TVS dispatched more units of Star City to foreign markets than it was able to sell in India last month

TVS is one of the strongest performers in the two-wheeler segment in India and it is currently the third largest two-wheeler manufacturer in the country. Despite facing a tough last year primarily due to the Covid-19 pandemic, the Hosur-based bikemaker managed to hold its ground and continued to witness decent growth during the said period.

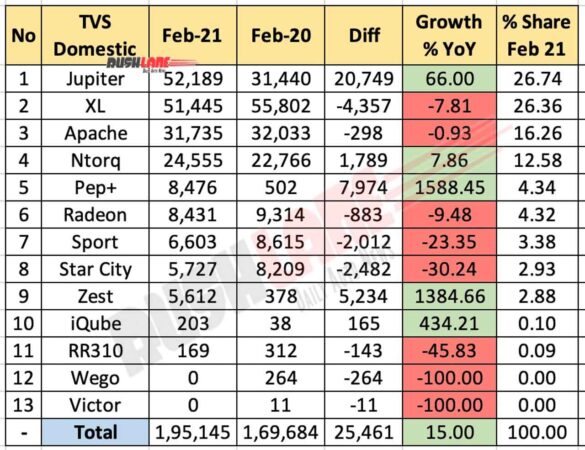

Domestic- Jupiter, XL Super Lead the sales chart

In February 2021, TVS dispatched a total of 1,95,145 two-wheelers to its dealerships across the country as compared to 1,69,684 units retailed during the same period last year. This translated to YoY growth of 15 percent. The sales chart was led by the company’s highest-selling scooter Jupiter with a cumulative sales of 52,189 units last month.

During the same month last year, TVS sold 31,440 units of the scooter with a YoY growth of 66 percent. It was closely followed by the company’s only moped offering XL with a sales volume of 51,445 units. In comparison, TVS sold 55,802 units of XL which translates to a 7.81 percent decline in YoY sales.

This was followed by the company’s Apache range of premium sporty motorcycles which registered sales of 31,735 units in February this year. As opposed to this year, last year TVS sold 32,033 units of Apache motorcycles which resulted in YoY degrowth of 0.93 percent.

Scooters- Ntorq, Pep+ show sizable growth

The fourth spot was taken by the brand’s flagship scooter Ntorq which registered a sales volume of 24,555 units last month. The sales figure was 1,789 units shorter during the same period last year thus resulting in YoY growth of 7.86 percent.

| No | TVS Domestic | Feb-21 | Feb-20 | % |

|---|---|---|---|---|

| 1 | Jupiter | 52,189 | 31,440 | 66.00 |

| 2 | XL | 51,445 | 55,802 | -7.81 |

| 3 | Apache | 31,735 | 32,033 | -0.93 |

| 4 | Ntorq | 24,555 | 22,766 | 7.86 |

| 5 | Pep+ | 8,476 | 502 | 1588.45 |

| 6 | Radeon | 8,431 | 9,314 | -9.48 |

| 7 | Sport | 6,603 | 8,615 | -23.35 |

| 8 | Star City | 5,727 | 8,209 | -30.24 |

| 9 | Zest | 5,612 | 378 | 1384.66 |

| 10 | iQube | 203 | 38 | 434.21 |

| 11 | RR310 | 169 | 312 | -45.83 |

| 12 | Wego | 0 | 264 | -100.00 |

| 13 | Victor | 0 | 11 | -100.00 |

| – | Total | 1,95,145 | 1,69,684 | 15.00 |

Ntorq was followed by the company’s entry-level scooter Scooty Pep+ with a registered sales volume of 8,476 units. The figures stood at only 502 units during February last year which translated to a massive YoY growth of 15788.45 percent.

The sixth, seventh and eighth spots were taken by the company’s entry-level motorcycles Radeon (8,431 units), Sport (6,603 units) and Star City (5,727 units). All three bikes registered negative YoY growths of 9.48 percent, 23.35 percent and 30.24 percent respectively. The other scooter offering from TVS, Zest recorded sales of 5,611 units as opposed to a paltry sales volume of 378 units last year in February leading to a YoY increase by 1384.66 percent.

Exports Fair Slightly Better

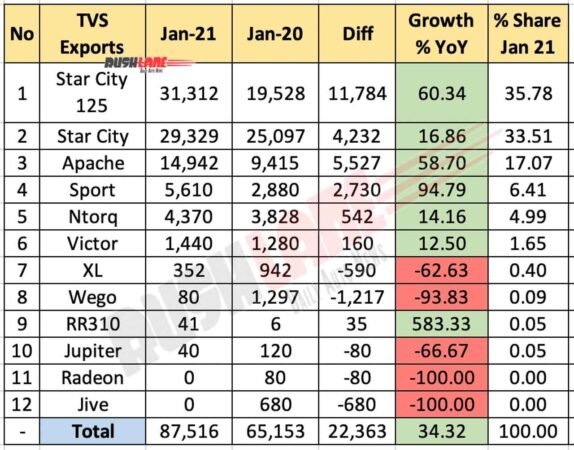

Coming to exports, the manufacturer fared a little better with a total of 87,516 units dispatched to overseas markets in January this year. In comparison, TVS shipped 65,153 units to foreign countries during January 2020. This resulted in YoY growth of 34.32 percent in exports. The sales chart was led by Star City 125 which is not present in the Indian market. With sales of 31,312, it witnessed a YoY growth of 60.34 percent.

The regular Star City followed in at the second spot with 29,329 units dispatched last month. In comparison, TVS sold 25,097 units during the same month last year with 16.86 percent YoY growth. Other prominent models that were exported overseas were Apache (14,942 units), Sport (5,610 units), Ntorq (4,370 units) and Victor (1,440 units) with a YoY growth of 58.70 percent, 94.79 percent, 14.16 percent and 12.50 percent respectively.