Mahindra holds a staggering 68% market share in this segment – thanks to the success of new XUV700 and Scorpio / N

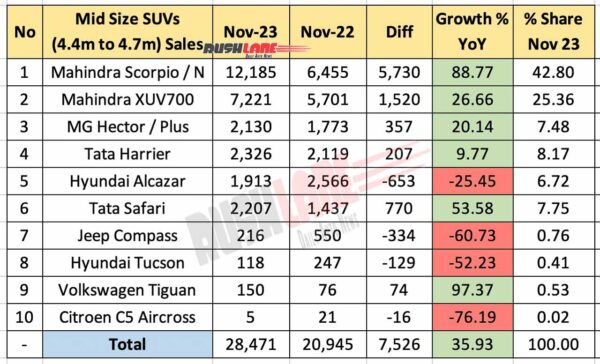

The Indian automotive market, particularly the mid-size SUV segment encompassing vehicles ranging from 4.4 meters to 4.7 meters in length, exhibited remarkable growth in November 2023. The sector saw a substantial surge of 35.93% in year-on-year sales, marking a significant increase from 20,945 units in November 2022 to 28,471 units in November 2023.

Mid Size SUV Sales Nov 2023 – Year-on-Year Insights

The standout performer in this period was Mahindra – thanks to the Scorpio / N and XUV700. Scorpio range experienced an astounding 88.77% surge in sales, with 12,185 units sold compared to 6,455 units in November 2022.

Following closely was the Mahindra XUV700, which recorded a commendable 26.66% growth with 7,221 units sold, up from 5,701 units in the same period last year. Tata Motors, with its updated Harrier and Safari models, showcased positive growth rates at 9.77% and 53.58%, respectively.

However, the Hyundai Alcazar faced a noticeable setback, witnessing a 25.45% decline with 1,913 units sold in November 2023 compared to 2,566 units in November 2022. Jeep Compass and Hyundai Tucson also experienced substantial drops of 60.73% and 52.23%, selling 216 and 118 units respectively, down from higher figures in November 2022.

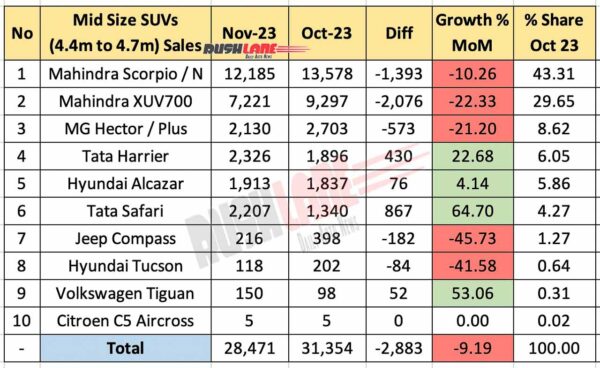

Mid Size SUV Sales Nov 2023 – Month-on-Month Comparison

Despite the year-on-year surge, a month-on-month analysis revealed a 9.19% decline in sales from October 2023’s 31,354 units to November’s 28,471 units. Mahindra’s Scorpio and XUV700 faced declines of 10.26% and 22.33% respectively in November compared to October. Tata’s Safari, however, showcased a remarkable 64.70% increase in sales month-on-month, selling 2,207 units in November, up from 1,340 units in October.

Market Insights and Trends

The mid-size SUV market in India continues to witness dominance by Mahindra’s offerings, solidifying their position with robust growth and market share. Tata Motors, while showing positive growth trends, faces a mixed bag with the Harrier performing steadily and the Safari demonstrating strong growth. Conversely, the decline in sales for Hyundai’s Alcazar and the substantial drops for Jeep Compass and Hyundai Tucson highlight shifts in consumer preferences or market dynamics affecting these particular models.

The overall market trends underline a persistent consumer interest in mid-size SUVs, driven by factors such as enhanced features, performance, and comfort. Additionally, competitive pricing and innovative marketing strategies have contributed to the segment’s overall growth. As the year draws to a close, industry experts anticipate continued fluctuations influenced by multiple factors. These include evolving consumer sentiments, the impact of promotional campaigns, and the broader economic landscape.

Looking ahead, manufacturers are expected to focus on introducing new features, advanced technology, and possibly even electric or hybrid variants to meet the growing demand for eco-friendly vehicles. Moreover, strategic pricing and promotional activities are likely to play pivotal roles in shaping consumer preferences in the highly competitive mid-size SUV market.