Commercial vehicle retail sales improved on a YoY and YTD basis, but far off from pre-Covid peak sales figures

Commercial vehicle sales improved across all segments, be it LCV, MCV and HCV in March 2023. Demand for trucks and buses was high last month thanks to pre-buying ahead of BS6 Phase 2 transition though sales were nowhere close to figures in the 2018-19 fiscal or should we say the pre-covid period. FY 2023 commercial vehicle sales stood at 9.39 lakh units, growth of 33% over FY 2022.

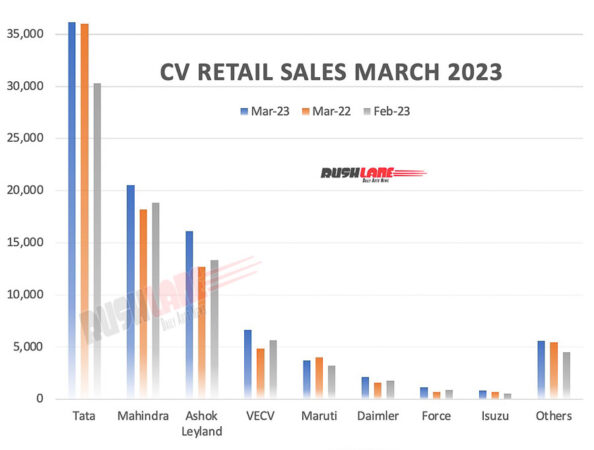

Commercial Vehicle sales March 2023

CV retail sales in March 2023 stood at 92,790 units, up 10.30 percent when compared to 84,124 units sold in March 2022. Commercial vehicle retail sales in Feb 2023 had stood at 79,027 units thus relating to a significant MoM growth. YTD retail sales were at 9,39,741 units in the FY 2022-23 period, a 32.88 percent growth from 7,07,186 units sold in FY 2021-22.

Taking into account YoY retail sales, every segment under commercial vehicles posted increased sales except for the LCV segment. Sales of LCVs dipped 0.91 percent to 49,745 units in the past month from 50,200 units sold in March 2022. On the other hand, MCV and HCV improved by 18.26 percent and 26.18 percent respectively to 6,050 units and 33,119 units. There were others in the list that contributed 3,876 units to total retail sales, up 51.35 percent from 2,561 units sold in March 2022.

Tata Motors was the top selling OEM in terms of commercial vehicles in March 2023. Sales improved to 36,152 units in the past month over 36,005 units sold in March 2022. Market share however, dipped to 38.96 percent from 42.80 percent YoY. In the company’s CV range is the popular Prima Series of trucks that comes in with ADAS feature while the company also added this safety feature to its Ultra and Signa range of trucks.

At No. 2 was Mahindra with retail sales of 20,509 units in the past month, up from 18,205 units sold in March 2022. Market share went up to 22.10 percent from 21.64 percent YoY. Ashok Leyland also reported an increase in retail sales to 16,124 units in March 2023 from 12,691 units sold in March 2022. Market share increased to 17.38 percent from 15.09 percent respectively. Tata, Mahindra and Ashok Leyland were the only three OEMs to report retail sales above the 10,000 unit mark.

Daimler, Force Motors, SML Isuzu

Lower down the order were VE Commercial vehicles with 6,637 unit retail sales in March 2023, up from 4,826 units sold in March 2022. Market share went up to 7.15 percent from 5.74 percent YoY. Maruti Suzuki was the only OEM to report de-growth in terms of commercial vehicle retail sales last month. Sales dipped to 3,699 units in March 2023 from 3,987 units sold in March 2022. This took market share down to 3.99 percent from 4.74 percent. It was however a MoM growth in sales when compared to 3,209 units sold in Feb 2023.

Lower down the list was Daimler India with retail sales of 2,134 units in March 2023 with a 2.30 percent market share up from 1,587 units sold in March 2022 when market share stood at 1.98 percent. It was followed by Force Motors with 1,109 unit retail sales in March 2023 from just 685 units sold in March 2022.

SML Isuzu saw its retail sales go up to 850 units in the past month from 672 unit retail sales in March 2022. There were others in this list that added 5,576 units to total retail CV sales, a marginal increase from 5,466 units sold in March 2022.