Mercedes-Benz, BMW and Audi India report sales growth in 2021 on the back of a spectacularly difficult 2020

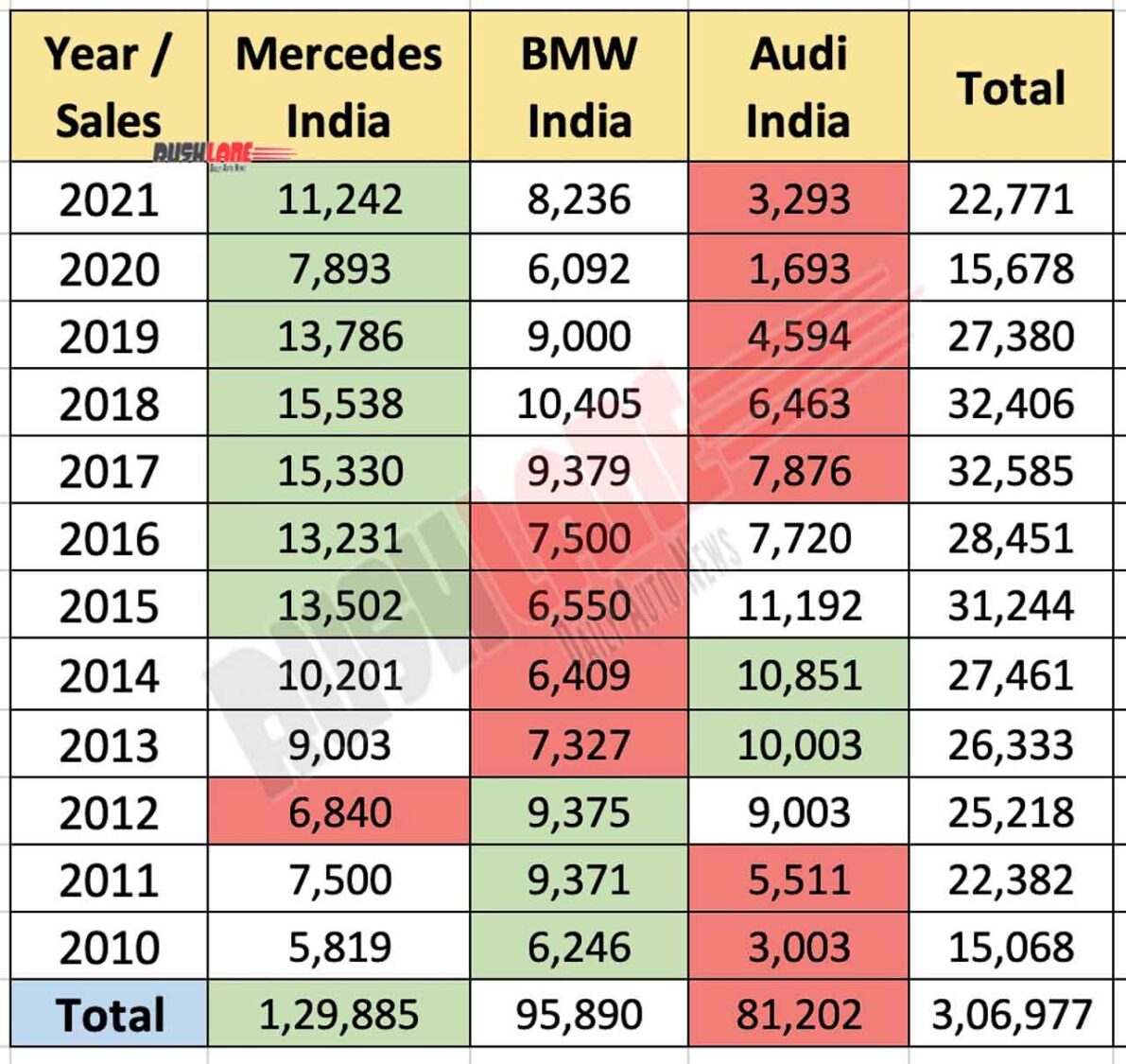

The top 3 luxury car auto manufacturers have collectively reported numbers at just over 22.5k units through 2021. Sales numbers are trailing behind, when compared to the numbers from previous years. Though sales recovery is taking long, all three manufacturers reported sales growth last year, on the back of low base sales in 2020.

India Luxury Car Sales 2021 – Mercedes Maintains Lead

When comparing the top 3, Mercedes Benz came out on top having reported sales of 11,242 units. In 2020, sales were reported at 7,893 units. The lowest since 2012 when numbers were reported at 6,840 units.

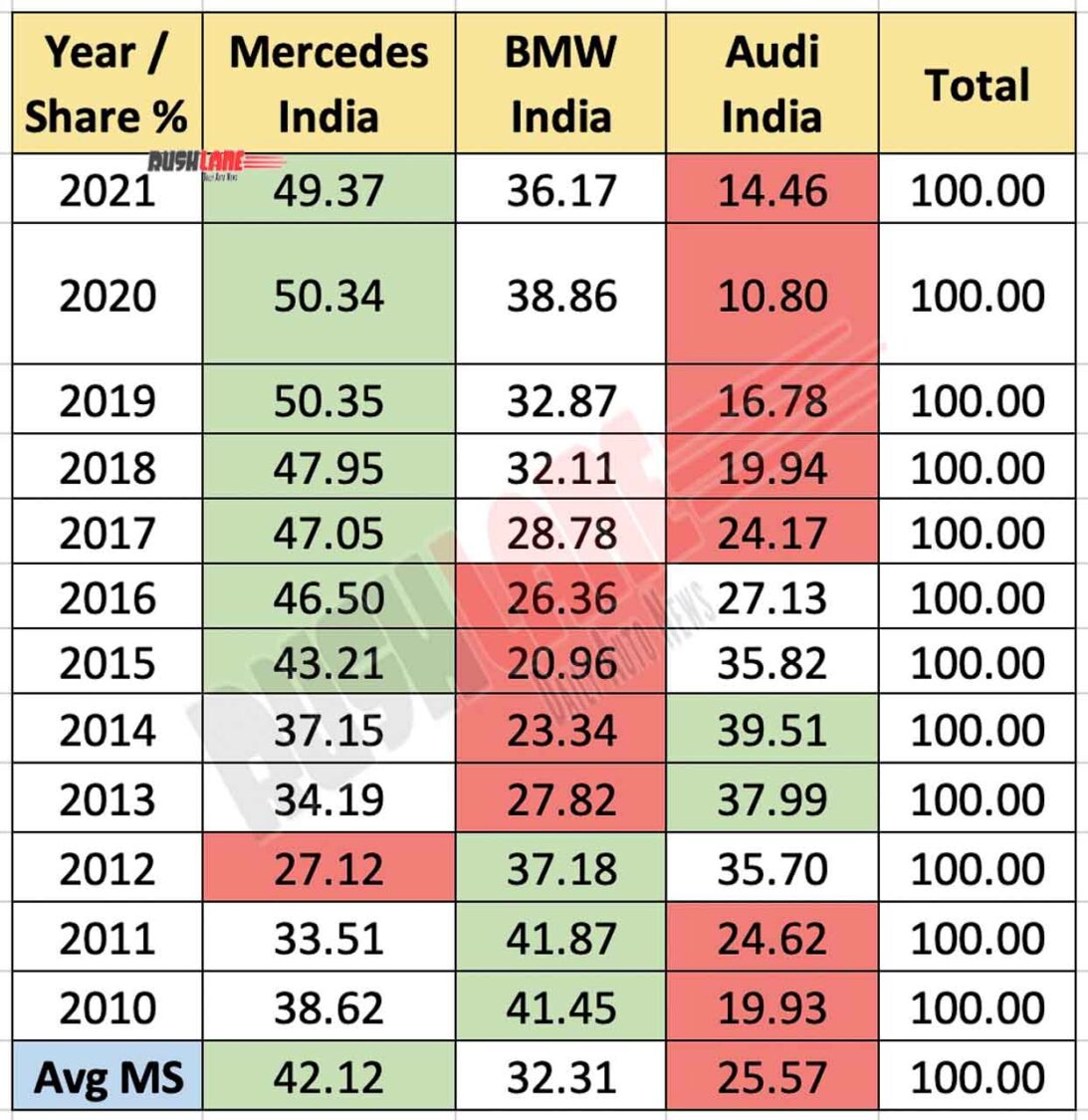

Market share among the top order sees Mercedes-Benz enjoy almost 50 percent dominance, in 2021. Numbers improved through 2021 despite a complex second wave of the Covid19 pandemic. Difficulties were most acute in Q2 2021.

Sales in 2021 was further impacted by a continual shortage of chips/semiconductors. Depending on how quickly supply chain lags are sorted, the market will correspondingly bounce back. Until such seamless operations, one can expect production delay owing to unavailability of parts, and thereby deliveries delayed. Lower sales aren’t an indication of demand stability. Delayed production directly impacts sales.

Audi and BMW India

BMW India reported sales at 8,236 units in 2021. This number was down to just over 6k units in 2020. With Covid19 pandemic gripping all aspects of business in 2020, sales numbers were particularly low despite occasional signs of improved sales in a few individual months that year.

Comparatively, Covid19 pandemic impact was more profound for a much shorter period in 2021. This offered far more opportunities for companies to sell more cars. Market share among the top 3 saw BMW claim 36.17 percent, and Audi India, 14.46 percent.

Audi India sales are at about 3.3k units in 2021. The previous year this number was as low as 1.7k units. In fact in 2020, all 3 companies collectively reported sales at a little over 15.5k units. All three companies have been able to get on the growth path in 2021. Market share in 2020 was similar to that reported in 2020. For the longest time, Mercedes-Benz has enjoyed the majority share.

| Year / Sales | Mercedes India | BMW India | Audi India | Total |

|---|---|---|---|---|

| 2021 | 11,242 | 8,236 | 3,293 | 22,771 |

| 2020 | 7,893 | 6,092 | 1,693 | 15,678 |

| 2019 | 13,786 | 9,000 | 4,594 | 27,380 |

| 2018 | 15,538 | 10,405 | 6,463 | 32,406 |

| 2017 | 15,330 | 9,379 | 7,876 | 32,585 |

| 2016 | 13,231 | 7,500 | 7,720 | 28,451 |

| 2015 | 13,502 | 6,550 | 11,192 | 31,244 |

| 2014 | 10,201 | 6,409 | 10,851 | 27,461 |

| 2013 | 9,003 | 7,327 | 10,003 | 26,333 |

| 2012 | 6,840 | 9,375 | 9,003 | 25,218 |

| 2011 | 7,500 | 9,371 | 5,511 | 22,382 |

| 2010 | 5,819 | 6,246 | 3,003 | 15,068 |

| Total | 1,29,885 | 95,890 | 81,202 | 3,06,977 |

2019, 2020, and 2021 sales

Difficulties these past two years can be associated to Covid19. However, even before the global impact of the pandemic, Mercedes-Benz, BMW, and Audi had reported sales decline in 2019. While 2018 was a particularly strong sales year for all 3 manufacturers, in 2019 neither could keep up with the momentum of the preceding year, or for that matter 2017.

The start of 2022 is turning out to be particularly shaky considering the increase in daily Covid19 infections reported. Currently lockdowns are limited to citizens and not manufacturing units as in recent times.