Tata Motors topped the CV retail sales list in August 2023 despite a YoY de-growth

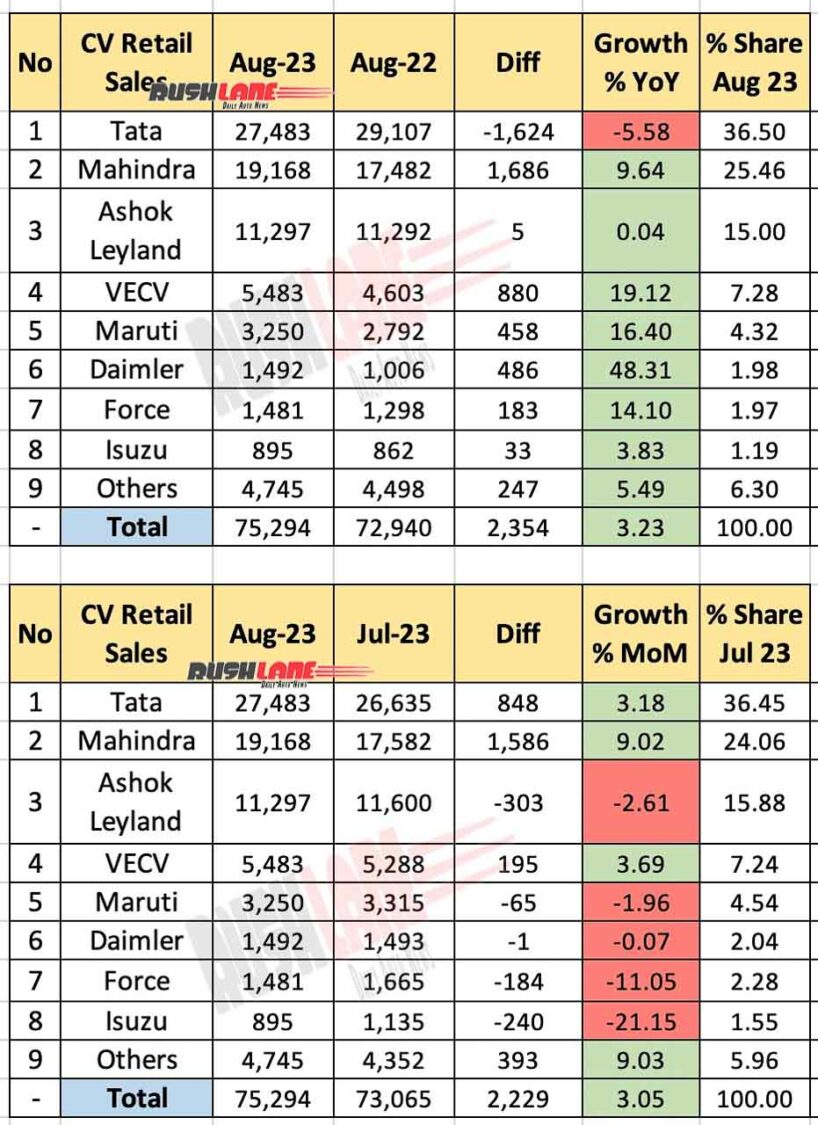

Federation of Automobile Dealers Association’s (FADA) vehicle retail data for commercial vehicles for the month of August 2023 shows off a 3.32 percent YoY and 3.05 percent MoM growth. Total CV retail sales stood at 75,294 units in the month of August 2023, up from 72,940 units sold in August 2022. On a MoM basis, there had been 73,065 units sold in July 2023.

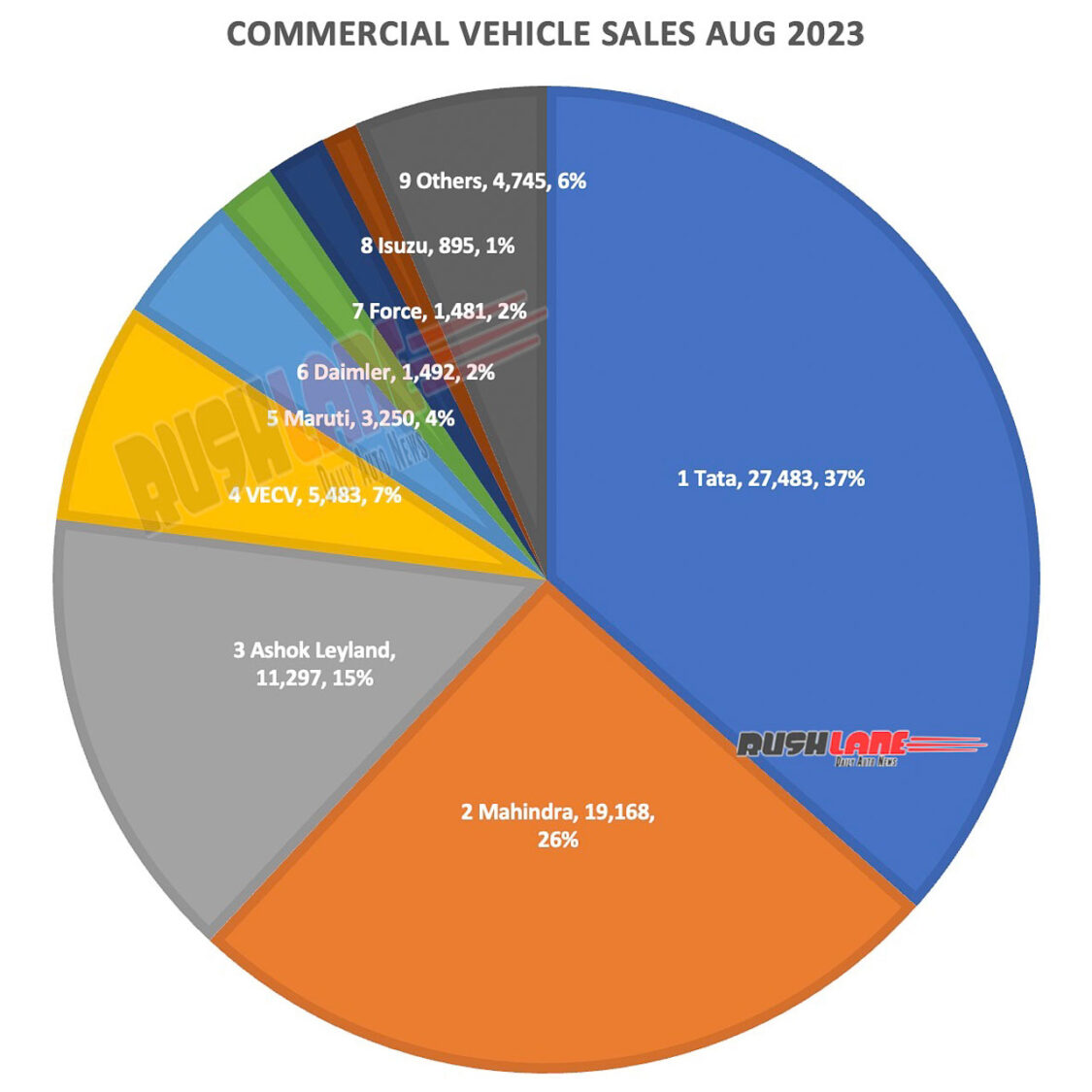

CV Retail Sales Aug 2023

Retail sales dipped YoY across the Light Commercial Vehicles (LCVs) segment to 43,929 units from 45,403 units sold in August 2022 but improved MoM by 1.60 percent from 43,236 units sold in July 2023. Medium Commercial Vehicles (MCVs) sales grew YoY by 15.16 percent to 5,895 units from 5,119 units sold in August 2022 while MoM sales dipped by 4.64 percent from 6,182 units sold in July 2023. Heavy Commercial Vehicles (HCVs) sales grew by 6.87 percent YoY and 7.56 percent MoM to 22,137 units while there were others in this segment that also saw significant growth in retail sales to 3,333 units.

Sales of CVs declined for Tata Motors in August 2023 down to 27,483 units when compared to 29,107 units sold in August 2022. Market share also fell to 36.50 percent from 39.91 percent YoY. It was a MoM growth from 26,635 units sold in July 2023. Apart from Tata Motors, every other OEM on this list has posted a YoY growth in CV retail sales.

Mahindra was at No. 2 with 19,168 units sold last month, this was a volume growth of 1,686 units when compared to 17,482 units sold in August 2023. Market share improved to 25.46 percent from 23.97 percent YoY. At No. 3 was Ashok Leyland with retail sales at 11,297 units in August 2023, a very marginal increase over 11,292 units sold in August 2022.

Volvo, Maruti, Force, SML Isuzu

Volvo Eicher Commercial Vehicles (VECV) saw its retail sales increase to 5,483 units last month, up from 4,603 units sold in August 2022. Market share improved to 7.28 percent from 6.31 percent YoY. Maruti Suzuki CV retails stood at 3,250 units in August 2023, up from 2,792 units sold in August 2022 while Daimler saw its sales increase to 1,492 units in the past month from 1,006 units sold in August 2022.

YoY sales growth in retail sales was also reported by Force Motors to 1,481 units sold last month, up from 1,298 units sold in August 2022 while SML Isuzu sales grew to 895 units up from 862 units sold in August 2022. There were other CV OEMs on this list that have reported sales at 4,745 units in August 2023 up from 4,498 units sold in August 2022 taking up market share to 6.30 percent from 6.17 percent YoY.

FADA report indicates that while the industry has faced some challenges, it is still on a growth trajectory, with several manufacturers posting impressive gains. The coming months will be closely watched to see how the CV sector evolves further in response to changing market dynamics and economic conditions.

The data, collected in collaboration with the Ministry of Road Transport & Highways, Government of India, covers 1,352 out of 1,438 Regional Transport Offices (RTOs) across the country. This report delves into the year-on-year (YoY) and month-on-month (MoM) performance of various commercial vehicle manufacturers, shedding light on the state of the industry.