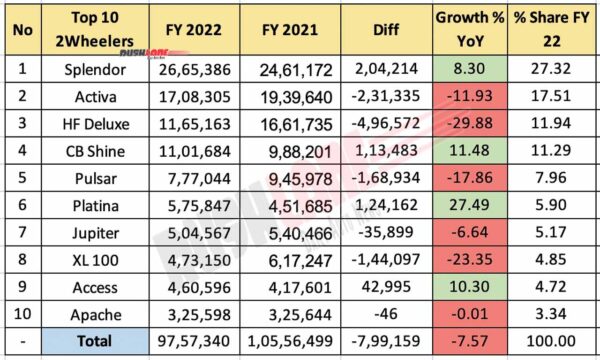

Top 10 two-wheeler sales for the fiscal just concluded is reported at 7.57 percent decline; Hero Splendor leads

Cumulative Top 10 two-wheeler sales for FY 2022 fell below the 1 crore mark. Total sales fell to 97,57,340 units, down from 1,05,56,499 units. Volume loss is reported at just under 8 lakh units at 7.57 percent decline.

Top spot, as always goes to Hero Splendor. Sales is up at 26,65,38 units at 8.30 percent growth. Volume gain stood at 2,04,214 units, up from 24,61,172 units. Hero Splendor sales in the last fiscal made up for over a quarter of 10 top two-wheeler sales at 27.32 percent.

Top 10 Two Wheelers FY 2022

Honda Activa sales continue at second place despite decline. Sales in FY22 fell to 17,08,305 units, down from 19,39,640 units. Volume loss stood at 2,31,335 units at 12 percent decline. Activa sales contributed to 17.51 percent of total sales of the top order. With over a tenth of its volume shaved off, volume difference between both top sellers is at a humongous 9,57,081 units. This puts Splendor dominantly on top spot.

Hero HF Deluxe takes third spot following a sharp fall of 30 percent. FY22 sales fell to 11,65,163 units, down from 16,61,735 units. Volume loss stood at just below 5 lakh units marking the sharpest fall in the top order. The steep decline resulted in HF Deluxe only just edging ahead of Honda CB Shine sales.

The latter reported 11.48 percent growth, up at 11,01,684 units from 9,88,201 units. Volume gain stood at 1,13,483 units. Both bikes enjoyed market share at over 11 percent. Volume difference reduced to 63,479 units, having improved vastly from volume difference of 6,73,534 units in FY21.

Bajaj took fifth and sixth spot with its Pulsar series, and Platina. While Pulsar sales fell for the fiscal, Platina sales improved. Pulsar sales were down at 7,77,044 units from 9,45,978 units. Volume loss stood at 1,68,934 units at 17.86 percent decline. It accounted for just under 8 percent of market share in the top 10 list. Platina contributed to just under 6 percent. Total sales for FY22 were up at 5,75,847 units from 4,51,685 units. Volume gain stood at 1,24,162 percent. Sales growth for the fiscal is reported at 27.49 percent.

Suzuki Access scooter sales

TVS took the next 2 spots. The Jupiter scooter took top spot for TVS at 5,04,567 units. Sales fell from 5,40,466 units. Volume loss is reported at just under 36k units. Volume loss stood at 6.64 percent. Jupiter accounted for 5.17 percent market share. XL100 sales fell by 23.35 percent. Sales were down at 4,73,150 units from 6,17,247 units. Volume loss is reported at 1,44,097 units. Sales accounted for just under 5 percent market share in the top 10 sales orders.

| Top 10 Two Wheelers | FY 2022 | FY 2021 | Growth % YoY |

|---|---|---|---|

| 1. Hero Splendor | 26,65,386 | 24,61,172 | 8.30 |

| 2. Honda Activa | 17,08,305 | 19,39,640 | -11.93 |

| 3. Hero HF Deluxe | 11,65,163 | 16,61,735 | -29.88 |

| 4. Honda CB Shine | 11,01,684 | 9,88,201 | 11.48 |

| 5. Bajaj Pulsar | 7,77,044 | 9,45,978 | -17.86 |

| 6. Bajaj Platina | 5,75,847 | 4,51,685 | 27.49 |

| 7. TVS Jupiter | 5,04,567 | 5,40,466 | -6.64 |

| 8. TVS XL 100 | 4,73,150 | 6,17,247 | -23.35 |

| 9. Suzuki Access | 4,60,596 | 4,17,601 | 10.30 |

| 10. TVS Apache | 3,25,598 | 3,25,644 | -0.01 |

| Total | 97,57,340 | 1,05,56,499 | -7.57 |

Suzuki Access scooter sales improved for the fiscal year just ended. Growth stood at 10.30 percent. Sales were up at 4,60,596 units, up from 4,17,601 units. Volume gain stood at 42,995 units. While Access trailed XL100 sales by 2 lakh units in FY21, in FY22 that number is miniscule at around 13k units. TVS Apache sales graph was flat at 3,25,598 units. In the previous fiscal the company had sold 46 more units.