Hero Electric and Okinawa head the list of two wheeler registration in the past calendar year

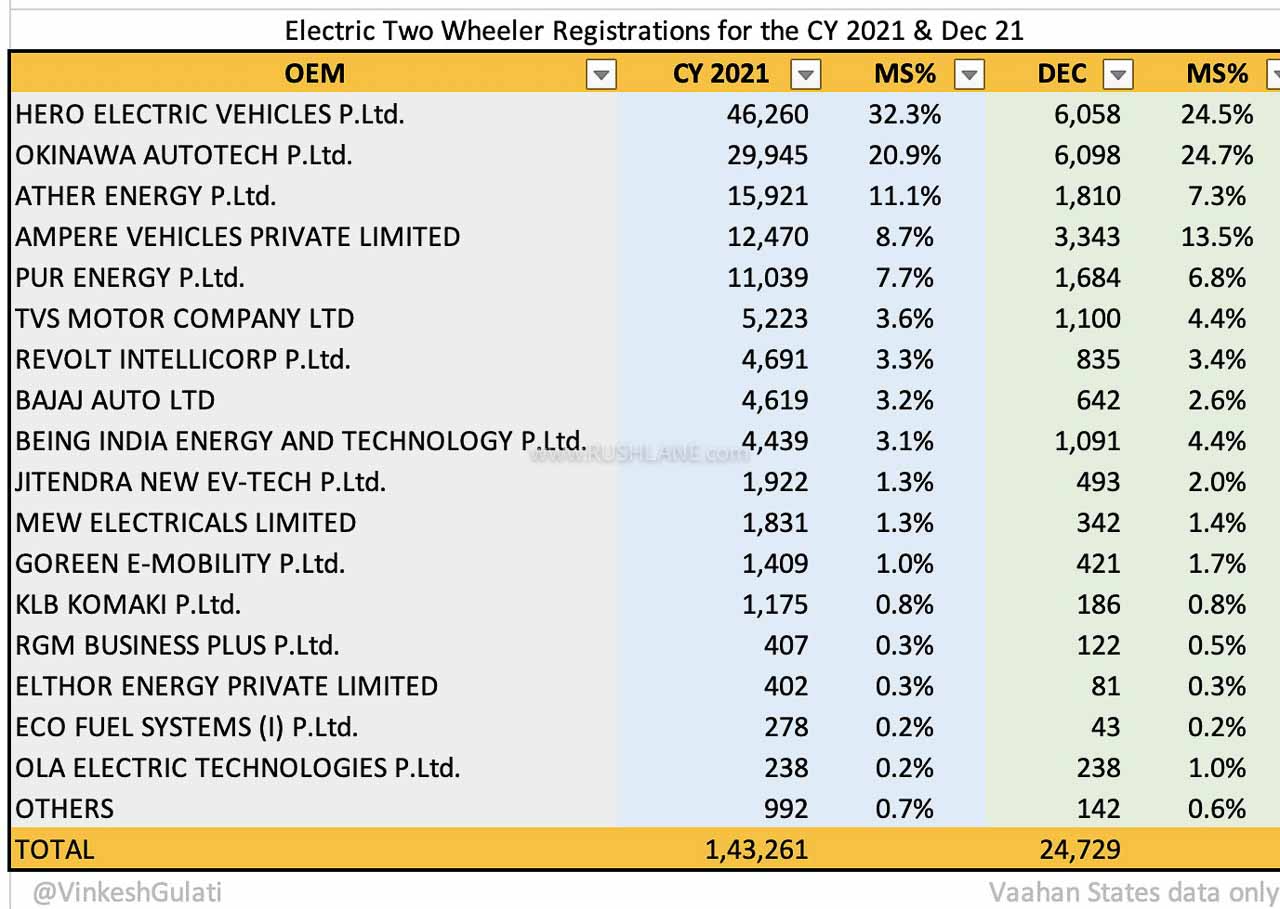

The year 2021 has seen an exponential increase in demand for electric two wheelers in India. Overall electric two-wheeler registrations in the 2021 calendar year stood at 1,43,261 units with more electric two-wheelers sold in first half of 2021 than in all of 2020.

This segment has started to emerge stronger and noting this increased demand, more automakers are joining the bandwagon. Total sales in December 2021 from each of the electric two wheeler makers on the list stood at 24,729 units.

Electric Two Wheeler Sales Dec 2021 – Hero Electric in the Lead

Hero Electric was a leader in this segment in the past calendar year. Total registrations through 2021 stood at 46,260 units allowing the company to command a market share of 32.3 percent. Taking only December 2021 into account, registrations stood at 6,058 units with market share of 24.5 percent.

Hero Electric has noted outstanding demand for its Flash, Optima, Dash and NYX while the Photon is also a popular model in the company lineup. Hero Electric also plans launch the brand’s first electric motorcycle called AE-47 as on date, in the coming year expected to be priced between Rs 1.3-1.5 lakh.

At No. 2 was Okinawa Autotech with registrations of 29,945 units in CY2021. The company commands a 20.9 percent market share and the past month has seen registrations to the extent of 6,098 units. The CY2021 was particularly noteworthy for Okinawa as the company crossed the 1 lakh unit mark in terms of sales in India.

Okinawa sales were dominated by iPraise+ and Praise Pro electric scooters. Noting this outstanding demand, the company now plans an investment of around Rs 200-250 crore on a new plant in Bhiwadi, Rajasthan with a target of 100 percent localization by end of FY2022.

Ather Energy At No 3

Next up was Bengaluru based EV startup Ather Energy, clocking registrations to the tune of 15,921 units in the January to December 2021 period. The company currently holds an 11.1 percent market share and has seen registrations of 1,810 units in the month of December 2021. Ather has only two models sale in India with the Ather 450X and 450 Plus both of which are priced at Rs 1,26,926 and Rs 1,07,916 respectively.

At fourth and fifth positions were Ampere and Pure EV with registrations to the extent of 12,470 and 11,039 respectively. Ampere commands an 8.7 percent market share with registrations in December 2021 at 3,343 units. Ampere sells both electric 2-wheelers and 3-wheelers and its Magnus EX scooter is gaining in demand especially for the fact that it offers 100 kms ride range on a single charge. PUR Energy holds a market share of 7.7 percent and has seen registrations in December 2021 at 1,684 units. PURE EPluto scooter is among its most favored models in the PUR Energy lineup.

TVS, Bajaj and Revolt

TVS Motors, Revolt and Bajaj Auto followed in quick succession in terms of registrations in the past year. TVS registrations stood at 5,223 units with market share at 3.6 percent while Revolt sales were at 4,691 units with market share of 3.3 percent. Bajaj Auto finds most favour for its Chetak EV and had registrations of 4,619 units commanding a market share of 3.2 percent. The current Chetak Electric’s offers riding range of 95+ km/charge in Eco mode and 85+ km/charge in Sport mode while the company is in the process of introducing a more powerful version of the Chetak electric scooter generating better power.

Registrations in the electric two wheeler segment continued with Being India with 4,439 units in the past calendar year followed by Jitendra New EV-Tech with 1,922 units registered and a market share of 1.3 percent. Lower down the order were Mew Electricals (1,831 units), Goreen e-Mobility (1,409 units) and KLB Komaki (1,175 units). Startups RGM, Elthor Energy, ECO Fuels and Ola Electric also saw sales of 407 units, 402 units, 278 units and 238 units respectively while there are other in this segment that had registrations of 992 units in the past calendar year.