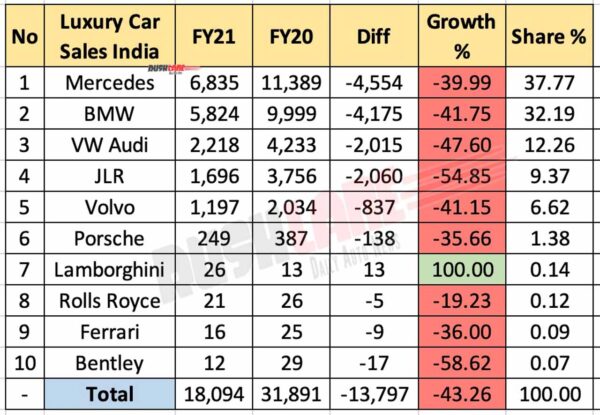

Indian luxury car segment retail registrations contract by over 40 percent in FY21

Despite continuous uncertainty in the last fiscal, a few phases of business activity saw some pops of green trickle in where mass market two-wheeler and car sales was concerned. However, this phenomenon didn’t hold true for the Indian luxury car segment. In certain cases, retail sales dipped to half of the previous fiscal.

While total vehicle registrations fell across platforms in the last fiscal, it was the steepest decline for luxury car manufacturers.

Disclaimer – FADA data currently excludes registration data from Andhra Pradesh, Madhya Pradesh, Lakshadweep and Telangana. Data available accounts for 1,289 of 1,493 RTOs in collab with MoRTH.

Mercedes-Benz India at the top

Mercedes-Benz India continued to sit atop of the board despite 40 percent decline through FY21, and was able to keep BMW at bay. FADA retail reg numbers came in at under 7k. At 6,835, the numbers no longer paint a story of unmatchable dominion, and at the very least looks bleak as compared to 11,389 units reported in FY20.

Current market predictions point to another fiscal of uncertainty. This is already visible owing to varying lockdown protocols depending on state mandates, shutdown of dealerships, production halts, and unavailability of parts that’s creating supply chain slowdowns.

Add to this projected economic recovery, monsoons, yet to be seen impact of current lockdown protocols, movement of migrant workers leading to staffing issues at varied business and manufacturing houses, current loan repayment norms, and other issues.

Covid-19 pandemic grows

The current business environ affects one and all. And it’s far to early to determine which trends survive the Covid-19 pandemic. The continuous onslaught that the virus brings upon us cares not about business trends. In fact, it’s far too early to even determine when business will be able to function at better capacity, leave alone full capacity. All of this keeps performance close to that in FY19 at quite a distance. For the luxury car market, even FY19 wasn’t one to right home about with the segment already on a decline.

BMW India has reported retail reg at 5,824 units down from just under 10k units at 41.75 percent decline. Volume loss stood at 4,175 units, and market share at 32.19 percent. Audi volumes almost halved at 2,218 units, down from 4,233 units for market share of 12 percent.

| Luxury Car Retail Sales | FY21 | FY20 | % |

|---|---|---|---|

| Mercedes | 6,835 | 11,389 | -39.99 |

| BMW | 5,824 | 9,999 | -41.75 |

| VW Audi | 2,218 | 4,233 | -47.60 |

| JLR | 1,696 | 3,756 | -54.85 |

| Volvo | 1,197 | 2,034 | -41.15 |

| Porsche | 249 | 387 | -35.66 |

| Lamborghini | 26 | 13 | 100.00 |

| Rolls Royce | 21 | 26 | -19.23 |

| Ferrari | 16 | 25 | -36.00 |

| Bentley | 12 | 29 | -58.62 |

| Total | 18,094 | 31,891 | -43.26 |

JLR retail reg contracted to less than half at 54.85 percent decline, at 1.7k units, down from 3,756 units. Volvo numbers fell to 1.2k units from just over 2k units at over 40 percent decline. Porsche numbers are reported at just under 250 units. Lamborghini retails grew to 26 units. 21 units of Rolls Royce are reported registered, 16 units of Ferrari, and 12 units of Bentley.