FADA Research luxury car segment sales declines by a third for October 2020

Auto sales in recent months has been on the rise for most mass market manufacturers. While luxury carmakers have been showing improvement, they are not in the dream yet. The ongoing festive season usually brings a cheer to many an auto manufacturer considering there are people who will time their purchases. However, this year retail sales reported by FADA point to a decline of sorts across the spectrum.

FADA Retail Sales – Premium / Luxury Cars

While numbers may not reflect sales down to the last unit owing to a number of factors, they are indicative of current market situation. Sales figures shared by FADA, don’t include numbers from AP, MP, LD and TS; as these States/UT’s are not yet on Vahan 4. Vehicle reg data is collated as on November 8, 2020 and in collab with Ministry of Road Transport & Highways (MoRTH), Government of India and has been gathered from 1,257 out of 1,464 RTOs.

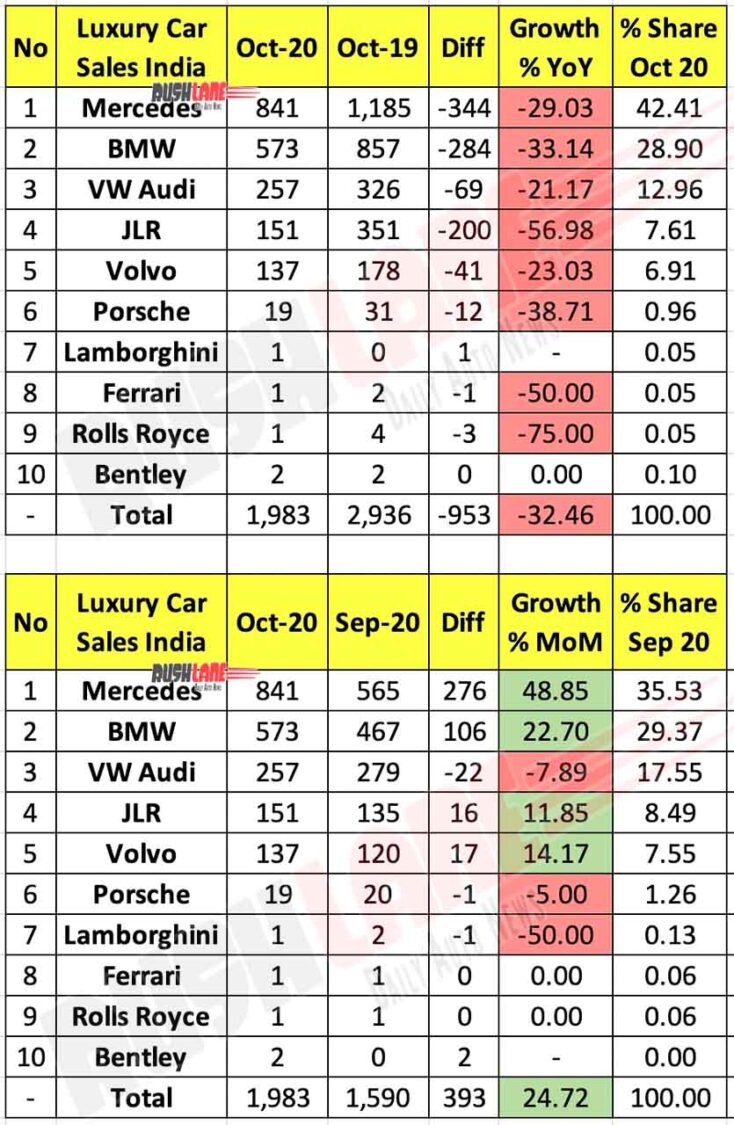

Basis this, total October 2020 sales is reported at 1,983 units, down 32.46% from 2,936 units sold in October 2019 and volume loss of 953 units. Of this, Mercedes Benz India enjoys numero uno position in the luxury car market.

Sales are reported at 841 units, at 29.03 percent decline from 1,185 units sold a year earlier earlier. Mercedes accounts for 42.41 percent market share. MoM sales growth is reported at 48.85% up from 565 units sold last month before.

BMW follows next with 573 units sold at 33.14 percent sales decline from 857 units sold a year earlier. The brand enjoys 28.9 percent market share. MoM sales growth is reported at 22.7 percent, up from 467 units sold in September 2020.

VW Audi sales accounts for 257 units at 21.17 percent sales decline from 326 units. Audi enjoys 12.96 percent market share. MoM sales fell by 7.89 percent down from 279 units. JLR sales fell by more than half at 56.98 percent decline down 250 units from 351 units. Market share is reported at 7.61 percent. MoM sales grew 11.85 percent, up from 135 units. Volvo reports sales decline at 23.03 percent, and accounts for 6.91 percent market share. Sales fell 237 units from 178 units. MoM sales grew 14.17 percent up from 120 units.

| No | Luxury Car Sales India | Oct-20 | Oct-19 |

|---|---|---|---|

| 1 | Mercedes | 841 | 1,185 |

| 2 | BMW | 573 | 857 |

| 3 | VW Audi | 257 | 326 |

| 4 | JLR | 151 | 351 |

| 5 | Volvo | 137 | 178 |

| 6 | Porsche | 19 | 31 |

| 7 | Lamborghini | 1 | 0 |

| 8 | Ferrari | 1 | 2 |

| 9 | Rolls Royce | 1 | 4 |

| 10 | Bentley | 2 | 2 |

| – | Total | 1,983 | 2,936 |

Uber luxury segment

Porsche sales is reported at 19 units down from 31 units. MoM sales declined by a single unit. Oh units each of Lamborghini, Ferrari, and Rolls-Royce was sold last month. Two units of Bentley were sold. Month on month sales is same for Ferrari, Rolls-Royce, and Bentley. Lamborghini sold a unit less from September 2020.

Projections in recent years indicated that the luxury car market would grow to be above 40,000 units in a year. However, that pattern was broken last year itself with the year ending closer to 35,000 units. As such, the luxury car sales are on the decline currently. Most manufacturers were already reporting a decline even in 2019 at this time. For the most part, market situations affect the luxury car market differently, but this year the impact has been largely negative.