Car wholesales increased 10 percent and 16 percent MoM and YoY in Jan 2021

Rising need for personal mode of travel over shared mobility or public transportation has spurred up demand in the auto sector. This sector which had been facing severe constraints over the past year noted double digit growth in December 2020 and this positive trend has continued in the New Year.

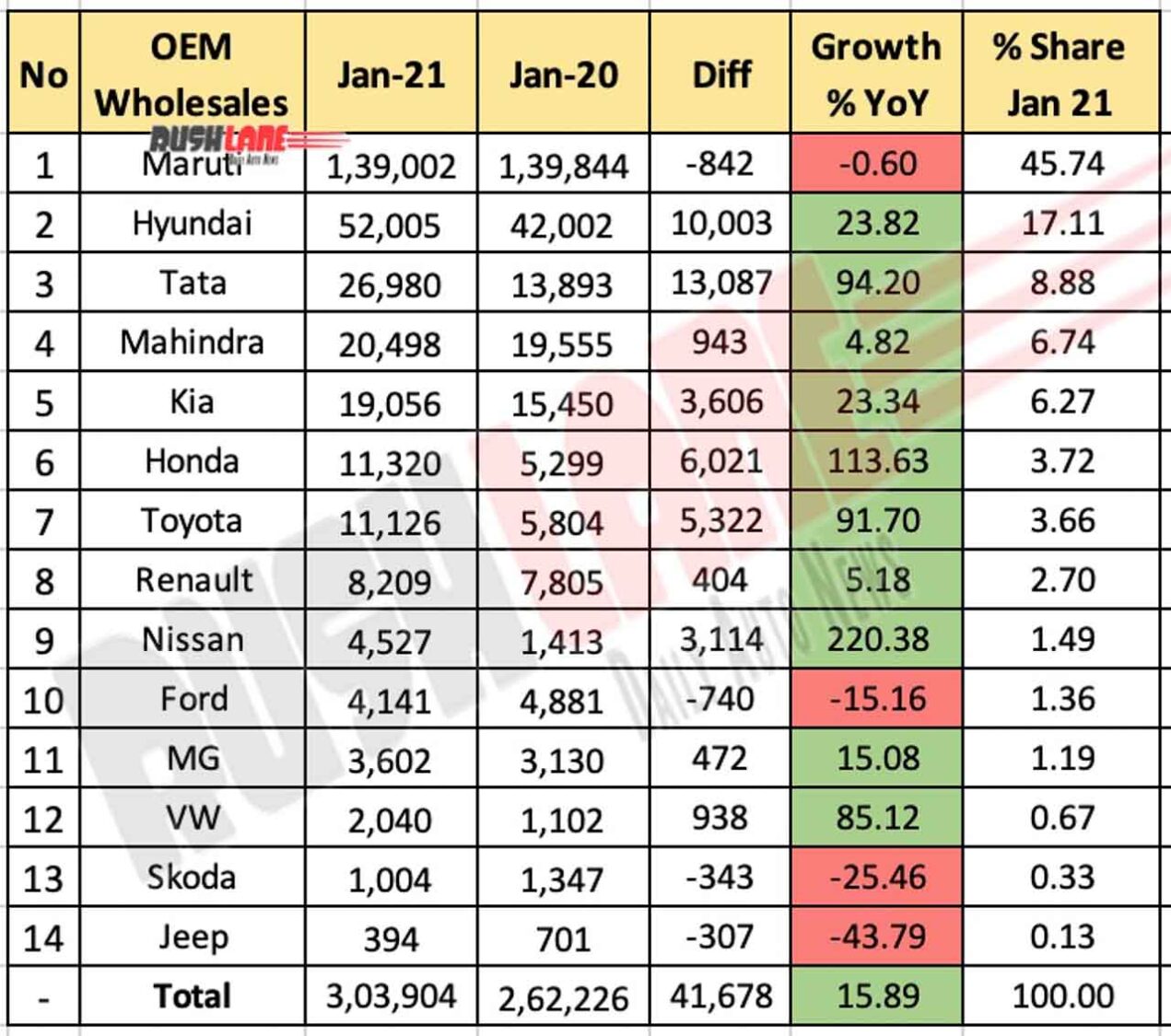

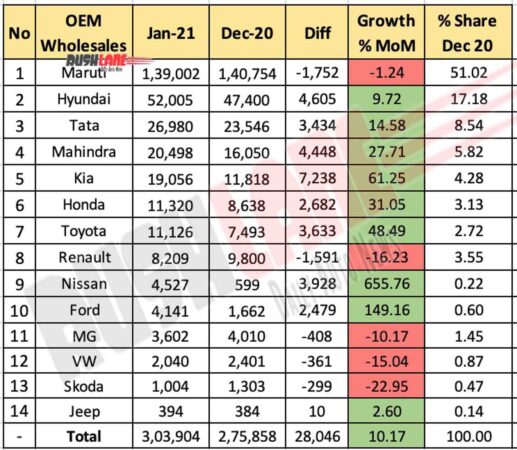

Several new car launches, which were otherwise scheduled for early 2020 had also been put off and made their entry into markets in the latter half of last year which also aided the passenger vehicle segment to post positive sales results. Sales in January 2021 saw a total of 3,03,904 units sold, up 16 percent over 2,62,226 units sold in Jan 20 and higher by 10 percent over 2,75,858 units sold in Dec 20.

Maruti Market Share Declines

At the top of the sales charts, as is always seen, was Maruti Suzuki commanding a major part of sales totals. Currently commanding a market share of 45.8 percent, down from over 53% in Jan 2020 and 51 percent share held in Dec 20. Maruti market share has declined by 7.59% YoY and 5.37% MoM.

The company reported wholesales of 1,39,000 units in Jan 20. Though this was a marginal dip both in terms of MoM sales (1,40,754 units) and YoY sales (1,39,844 units) the company has seen rising demand in the UV segment with increased sales for its Gypsy, Ertiga, S-Cross, XL-6 and Brezza.

Hyundai Motor India Limited saw more positive sales in Jan 21 at 52,005 units, up 10 percent as against 47,400 units sold in Dec 20 and up 24 percent as compared to 42,002 units sold in Jan 20. Hyundai currently commands a 17.1 market share. The company expects to boost sales in the months ahead with new cars being planned among which are the 7 seater version of the Creta and a new micro SUV codenamed AX1 as on date.

Tata Motors Sales Jan 21

Wholesales as reported by Tata Motors in Jan 21 stood at 26,980 units. YoY growth stood at 94 percent with 13,893 units sold in Jan 20 while MoM sales increased 15 percent as Dec 20 sales had stood at 23,546 units. Early last month, the company also increased prices across board. The price hike was upto Rs.26,000 however, it came with a rider that all customers that placed bookings on or prior to 21st Jan 21 would be exempted from this hike.

Mahindra also noted an increase in wholesales in the past month. Sales which had stood at 19,555 units in Jan 20 increased 5 percent to 20,498 units in Jan 21. MoM sales however, noted a higher percentage increase by 28 percent as against 16,050 units sold in Dec 20. Mahindra is currently facing shortage of micro-processor semiconductors but is working with suppliers to speed up supplies to meet market demand.

Kia, Honda and Toyota

A fairly newcomer to the Indian automotive sector, Kia Motors has climbed the sales charts scoring over the likes of Honda, Toyota and Renault. The company’s sales volumes stood at 19,056 units in Jan 21, up 23 percent over 15,450 units sold in Jan 21 and an increase of 61 percent over Dec 20 sales of 11,818 units.

Honda sales have noted a significant YoY increase by 114 percent. Sales which had stood at 5,299 units in Jan 20 surged to 11,320 units in the past month. Toyota also noted a higher YoY sales pitch, up 92 percent to 11,126 units in Jan 21 from 5,804 units sold in the same month of the previous year.

Japanese automaker Toyota recorded sales of 11,126 units in January 21, up 92 percent from 5,804 units sold in Jan 20 while MoM sales increased 48 percent as sales had stood at 7,493 units in Dec 20. In Jan 21 the new Fortuner facelift was launched.

Magnite Boost For Nissan

Even as Renault has noted a 16 percent de-growth MoM to 8,209 units sold in Jan 21 as against 9,800 units sold in Dec 20, Nissan has seen a surge in demand in Indian markets where it had been facing several constraints. Sales in Jan 21 increased to 4,527 units (including Datsun), up 220 percent as against 1,413 units sold in Jan 20.

Launch of the new Magnite saw MoM sales surge 571 percent as against 599 units sold in Dec 20. It may be recalled that Nissan commenced deliveries of the Magnite at the end of Dec 20. The Magnite has seen such demand that waiting period has been extended to 9 months in some cities.

Ford India has also noted a significant MoM increase in sales by 149 percent to 4,141 units in Jan 21 as against 1,662 units sold in Dec 20. Like Mahindra, Ford is also hit by shortage of semi-conductors and this caused the company to shut down its plants and a recent statement revealed that this shut down could be extended for several more days till supplies are regularized.

MG Motor India has released retail sales which increased 15 percent to 3,602 units in Jan 21 as compared to 3,130 units sold in the same month of last year. However, when compared to sales in Dec 20, the company suffered de-growth of 10 percent as 4,010 units had been retailed in that month.

Volkswagen and Skoda faced a dip in demand in Jan 21 while Fiat sales increased 3 percent to 394 units, up from 384 units sold in Dec 20 but fell as much as 44 percent as compared to 701 units sold in Jan 20.