Bajaj reported growth for domestic wholesales and exports in November 2020

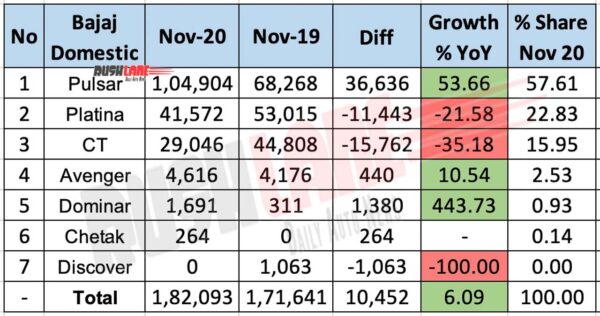

Domestic sales growth for Bajaj in November 2020 was at 6.09 percent. Wholesales grew to 1,82,093 units from 1,71,641 units at volume gain of over 10k units. Comparatively, exports was even better. Bajaj Pulsar, the quintessential bestseller range was listed at 53.66 percent YoY growth.

Wholesales were up at 1,04,904 units from 68,268 units at volume gain of 36,636 units. Consequently, at 57.61 percent share of total Bajaj wholesales, it literally kept Bajaj’s float afloat.

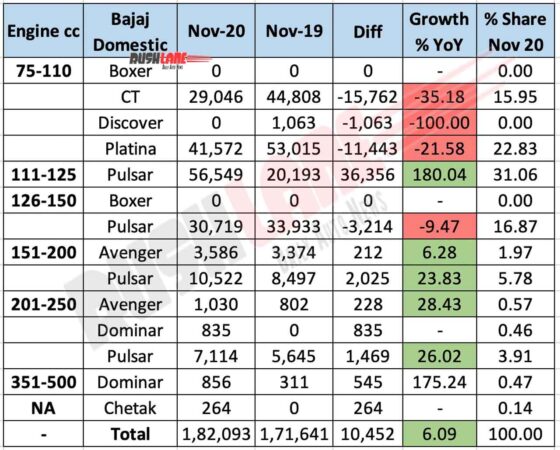

Smaller displacement Pulsar range was most in demand at 56,549 units. This was followed by the 150cc segment offering at about 30k units. At the 200 cc threshold, wholesales was reported at 10,522 units. While the bigger under 250cc unit saw numbers listed at 7,114 units.

Beyond Bajaj Pulsar

There’s no denying that smaller displacement mass market daily commuters make up the majority of market demand. The same is true for Bajaj Platina. While sales stood at 41,572 units, it was noticeably lower than the 53,015 units reported a year earlier. Sales decline was at 21.58 percent. CT sales decline was even more steep. Wholesales fell to 29,046 units. Down 35.18 percent from 44,808 units. Like Platina, CT too aids Bajaj’s small motorcycle quest.

Avenger wholesales was stable at 4,616 units. But this is an easy feat owing too mall sales volume. In fact, Avenger only accounts for 2.53 percent of total domestic sales for Bajaj. Growth was reported at 10.54 percent, up from 4,176 units. The smaller displacement units was the sales star at 3,586 units. Dominar was once projected as the next big thing. Obviously that never came to fruition.

However, sales did pickup last month. At 1,691 units, up from 311 units. YoY growth stood at 443.73 percent. Both displacement units were sold in similar volume. While all of Bajaj’s products are strictly motorcycles, the company did resurrect Chetak last year.

For the most part in an all new electric avatar barring the familiar name. 264 units were sold. Eventually, EV sales will be big. For now, its contribution to total domestic sales last month was .14 percent.

Exports grew in November 2020

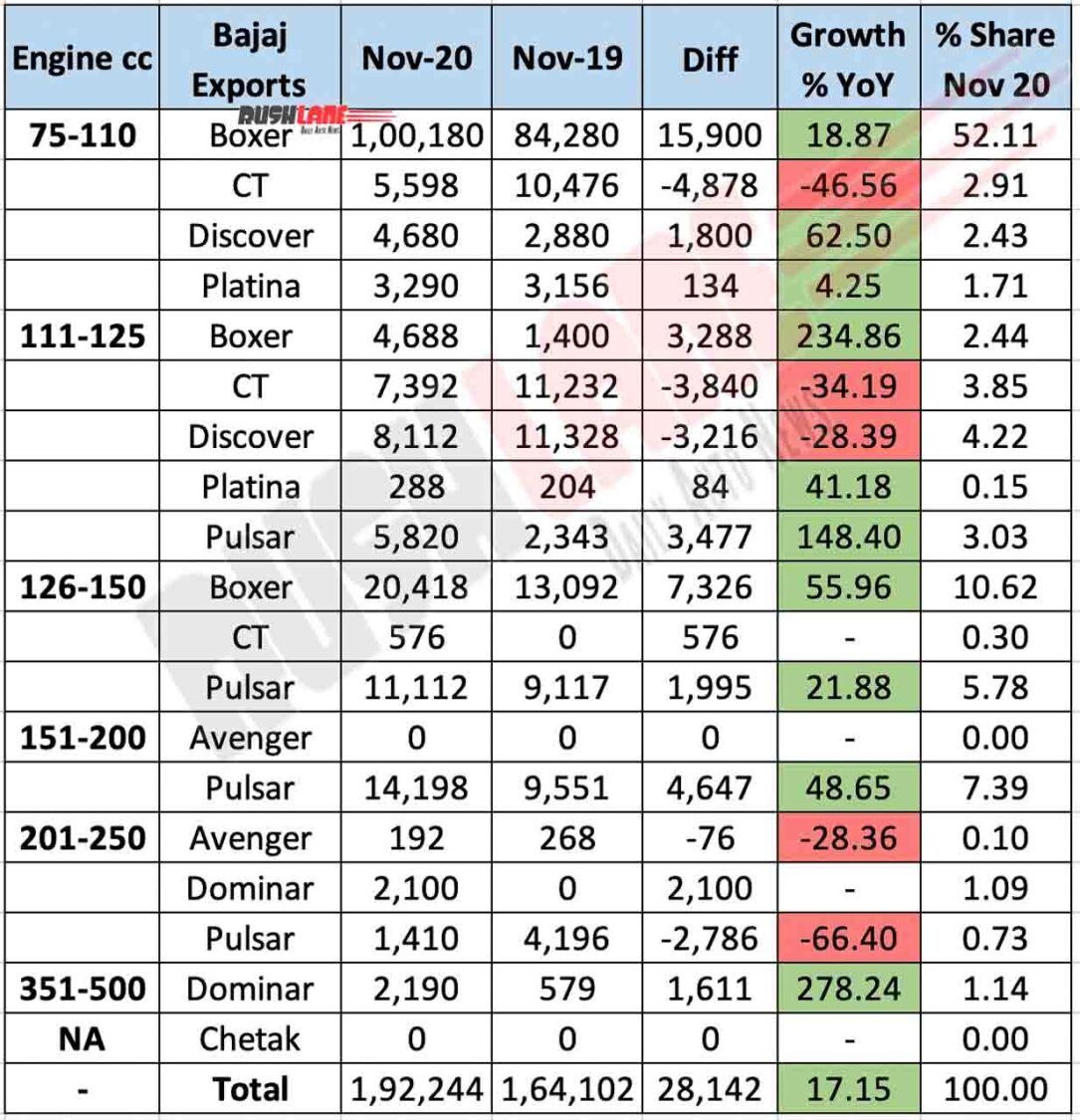

Doing the month, Bajaj Boxer punched its way forward, even stronger than before. Sales grew to 1,25,286 units. Up from 98,772 units at 26.84 units. It made up 65.17 percent of exports. The smallest displacement boxer takes the lion’s share of sales at over a lakh units.

However many boundaries it crossed, Boxer sales in India has long since stopped. In the overseas department, Boxer deafest Pulsar sales by miles. At 32,540 units, exports grew 29.09 percent, up from 25,207 units. For Pulsar, its the mid variants that triumphed collectively at a cumulative total at over 15k units.

CT exports fell 37.51 percent, down to 13,566 units from 21,708 units. The 125cc units accounted for more than half of total sales. Discover exports dropped by almost 10 percent at 12,792 units from 14,208 units. Although once popular name in India, both variants were snipped at the start of FY21. They simply didn’t warrant a BS6 update.

Dominar sales overseas was more than what the company achieved here. Exports grew manifold at 4,290 units, up from 579 units. Platina sales was stable at 3,578 units. Avenger continued its low volume run at 192 units.