%. MoM growth is 35.60%, as compared to 1,79,999 units sold in August 2021. TVS MoM growth is highest in the list in percentage terms. It is also the only company to register positive growth in both YoY and MoM terms in September.

Next in the list is Bajaj with sales of 1,73,945 units in September. YoY growth is down by -20.75%, as compared to 2,19,500 units sold in September last year. Market share is at 11.83%. MoM growth is positive at 10.11%, as compared to 1,57,971 units sold in August 2021.

Suzuki and Royal Enfield take the fifth and sixth spot, respectively. Their YoY and MoM growth are both negative. With sales of 55,608 units in September, Suzuki YoY loss is at -14.71%. MoM loss is at -10.03%. Royal Enfield sales are at 27,233 units, which is YoY and MoM loss of -51.54% and -30.30%, respectively.

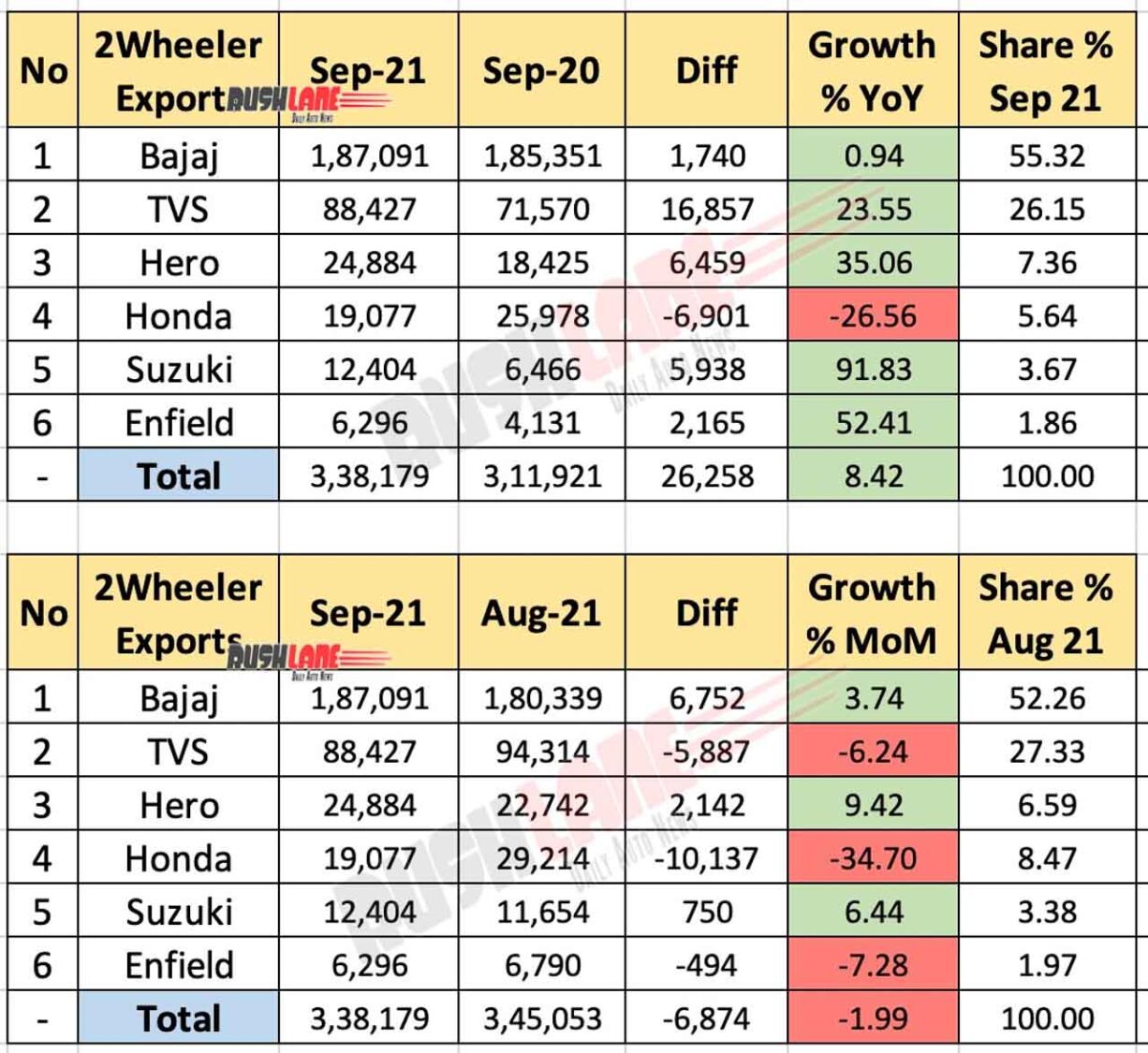

Two Wheeler Exports Sep 2021

Bajaj continues to dominate international markets with exports of 1,87,091 units in September. YoY growth is up 0.94%, as compared to 1,85,351 units exported in September last year. Market share is at 55.32%. MoM growth is at 3.74%, as compared to 1,80,339 units exported in August 2021.

TVS is second with exports of 88,427 units. YoY growth is up by 23.55%, as compared to 71,570 units exported in September last year. Market share is at 26.15%. MoM growth is negative at -6.24%, as compared to 94,314 units exported in August 2021.

Hero is third with exports of 24,884 units in September. YoY and MoM numbers have improved by 35.06% and 9.42%, respectively. Hero market share in exports is at 7.36%. Other OEMs in the list are Honda (19,077 units), Suzuki (12,404) and Royal Enfield (6,296). Among these, only Honda has negative YoY growth. In MoM terms, Honda and Royal Enfield have negative growth whereas Suzuki has gained 6.44%.