Uttar Pradesh saw the maximum increase in number of road deaths which increased from 16,004 in 2013 to 22,256 in 2018, while there are lessons to be learnt from Tamil Nadu and Andhra Pradesh; wherein there have been a significant decrease in road fatalities.

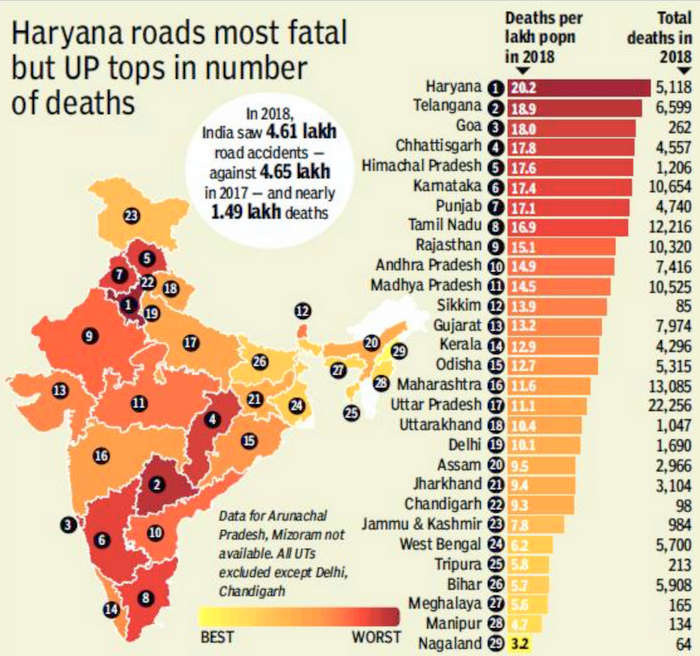

2018 saw a total of 4.61 lakh road accidents across India as compared to 4.65 lakhs in 2017. Though the number of road accidents have dipped marginally, the same cannot be said where road fatalities are concerned. This figure which stood at 1.51 lakhs in 2016, dipped to 1.48 lakhs in 2017, which went up to 1.49 lakhs in the past year.

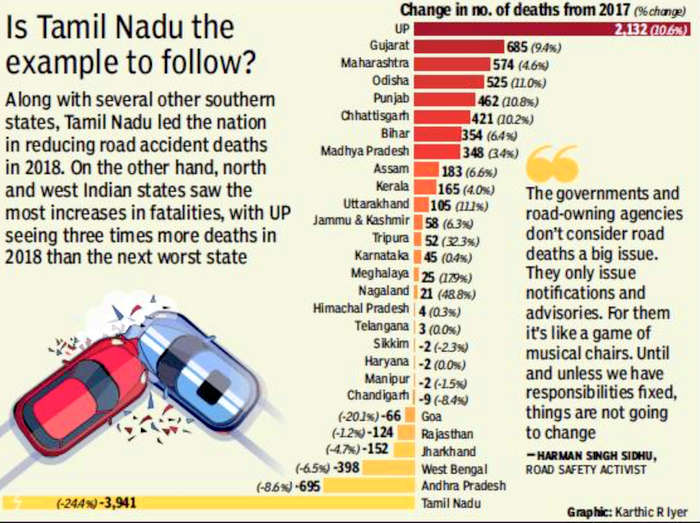

Road accident statistics in India have revealed that the state of Uttar Pradesh has registered the maximum increase on road fatalities. Road deaths in the state increased by more than 2,000 in 2018 as compared to that noted in 2017 while at the other end of the spectrum, the state of Tamil Nadu has registered the most declines in road fatalities by as much as 25 percent with 3,941 fewer road deaths occurred in 2018 as compared to 2017.

Following highest number of road deaths recorded in Uttar Pradesh, Gujarat came second followed by Maharashtra, Orissa, Punjab and Chhattisgarh. However, states such as Tamil Nadu, Andhra Pradesh, West Bengal, Jharkhand, Rajasthan and Goa and have put some check on the number of road deaths.

To see this from another perspective, the International Road Federation, a Geneva based body working towards safer roads has expressed concern over the rising number of road accidents. Statistics reveal that India accounts for more than 11 percent of global road accident fatalities. India is also a signatory to the United Nations Decade of Action for Road Safety that targets a 50 percent reduction in road fatalities by 2020.

T Krishna Prasad, DGP and chairman of Telangana Road Safety Authority, cites the need to identify the reasons for high number of road fatalities and the need for an action plan. The State Police Chief of Tamil Nadu has gone a step further and designated an additional SP in each district with a Commissionerate as a nodal officer for road safety. Their performance is recorded in the Performance Appraisal Report while highway patrolling has been ramped up with a dedicated safety control room at the Police HQ along with monthly meetings held to address related issues.

While the authorities are taking all steps to reduce accidents in general and road fatalities in particular, the onus lies primarily on the road users. It is by stringently following road safety regulations, in terms of over speeding, drink driving, road rage and speaking on mobile phones, that these figures can be brought down significantly.