Sales of automobiles have taken a hit in recent months mainly due to the global shortage of semiconductor chips

C-segment compact SUVs have been highly sought-after in the last few years with many new models added in this space in the past few years. This year itself, the Indian market witnessed the launch of three compact C-segment SUVs namely Skoda Kushaq, Volkswagen Taigun and the latest in this list- MG Astor.

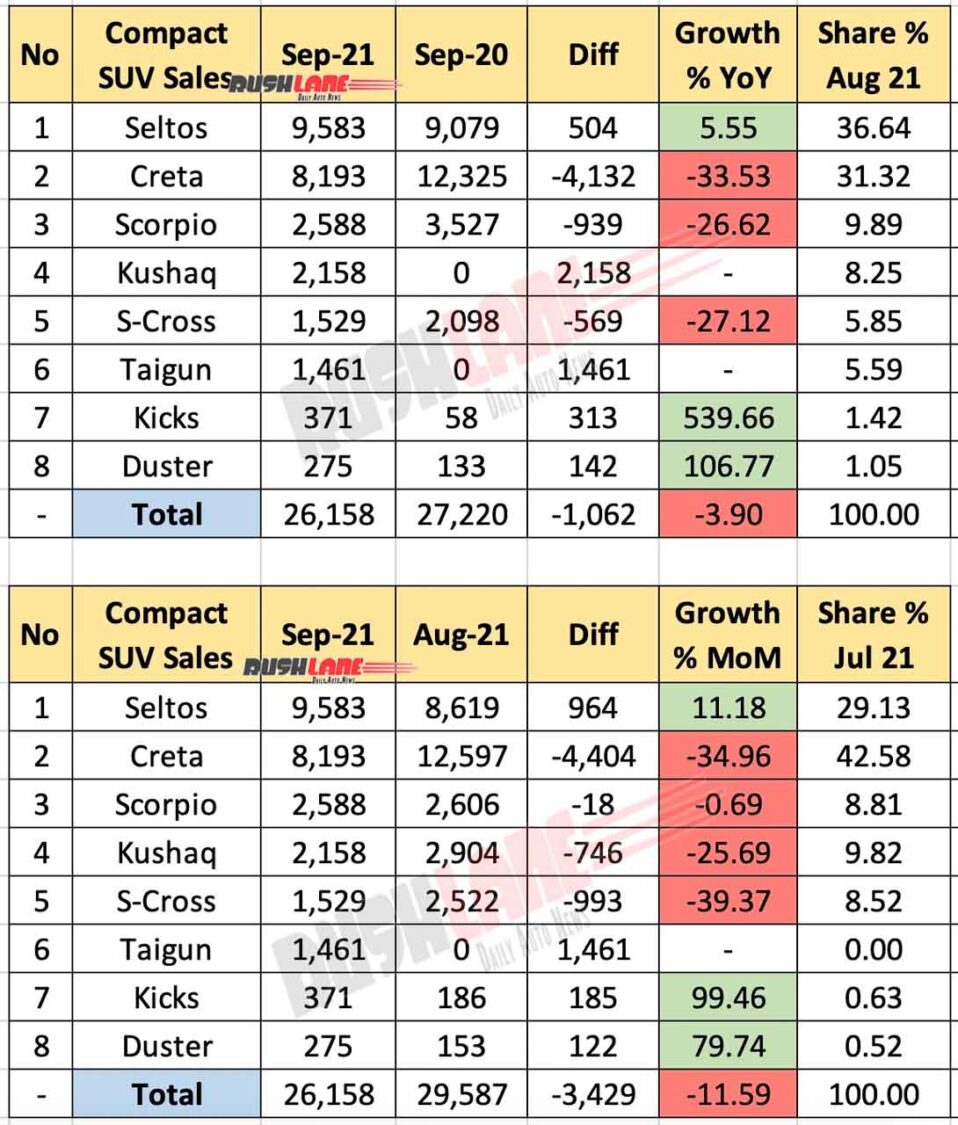

A total of 26,158 SUVs from the compact C-segment space were sold in September this year. During the same month last year, a sales volume of 27,220 SUVs was registered by Indian carmakers which have resulted in YoY degrowth of 3.90 percent. In August this year, OEMs dispatched 26,158 units of compact SUVs which led to an MoM decline of 11.59 percent.

Compact SUV Sales Sep 2021 – Seltos Beats Creta

The sales chart was topped by Kia Seltos after a long time. Seltos was able to dethrone its cousin Hyundai Creta and registered a sales volume of 9,583 units in September this year. The Korean SUV registered a YoY growth of 5.55 percent and an MoM growth of 11.18 percent. Creta, on the other hand, dropped to the second spot with 8,193 units dispatched to dealerships across the country.

The sales volume dropped from 12,325 units in September last year and 12,597 units in August this year. This has translated to a 33.53 percent YoY decline and a 35 percent MoM decline.

The third place was taken by Mahindra Scorpio with a total monthly sales volume of 2,588 units. In comparison, Mahindra retailed 3,527 units of the boxy SUV during September last year and 2,606 units in August this year.

Czech, German cousins lock horns

It resulted in YoY degrowth of 26.62 percent and a marginal MoM decline of 0.69 percent. Skoda dispatched 2,158 units of Kushaq last month as opposed to 2,904 units sold in August this year. This led to an MoM decline of 25.69 percent. Kushaq’s cousin Volkswagen Taigun went on sale last month and registered a sales volume of 1,461 units.

Maruti dispatched 1,529 units of S-Cross last month. This figure stood at 2,098 units in September last year and 2,522 units in August this year. It translated to a negative YoY growth of 27.12 percent and MoM decline of 39.37 percent. Nissan Kicks and Renault Duster are the low volume churners in this segment and only managed to accumulate a volume of 371 and 275 units respectively.

However, both the SUVs registered positive YoY and MoM growths. Kicks recorded a YoY growth of 539.66 percent and an MoM growth of 99.46 percent. On the other hand, Duster witnessed a YoY and MoM growth of 106.77 percent and 79.74 percent respectively.