The passenger vehicle segment has posted a 7.84 percent YoY de-growth in retail sales with Maruti Suzuki commanding a 46.80 percent market share

Passenger vehicle OEMs continued to face shortage of semiconductor supplies all through the past year. These supply constraints have extended to the past two months of 2022 as well and are expected to go on for a further period thus affecting production and timely deliveries. The on-going war between Russia – Ukraine war poses new challenges for the Indian auto industry. The price of crude breaching the US$110 mark has added to industry woes as oil marketing companies could bring in an increase in fuel prices by at least Rs. 10-15.

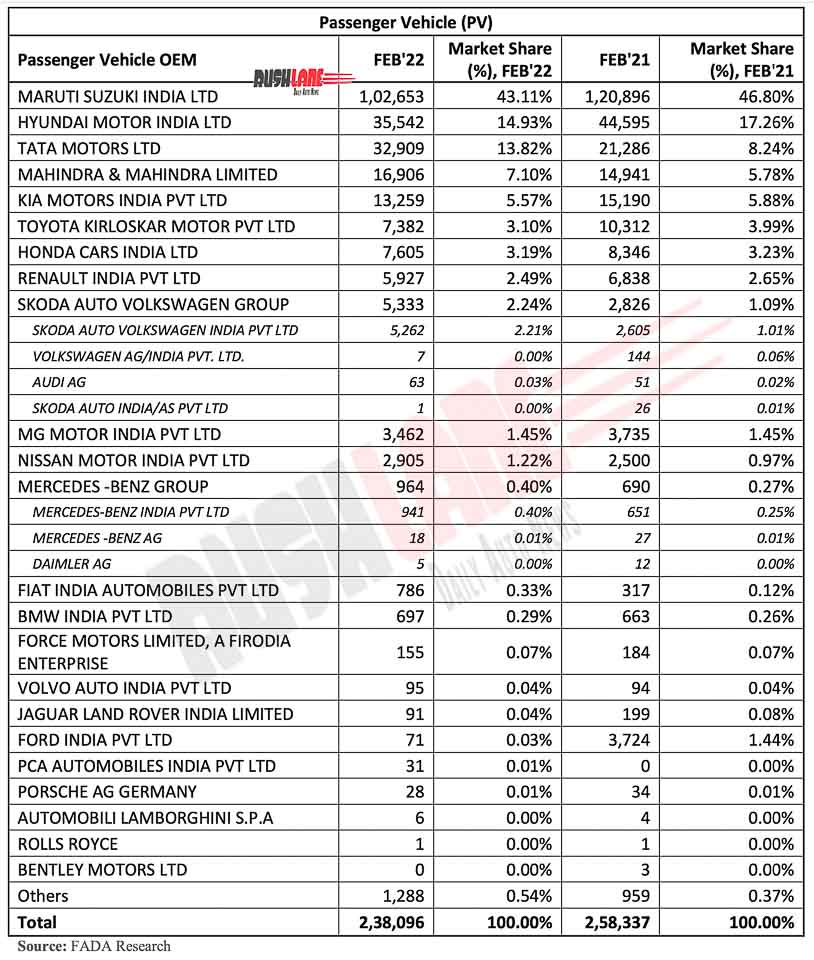

Retail sales of passenger vehicles, as released by Federation of Automobile Dealers Associations (FADA) shows a 7.84 percent decline. Sales which had stood at 2,58,337 units in February 2021 dipped to 2,38,096 units in the past month.

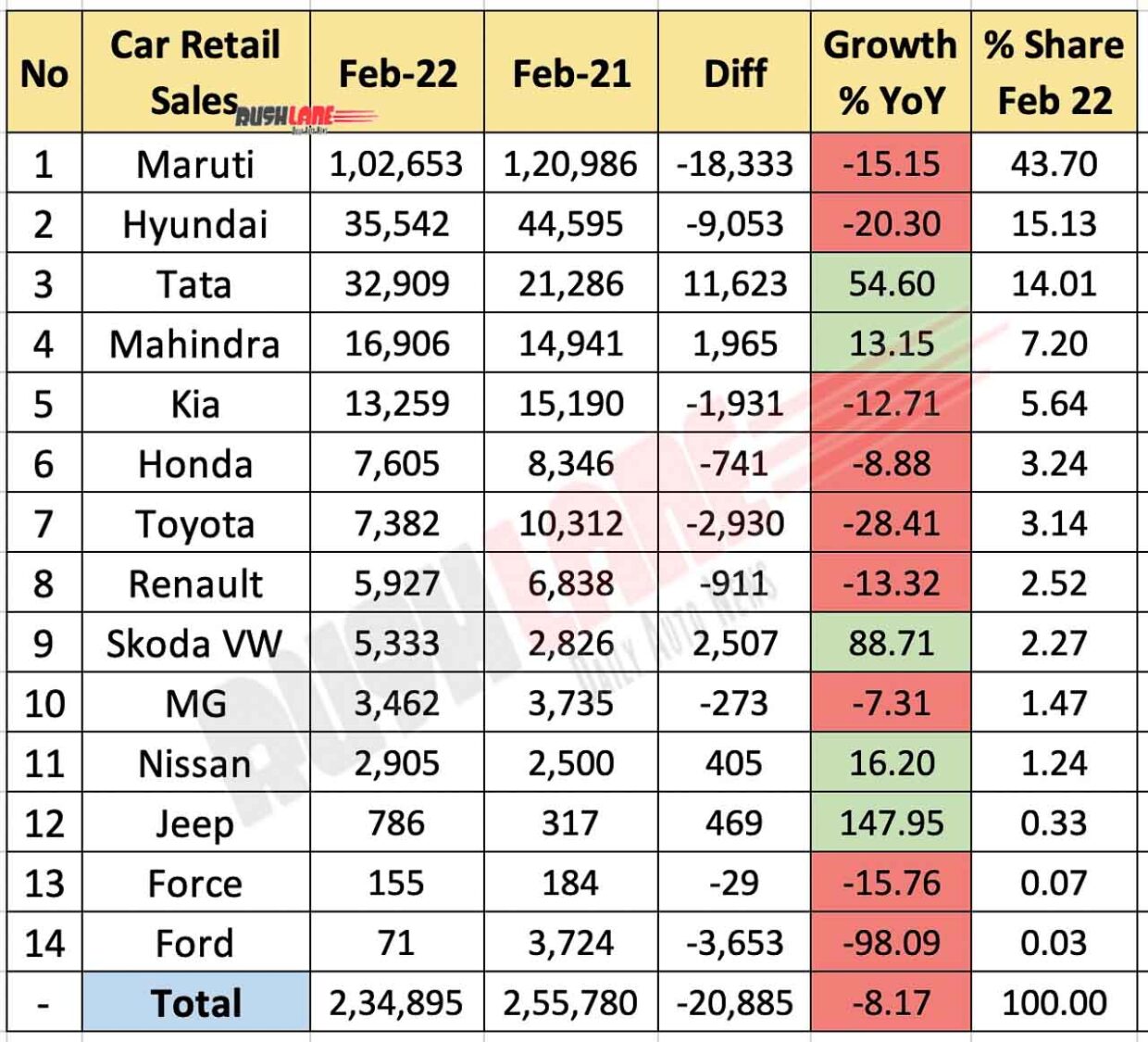

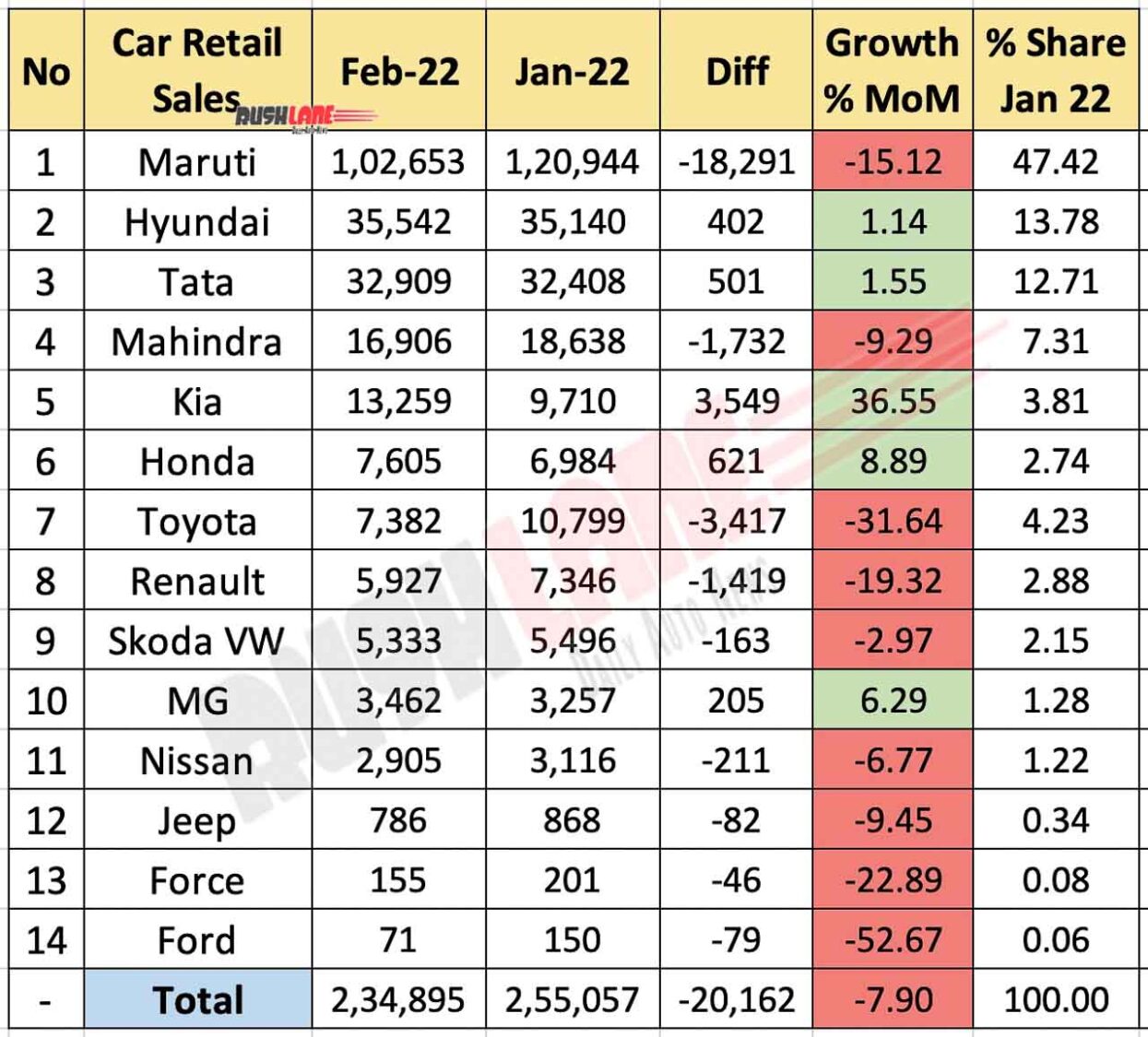

Car Retail Sales Feb 2022 – Maruti Suzuki Leads

Maruti Suzuki India Limited once again topped the sales charts in February 2022 and that too by a significant margin. Total retail sales last month stood at 1,02,653 units, lower as compared to 1,20,896 units sold in February 2021. This caused a dip in market share to 43.11 percent in February 2022 over 46.80 percent held in February 2021. None of the other automakers were able to record retail sales above the 50,000 unit mark.

Hyundai Motor India came in a distant second with 35,542 unit retail sales last month, down from 44,595 units sold in February 2021. Market share also dipped from 17.26 percent to 14.93 percent on a YoY basis. Hyundai is slated to bring in facelifted versions of Venue and Tucson into India. Prototypes of these two cars have been spied on test.

Tata Motors and Mahindra have both posted YoY growth in retail sales. Tata Motors’ retail sales stood at 32,909 units in February 2022, up from 21,286 units sold in February 2021. This brought about a significant increase in market share from 8.24 percent to 13.82 percent. Tata Motors has seen growth both in its passenger vehicle ICE segment while sales of its electric lineup has seen notable growth.

Demand for Mahindra XUV700 and Thar boosted company’s retail sales in February 2022 to 16,906 units in the past month, from 14,941 units retailed in February 2021. Market share increased from 5.78 percent to 7.10 percent YoY.

Kia India saw its retail sales dip to 13,259 units last month. This was against 15,190 units retailed in February 2021 while market share dipped from 5.88 percent to 5.57 percent on a YoY basis. Even as Seltos remained the top contributor, the company’s newest launch, Carens has been met with good response and expected to contribute to increased sales in the months ahead. Kia has also added a third shift at their Anantapur plant, in an aim to reduce wait times for all models.

Toyota, Honda, Renault

YoY retail sales de-growth was seen in the case of Toyota, Honda and Renault. Toyota retail sales stood at 7,382 units down from 10,312 units sold in February 2021 while Honda saw its retail sales at 7,605 units in the past month, down from 8,346 units sold in February 2021. Renault retail sales fell to 5,927 units from 6,838 units YoY.

Retail sales of Skoda Auto Volkswagen Group increased to 5,333 units last month, up from 2,826 units retailed in February 2021. This related to an increase in market share from 1.09 percent to 2.24 percent last month.

MG Motor, with sales of 3,462 units posted a YoY de-growth in retail sales while Nissan saw its retail sales increase to 2,905 units last month over 2,500 units sold in February 2021. Mercedes retail sales also increased to 964 units from 690 units on a YoY basis while Fiat India retail sales more than doubled to 786 units last month from 317 units sold in February 2021.

BMW India retail sales stood at 697 units while Force Motors sold 155 units and Volvo Auto at 95 units. Jaguar sales dipped to 91 units in the past month from 199 units sold in February 2021 while Ford India retail sales fell to 71 units from 3,724 units sold in February 2021. PCA Automobile (31 units), Porsche (28 units), Lamborghini (6 units) and Rolls Royce (1 units) completed this list. There were other PV makers who recorded retail sales at 1,288 units, up from 959 units retailed in February 2021.