After three good years, passenger car market in India is witnessing a downtrend in 2018. Data available till now (Jan-Oct 2018 sales) indicates 6.4% growth, which is the lowest since 2015. The only good months this year were May and June; and that too was due to GST base effect. There were quite a few interesting launches in 2018, but with the exception of Hyundai Santro, most others failed to create a major impact on consumer sentiments.

Experts say that this is just the beginning and the troubles for carmakers may continue till 2020. Next year is going to be crucial for India, as general elections are scheduled to be held. Political uncertainly will be at an all-time high till 2019 elections, which in turn may affect consumer sentiments. However, things may get better if a positive political situation emerges post the elections. 2020 will also be a challenging year for carmakers, as BS-VI emission norms will take effect. Car prices may shoot up, leading to reduced sales and growth.

As compared to 2017 monthly stats, growth rate has been sluggish all throughout 2018. The only exceptions were the months of May and June 2018. Even market leader Maruti Suzuki appears to be struggling during the second half of 2018. With falling sales, the growth rate of the entire passenger car industry is witnessing a downtrend.

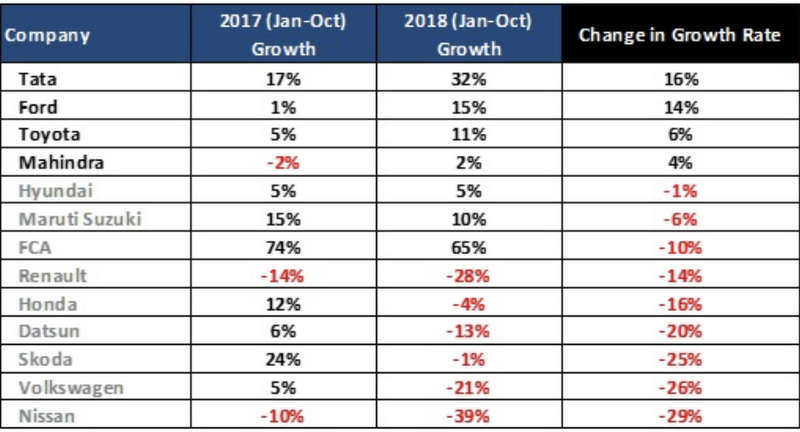

However, there have been a few exceptions such as Nexon and Tiago, which have helped Tata Motors to grow at 32% in 2018. This is a staggering performance, especially when you take a note of the industry growth rate, which is at 6.4% for the same period. With Tata having Harrier and 45X launch planned in 2019, they can expect to post increase in sales growth in the coming years.

Ford is another carmaker to beat industry trends by registering growth of 15%. Ford’s growth in India is led by Ford Freestyle and facelifted EcoSport. Toyota is also witnessing a good year, as sales of Innova have helped the company to achieve a growth of 11%. Mahindra Marazzo has been witnessing brisk sales, which has helped the company to achieve 2% growth in 2018.

Rest all carmakers have negative growth rates in 2018, when compared to 2017 growth rates. In the order of least affected to worst affected, we have Hyundai with a negative growth of 1%, Maruti Suzuki -6%, FCA -10%, Renault -14%, Honda -16%, Datsun -20%, Skoda -25%, Volkswagen -26%, and Nissan -29%.

Other factors that are playing spoilsport for Indian passenger car market include high interest rate, unstable fuel prices and depreciating value of Rupee. These factors have increased acquisition and running cost of cars, which in turn is creating negative consumer sentiments. However, there may be a silver lining, in that carmakers may announce top discounts and freebies to clear existing inventory. 2020 will mark the beginning of BS-VI emissions norms in India, so any old stock will have to be liquidated by that time.