Green Tax on Personal vehicles to be charged at the time of renewal of Registration Certification after 15 years

On Monday, Union Minister for Road Transport and Highways, Nitin Gadkari, has approved the levy of ‘Green Tax on old vehicles over 8 years. The proposal will be sent to all states for consultation prior to any formal notification being issued.

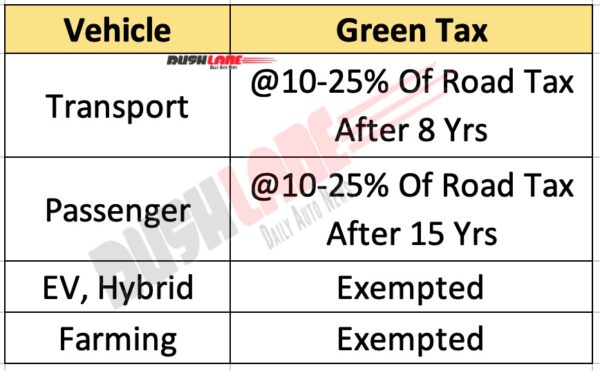

The proposal states that transport vehicles older than 8 years will be charged Green Tax at the rate of 10-25 percent of road tax. This will be levied at the time of renewal of fitness certificate. Electric vehicles are exempted from this levy while passenger vehicles will be subject to the same percentage of Green Tax but after a period of 15 years. The same will be levied at the time of renewal of registration certificate.

Green Tax Proposal

Green Tax is being levied so as to clean up the environment by dissuading use of older and more polluting vehicles. Unfit and highly polluting, exhaust emitting vehicles should be phased out and higher taxes is the only way to discourage users. This will instigate them shift to newer and less polluting vehicles which will in turn will significantly reduce pollution levels.

Vehicles such as electric, hybrid and those using alternate fuels such as CNG, ethanol and LPG besides those used for farming, like tractors, harvesters and tillers, will be exempted from Green Tax. Public transport vehicles line city buses will also be charged Green Tax at a lower percentage.

However, those vehicles being registered in highly polluted cities will have a higher Green Tax at the rate of 50 percent of road tax along with a differential tax which will depend on the kind of fuel and type of vehicle.

All revenue collected via Green Tax will go into a separate account and will be directed towards ways to improve pollution while funds can also be used by the state governments to set up emission monitoring systems.

Government Vehicle Scrapping Policy

The Union Minister for Road Transport and Highways has also approved the policy to de-register and scrap old vehicles above 15 years, owned by various Government departments and by public sector undertakings. This proposal is to be notified and will be brought into effect from 1st April 2022.

Estimates reveal that commercial vehicles that comprise 5 percent of total vehicles contribute as much as 65-70 percent to total vehicular pollution. Where older vehicles are concerned, that is those manufactured prior to 2000 comprise less than 1 percent of total fleet but still contribute 15 percent to pollution levels. This contribution is more than 10-25 times than that contributed by newer vehicles.

Cleaning up the environment is the need of the hour. The National Clean Air Program, NCAP which was launched in 2019 and now renamed National Clear Air Mission, aims to reduce the particulate matter (PM10 and PM2.5) concentrations in the air by as much as 20 to 30% by 2024. NCPA has identified 122 cities where pollution levels exceed national standards while the lack of air monitoring stations have also drawn some attention.