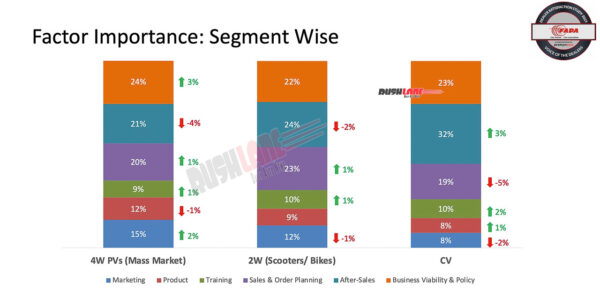

This study focusses on how satisfied dealer partners are with their respective OEMs in terms of Product and Business Viability

In the car segment, Hyundai Motors India and Maruti Suzuki have emerged as the frontrunners in FADA (Federation of Automobile Dealers Associations) Dealership Satisfaction Study for the year 2023. In the two wheeler segment it was Honda and Royal Enfield while in CV segment it was Eicher Motors, Tata Motors and Ashok Leyland that ruled the charts.

Dealer Satisfaction Report Sep 2023

This edition of Annual Dealer Satisfaction Survey spanned 1,821 dealers who represented around 3,500 outlets across various OEMs and all four geographical zones. The survey was conducted to understand dealer expectations from their OEMs and assess different aspects of business in terms of sales, after sales support, policies and business viability. It covered all segments such as passenger cars, two wheelers and commercial vehicles and was conducted by The Federation of Automobile Dealers Associations (FADA), in association with Singapore-based PremonAsia.

Auto dealers showed satisfaction in terms of certain aspects, there were concerns raised on dealer viability and policy collaboration with OEMs along with demands for better management of unsold inventory and actions against MBOs (Multi-Brand Outlets).

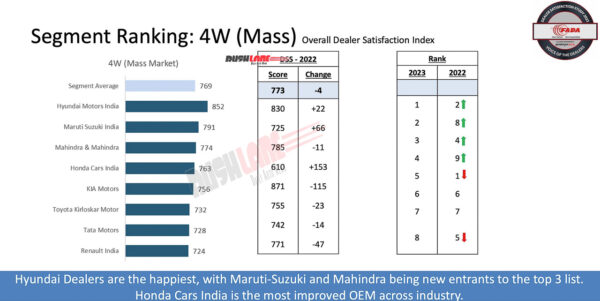

Car Dealers Satisfaction Study 2023

In the four wheeler segment, it was Hyundai Motor India that headed the list with a ranking of 852 points. Hyundai took over from Kia that had scored a higher rating in 2022 at 871 points, thereby gaining 22 points on a YoY basis. Kia dealer satisfaction score on the other hand fell by 115 points from 2022 to 756 points in 2023.

At No. 2 was Maruti Suzuki with 791 points with a 62 point increase over 725 score in dealer satisfaction in 2022. Mahindra with 774 points was down 11 points when compared to a dealer satisfaction score of 785 in 2022. Honda Cars India was at 4th position with 763 points and Kia and Toyota followed with 756 and 732 points respectively. Tata Motors and Renault scored 728 and 724 points respectively. Data was indexed to a maximum of 1000 points scale.

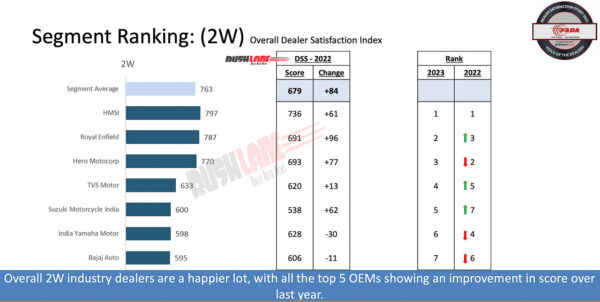

Two Wheeler Dealers Satisfaction Study 2023

In the two wheeler segment, HMSI was the highest scorer with 797 points. It retained its top spot and also gained 61 points from 736/1000 score in dealer satisfaction in 2022. It was followed by Royal Enfield and Hero MotoCorp with scores of 787 and 770 respectively, both of which scored higher on a YoY basis. There was also TVS (633), Suzuki (600), Yamaha (598) and Bajaj (595) on this list. India Yamaha Motors and Bajaj Auto saw lower scoring by 30 and 11 points respectively when compared to 628 and 606 scores held in a similar study conducted in 2022.

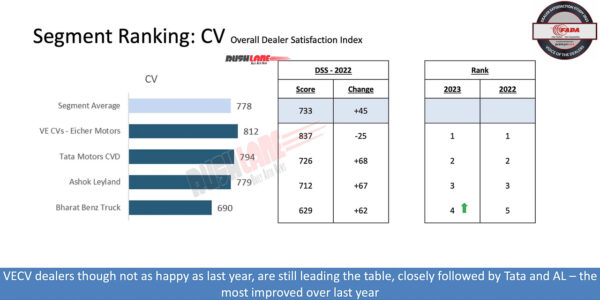

The commercial vehicle segment saw a segment average of 778 units. It was topped by Eicher Motors with 812 points, along with Tata (794), Ashok Leyland (779) and Bharat Benz (690). Even though Eicher Motors retained its top spot in dealer satisfaction study, it lost 25 points from a score of 837 points in 2022 while Tata Motors, Ashok Leyland and Bharat Benz scored higher on a YoY basis.

Segment-Specific Observations

The four wheeler segment found dealers showing satisfaction in terms of product reliability but voiced their concerns in terms of dead-stocks and inventory buyback policies of their respective OEMs. They also felt that their involvement in regard to policy making decisions was lacking. Dealers of two wheelers were also satisfied with product reliability and range but voiced the same concerns as 4 wheeler dealers in terms of buyback, deadstock and involvement in policy decisions by the OEMs.

Commercial vehicle dealers also had similar issues with deadstock and buyback particularly during the transition to BSVI compliant vehicles. Inventory management and dealership involvement continued to score lower for each segment indicating a vital area that needs attention and improvement.