Ola Electric headed the two wheeler electric retail sales with 3.29 lakh unit sales and a 34.76% market share

Electric 2W retail sales in FY2024 received a huge boost with almost every OEM posting significant YoY growth as compared to sales in FY2023. The segment was led by none other than Ola Electric while TVS, Ather and Bajaj Auto each crossed sales above the 1 lakh unit mark.

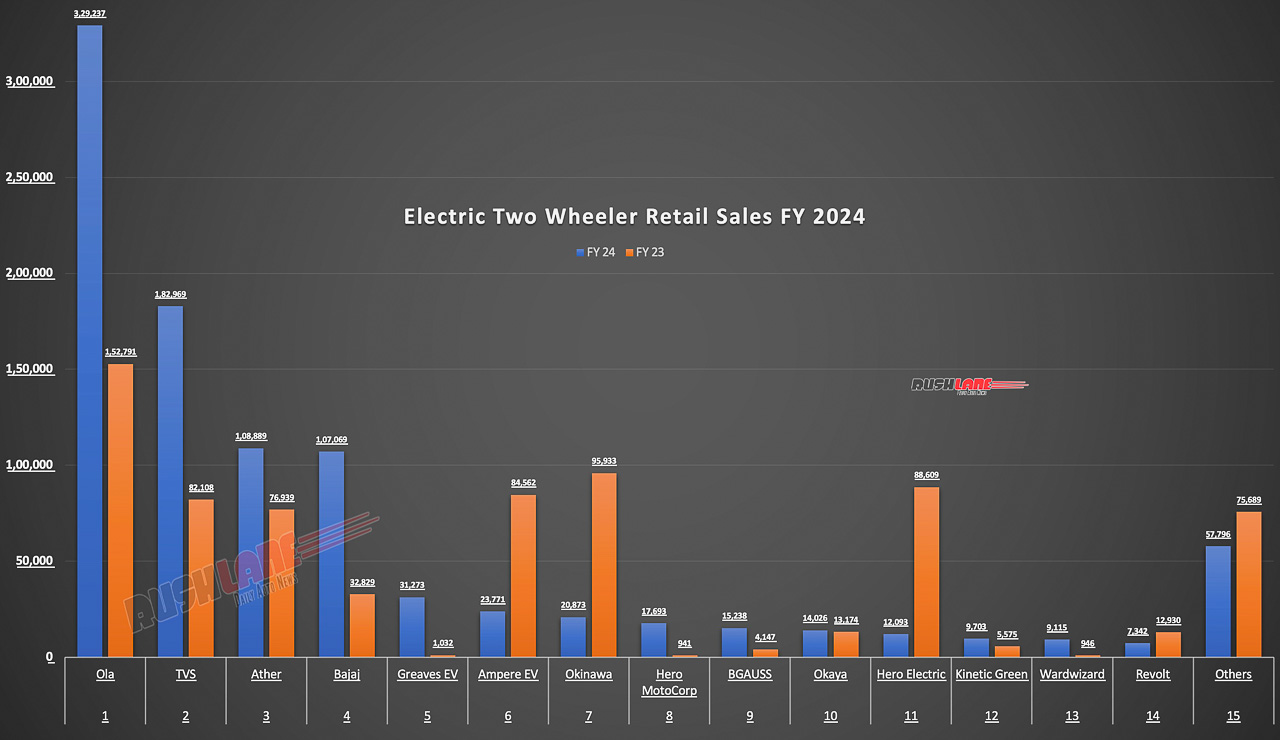

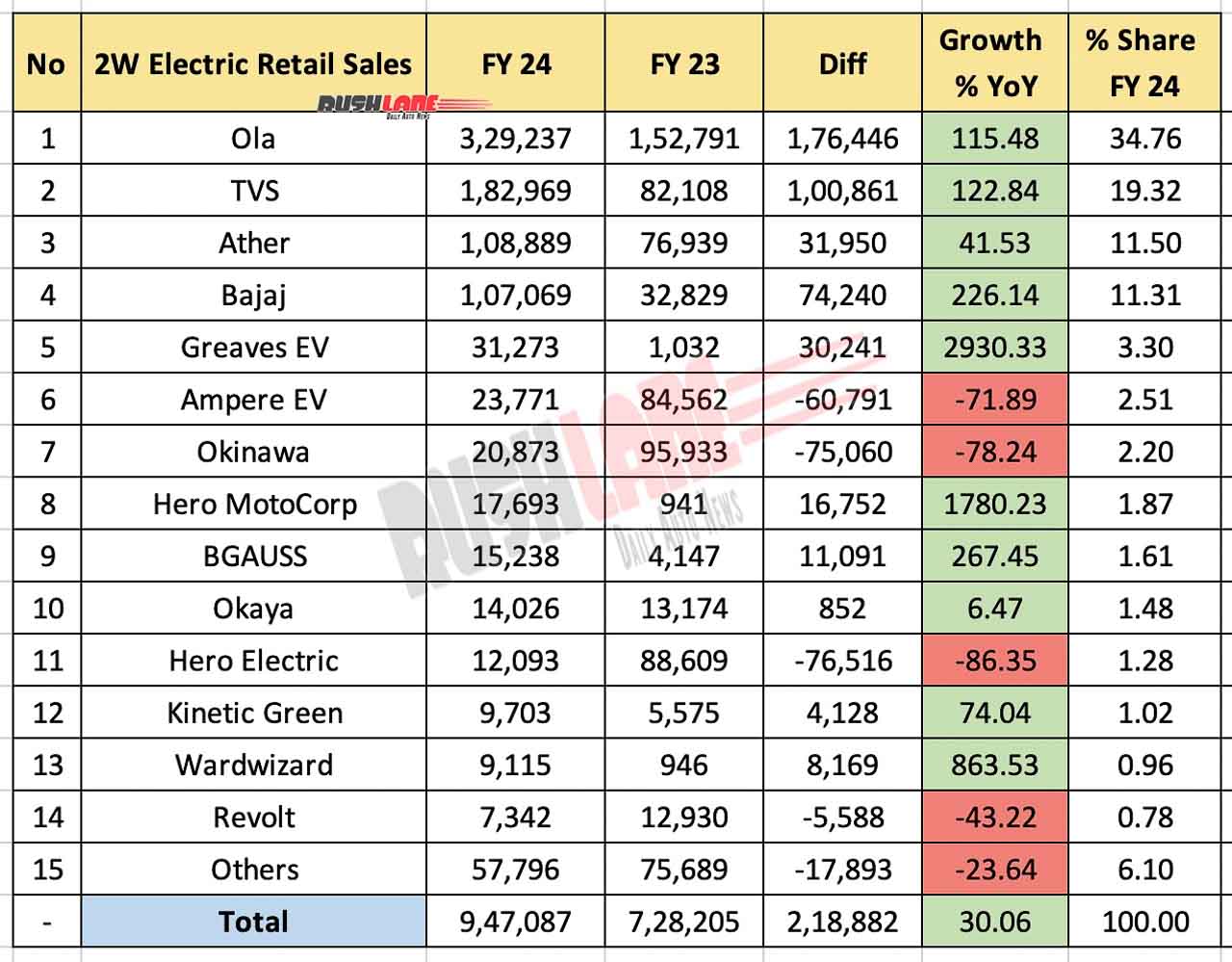

Electric 2W Retail Sales FY2024

Following our earlier report of electric two wheeler retail sales in March 2024, we now assess sales during the entire 12 months of the past financial year. Total electric two wheeler sales in FY2024 stood at 9,47,087 units, up 30.06 percent over 7,28,205 units sold in FY2023. This was a 2,18,882 units volume growth showing buyers acceptance to this more environmentally friendly, cost effective, mode of travel over their fossil fuel alternatives.

Ola Electric led this segment with a major market share of 34.76%. Ola’s portfolio, which currently includes models such as S1 X+ , S1 Pro and S1 Air, has seen retail sales of 3,29,237 units in FY2024, up 115.48% over 1,52,791 units sold in FY2023. At No. 2 was the TVS Motor with 122.84% YoY growth to 1,82,969 units of the iQube sold in FY2024. This was over 82,108 units sold in FY2023 relating to a 1,00,861 unit volume growth.

Ather has also seen outstanding sales for its Ather 450S and 450X with 1,08,889 unit retail sales in FY2024 up 41.53% over 76,939 units sold in FY2023. Sales in the coming months is set to increase significantly over the coming months as Ather Rizta electric scooter has been opened for bookings. Ather Rizta will compete with the TVS iQube on the price factor starting off at Rs 1,09,999 as against the TVS iQube which is priced at Rs 1,36,628.

Bajaj Auto retail sales in the electric segment grew by 266.14% with a total of 1,07,069 units of the Chetak sold in FY2024 up from 32,829 units sold in FY2023 to command an 11.31% market share. Impressive performance was seen for Greaves EV that has posted a 2930.33% YoY growth to 31,273 units in FY2024 up from 1,032 units sold in FY2023 relating to a 30,241 unit volume growth. Ampere and Okinawa have both reported YoY degrowth in retail sales by 71.89% and 78.24% respectively to 23,771 units and 20,873 units.

OEMs with Retail Sales at Sub-20,000 units In FY24

In the sub-20,000 unit segment, it was Hero MotoCorp that has seen enormous growth of 1780.23% to 17,693 units, a 16,752 unit volume growth from 941 units sold in the same period last year. Hero’s Vida V1 Plus and Pro variants steered the company to command a 1.86% market share in this segment. It was followed by BGauss (15,238 units) and Okaya (14,026 units), of which BGauss showed 267.45% and Okaya posted 6.47% YoY growth.

Hero Electric retail sales dipped to 12,093 units, down 86.35% over 88,609 units sold in FY2023 while Kinetic Green saw a 74.04% YoY growth to 9,703 units in FY2024 up from 5,575 units sold in FY2023. The list also included Wardwizard (9,115 units) and Revolt (7,342 units), while there were other contributors to this segment that have seen a 23.64% YoY de-growth in retail sales down to 57,796 units in FY2024 from 75,689 units sold in FY2024.