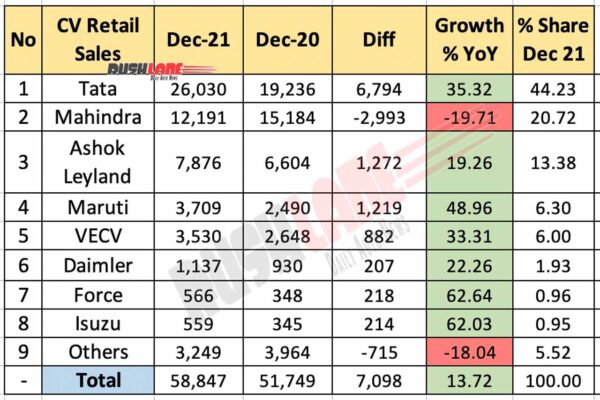

Commercial Vehicle retails posted double digit growth with an increase of 13.72 percent YoY in December 2021

The commercial vehicle segment was the only segment other than three wheeler segment to post growth in retail sales last month. The increase in expenditure announced by the Government of India in improvement of road infrastructure along with better freight rates could be reasons for the same.

The Commercial Vehicle (CV) segment noted an increase of 13.72 percent YoY to 58,847 units sold last month, up from 51,749 units sold in December 2020. It was however, a 1.13 percent de-growth as against 59,517 units sold in December 2019.

As has been announced by Federation of Automobile Dealers Associations (FADA), YoY growth in retails could be seen across LCV, MCV and HCV, with the medium and heavy commercial vehicles receiving the most attention with substantial growth. MCV sales grew at 64.03 percent to 4,099 units in December 2021 over 2,499 units sold in December 2020 and HCV sales increased by 42.45 percent to 16,066 units in the past month, up from 11,278 units sold in December 2020.

Commercial Vehicle Sales Dec 2021

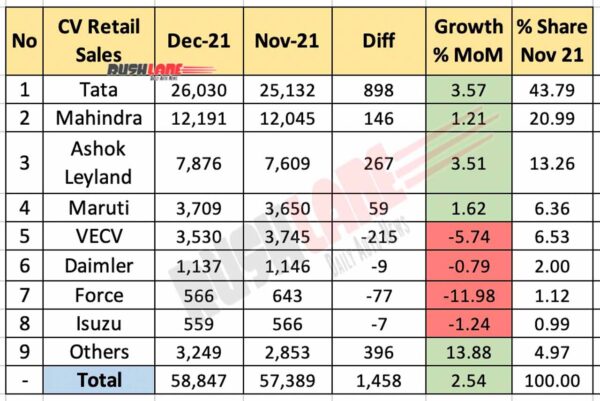

Tata Motors headed the list of CV retails in the past month as was the only automaker to post sales above the 25,000 unit mark. Sales stood at 26,030 units, up from 19,236 units sold in December 2020 while market share increased from 37.17 percent to 44.23 percent YoY. The company has just announced investment to the tune of Rs 7,500 crores in 5 years in commercial vehicles as the company intends to lead the EV segment in commercial markets.

Mahindra was the No. 2 seller in commercial vehicle retails last month. Sales however dipped to 12,191 units, down from 15,184 units retailed in December 2020, market share also dipped to 20.72 percent from 29.34 percent held earlier.

Currently holding a strong market position in the sub 3.5 tonne LCV segment, Mahindra has plans of launching an aggressive new product launch program with around 14 LCVs set for launch by 2026. These upcoming products will also include 6 electric vehicles along with an electric Jeeto cargo van as a part of the company’s new Born Electric Vehicle (BEV) program.

Ashok Leyland has seen increase in CV retails last month. Retail sales which had stood at 6,604 units in December 2020 increased to 7,876 units in the past month with market share at 13.38 percent. Ashok Leyland had launched the new Ecomet STAR in October 2021. It is available from 12ft to 24ft in CBC, FSD, DSD and HSD load body options.

Maruti Suzuki followed at No. 4 with retail sales growth to 3,709 units and market share of 6.30 percent over 2,490 units retailed in December 2020 when market share was at 4.81 percent.

VE, Daimler, Force Motors

Retails of VE, Daimler and Force Motors also saw significant increase on a YoY basis. VE sales increased to 3,530 units, up from 2,648 units sold in December 2020 while market share increased to 6 percent over 5.12 percent held in December 2020.

Daimler retails climbed to 1,137 units and Force Motors sold 566 units in the past month. SML Isuzu retails also increased to 559 units while other CV makers suffered a de-growth in retails to 3,249 units, down from 3,964 units sold in December 2020.