Under the new criteria, sub 4m SUVs can’t be termed as SUVs anymore, while compact SUVs and mid-size SUVs can be

Sub 4m SUVs are all the rage right now. Most of them enjoy tax benefits associated with the B-segment that they fall in. This segment is classified with a length constraint of 4000mm further constraints with respect to engines.

To fall under the B-segment category for lower tax benefits, vehicles should possess a petrol engine with a displacement under 1,200cc or a diesel engine with a displacement under 1,500cc. Manufacturers go to great lengths to avail of these tax benefits with a chopping approach.

Some examples of chopped-up cars to fit the B-segment are Bolero, Quanto, EcoSport, XUV300, 2nd gen Swift Dzire, Tata Zest and more. As per the new 48th GST council meeting, there is a window where sub 4m SUVs might benefit from further tax benefits. Let’s take a look.

Sub 4m SUVs To Get Cheaper

If you are not sure how much tax you are paying to the Indian Government when buying your SUV, it is almost 50% of the vehicle’s cost. Say, an SUV’s actual cost is just Rs. 10 lakh, a prospective SUV buyer is currently paying around Rs. 15 lakh, where additional Rs. 5 lakh is taxes.

These taxes comprise of Excise tax, VAT, road tax, motor vehicle tax and GST of up to 20-22%. Hence taking the total percentage of taxes up to 50% of the SUV’s actual cost. Speaking of SUVs, there is widespread confusion regarding the credibility of the segment SUV that is attracting 20-22% of GST.

The word SUV is used liberally by manufacturers to slap it on any vehicle they want. Union Finance Minister Nirmala Sitharaman chaired the 48th GST council to establish criteria to classify vehicles as SUVs and only those vehicles that will continue to attract 20-22% GST and those “SUVs” that can’t be termed as SUVs anymore will attract lower taxes.

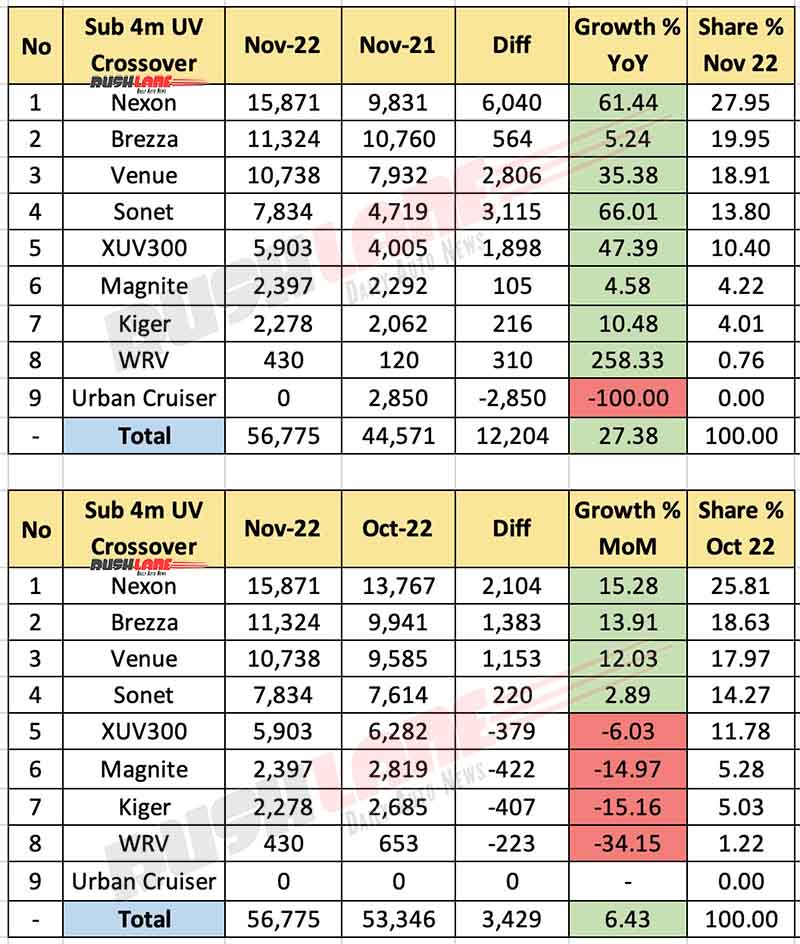

Under this new criteria, vehicles surpassing 4,000 mm length constraint, being powered by engines exceeding 1,500cc in displacement, and having more than 170mm of ground clearance will be termed SUVs. This means that sub 4m SUVs like Tata Nexon, Maruti Brezza, Hyundai Venue, Kia Sonet, Renault Kiger, Nissan Magnite, and Mahindra XUV300 are not SUVs and will now attract less GST taking prices lower to just 5%.

What To Expect?

Even though it is good news for car buyers, there are a few nuances that are not yet cleared by the council. For starters, all of the above-mentioned “SUVs” have ground clearance crossing 170 mm, but they comply with engine displacement limit and length limit. Is the 1,500cc limit for petrol or diesel engines? Is there a price constraint added to the mix? It is not yet revealed if a vehicle fails to comply with one of the limits, does it still attract 20-22% GST?

If so, this new criteria is of no use at all. Additional clarification is said to be on the way and that might shed clearer light on this new revelation. Car manufacturers should be looking into this matter as well. This might put a halt on manufacturers calling almost everything they launch as an SUV.