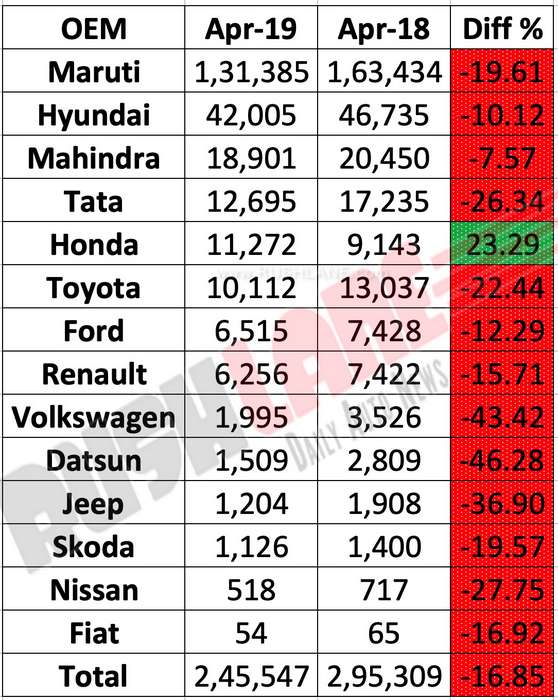

The overall sales trend of passenger vehicles in India for the first month of this financial year paints a grim picture. Compared to April 2018, car sales in April 2019 dropped by 16.7% clearly indicating a significant slow down in the market. Every OEM registered YoY decline in sales except one.

Honda Cars India managed to post 23% growth in April 2019 with 11,272 units as against 9,143 units in previous April. However, the performance doesn’t accurately represent the automaker’s position since the new Amaze which makes up for the lion’s share of Honda’s current sales wasn’t yet launched in April 2018 and hence the base was weak.

Maruti Suzuki, the undisputed leader of the Indian passenger vehicle segment, posted a decline of 19.6% (1,31,385 units) primarily because its Nexa premium outlet chain failed to deliver. Nexa network witnessed a negative YoY growth of 28% as it relies pretty much solely on Baleno for its sales volume. The auto giant also lost nearly 2% of market share in April 19 compared to same period last year but it still governs more than half of the market at 53.5%.

Maruti’s nearest rival, Hyundai, managed to increase its market share by 1.3% (at 17.7%) but the sales volume dipped by 10% to 42,005 units. Of all the OEMs that registered negative growth, Mahindra fared best with decline of 8% (18,901 units excluding Supro and Maxximo). The newly launched XUV300 sub-4m SUV has managed to mitigate the damage to some extent.

Tata Motors, FCA, Volkswagen, Renault and Toyota saw their YoY growth in April 2019 drop by 26%, 36.2%, 36%, 16% and 22% respectively. The worst fall, however, was registered by Nissan and its budget brand Datsun at 42.5%. Despite the launch of Nissan Kicks compact crossover and facelifted Datsun Go, the two brands could only manage a combined sales of 2,027 units last month.

Sales decline has resulted in job losses of over 3,000 in the auto industry. Over 300 outlets of 205 car dealers across have shut down as they have left the business for good. Financial losses amount to over Rs 2,000 crores. Dealerships of all car companies have shut down due to this. Nissan has seen 38 of their dealers shut down, 23 Hyundai dealers have stopped business. Tata, Honda, Maruti, Mahindra each have seen 10-12 dealerships shut down.

The slow down in growth which has been persisting for the last few months seems to be getting worse every passing month. Elections are not helping either. In addition to declining sales, raising commodity prices, unfavorable exchange rates, new government safety and emission regulations, etc., are applying immense pressure on OEMs’ profit margin. As it stands now, nobody can predict when will things get better for the Indian auto industry with reasonable accuracy.