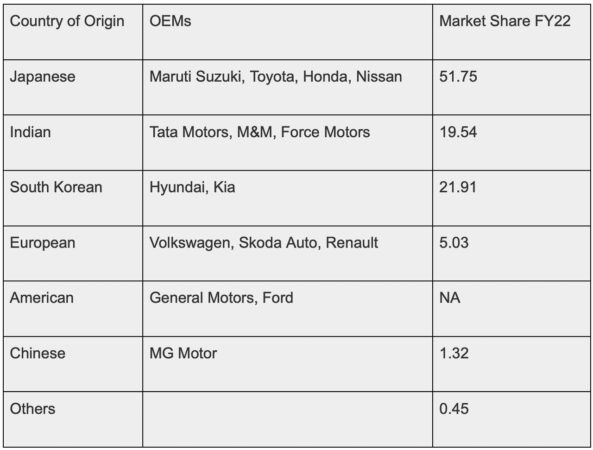

In FY 2022, market share commanded by both Tata Motors and Mahindra increased to 19.5 percent from 14 percent held in FY 2021

The automobile scenario in India has come a long way over the past decade. While the PV segment continues to be commanded by multinational brands, Indian automakers have emerged with renewed vitality. As on date, one in five cars sold in India are from two leading Indian OEMs – Tata or Mahindra.

The number of Indian automakers used to include the likes of Force Motors, Hindustan Motors, Ashok Leyland, Tata Motors and Mahindra in FY 2012. This, over the past decade, has now come down to just three leading automakers of Tata Motors, Force and Mahindra.

PV Market Share – Indian OEMs Vs International OEMs

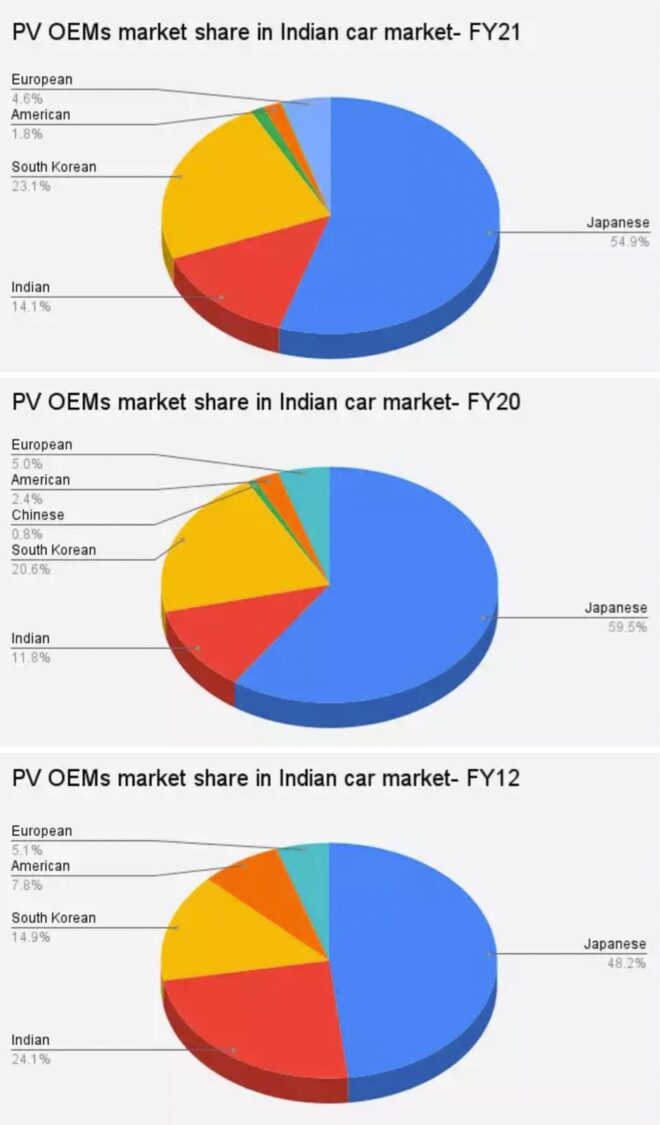

Market share of Indian automakers that stood at 14.45 percent in FY2019, increased substantially to 24 percent in FY 2012 but dipped to 11.8 percent in FY2020. It saw an increase to 14 percent in FY2021 but now, in FY2022, the market share has risen to 19.5 percent and that’s taking into account only Tata and Mahindra. These percentages also show that while Tata and Mahindra increased market share by 5 percent, foreign brands noted a marked decrease.

Tata and Mahindra may have a strong commercial vehicle lineup but their PV segment has also noted outstanding growth. Tata Motors commanded an 8.27 percent market share in FY 2021 which increased to 12.14 percent in FY 2022 which accounts for the company’s highest market share since FY 2019. It may be mentioned that during the peak of COVID pandemic, the company’s market share dipped to 6.85 percent.

Tata Motors has embarked on the electric vehicle route in which it has noted good demand. The company sells three electric products – Nexon EV, Tigor EV and XPRES-T in the domestic market. Tata also recently unveiled a coupe style SUV which it plans to launch in the next two years.

Mahindra has also seen good growth in the Indian automobile segment with significant increase in market share – thanks to newly launched XUV700 and Thar. They have a good hold over rural demand. Force Motors is another Indian automaker but only sells a few units of the Trax and Gurkha in domestic market.

Japanese Automakers Market Share

Japanese automakers, such as Maruti Suzuki, Toyota, Honda and Nissan, which had together commanded a 62.25 percent market share in FY 2019, saw a de-growth to 51.75 percent in FY 2022. This was against a 48.2 percent market share held in FY 2012 which has not related to substantial growth over the past decade.

A maximum portion of this growth could be attributed to Maruti Suzuki that dominates the Indian automobile sector by a hefty margin. Nissan saw an increase in market share following the launch of the new Magnite while Honda saw its market share dip from 5.44 percent held in FY 2019 to 2.81 percent in FY 2022. Toyota Kirloskar Motor on the other hand, has continued to hold on to its 4 percent market share.

Hyundai and Kia, two South Korean automakers commanded a 21.91 percent market share in FY 2022 down from 23.1 percent held in FY 2021 but a significant increase over 14.19 percent held in FY 2012. This increase in market share could be attributed to new launches by Hyundai along with Kia’s more recent entry with models such as the Seltos, Sonet and its new Carens that marked its foray into the much in demand MPV segment. The Kia Carens has met with overwhelming demand to the extent that waiting period is extended to 48-49 weeks for the top spec Carens Prestige.