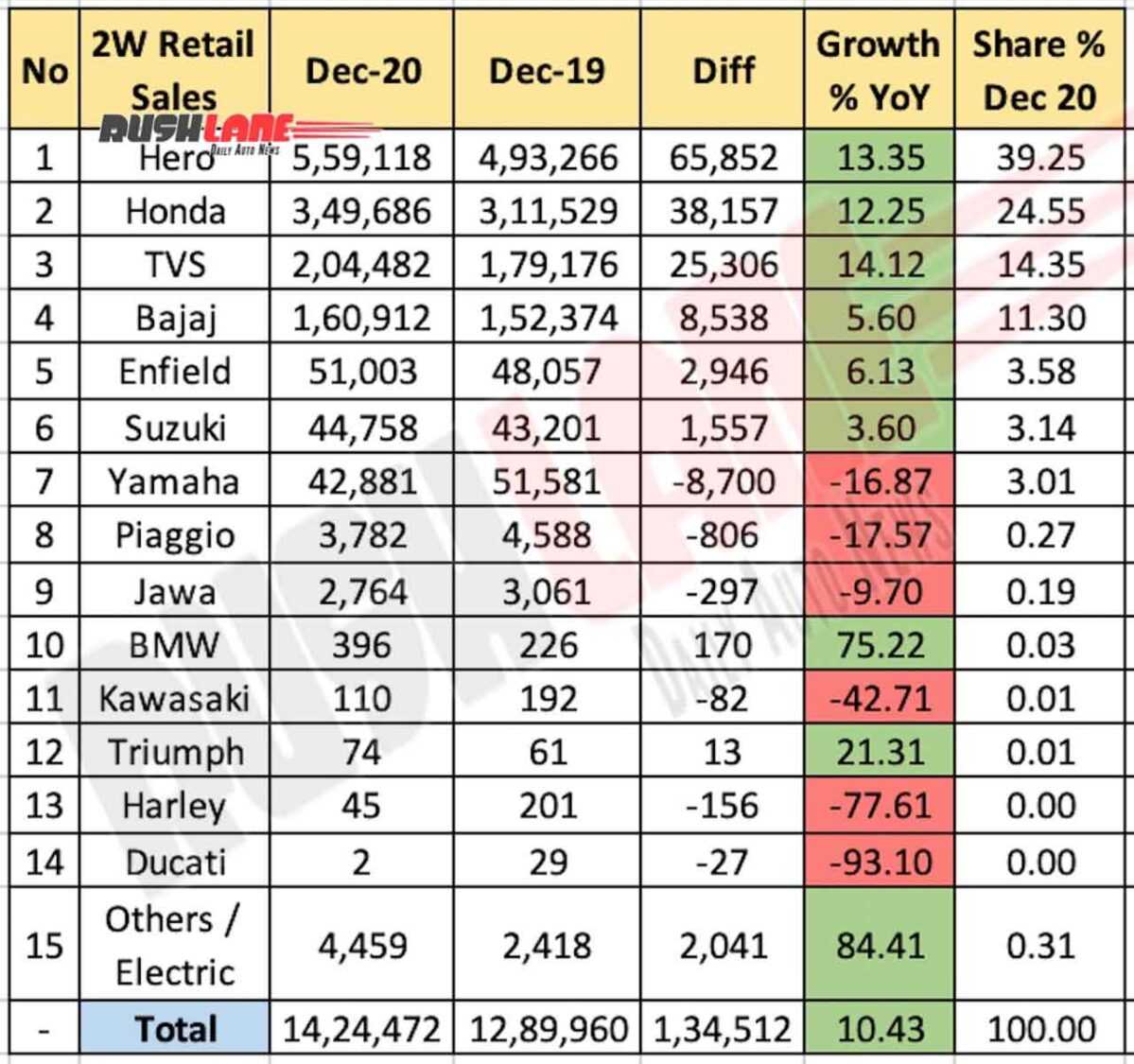

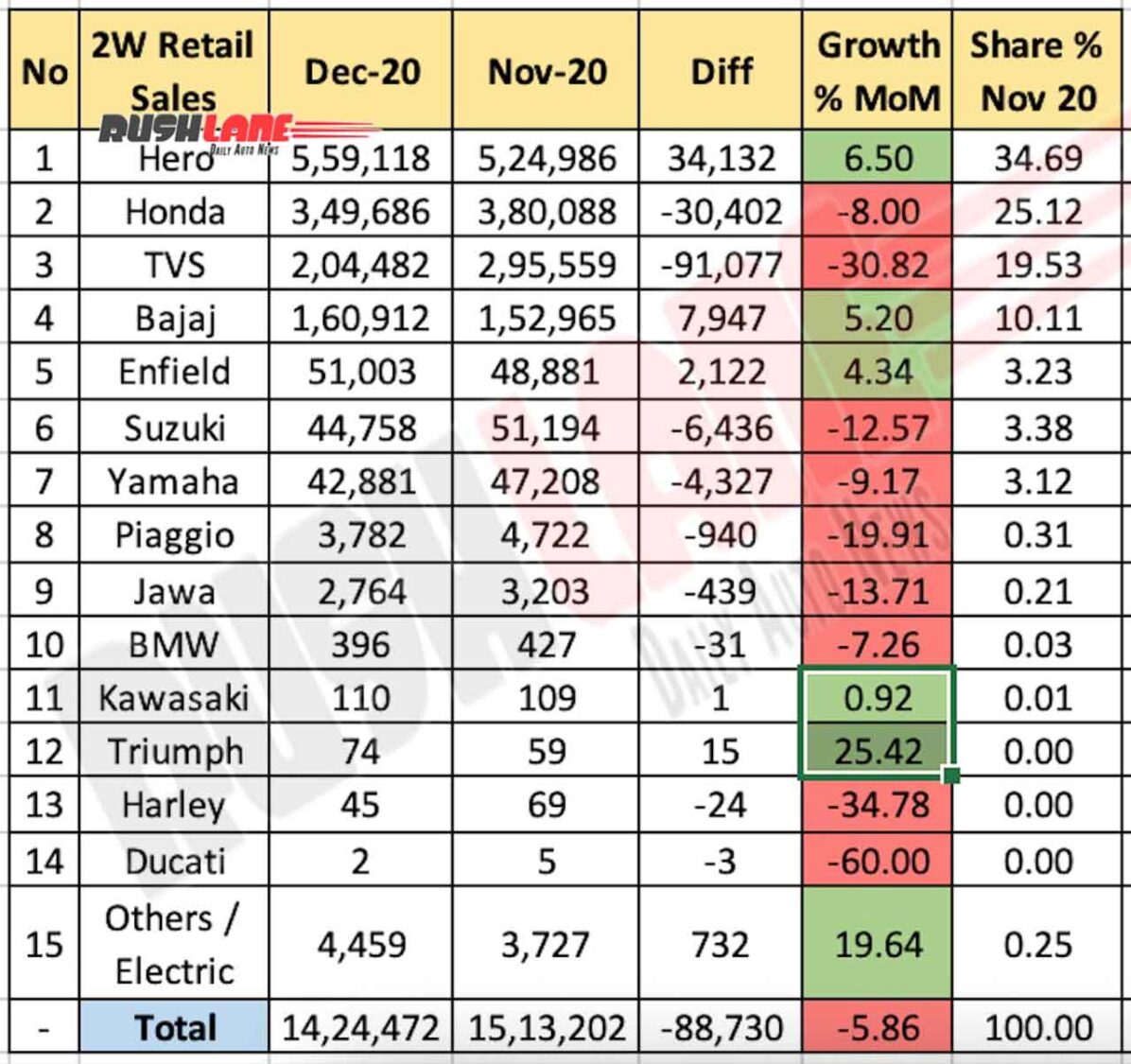

Two wheeler retail sales increased YoY by 10,43 percent while MoM sales dipped 5.86 percent

A large percentage of two-wheeler makers posted year-on-year sales growth in December 2020. Hero, Honda, TVS, Bajaj, Enfield and Suzuki noted positive YoY growth while other two wheeler makers – Yamaha, Piaggio, Jawa, BMW, Kawasaki and Harley suffered de-growth.

Taking into account YoY sales of two wheelers, total retail sales in the past month stood at 14,24,472 units, up 10.43 percent as against 12,89,986 units sold in Dec 19. MoM retails however, dipped 5.86 percent as 15,13,202 units had been sold in Nov 20.

Hero MotoCorp once again ruled the charts with 5,59,118 unit retails in the past month and a 39.35 percent market share. Retail sales were up 13.35 percent as against sales of 4,93,266 units in the same month of the previous year. MoM sales also ended on a positive note up 6.50 percent as against 5,24,986 units sold in Nov 20.

Hero, Honda, TVS lead two wheeler sales charts

Honda two wheeler sales stood at 3,49,686 units in Dec 20, up 12.25 percent as against 3,11,529 units sold in Dec 19. MoM sales fell 8 percent as the company had retailed 3,80,088 units in Nov 20. More than 50 percent of these total sales were from the Activa scooter while others such as the CB Shine, Dio, Unicorn, Livo, Grazia, Hornet and newly launched CB350 also added good numbers.

TVS Motor retail sales in the past month were at 2,04,482 units, up 14.12 percent as against 1,79,176 units sold in Dec 19. MoM sales dipped significantly by 30.82 percent as the company had sold 2,95,559 units in Nov 20. Sales were boosted in Nov due to festive demand.

Retail Sales of Bajaj Auto also noted significant growth in the past month. Bajaj two wheeler retails increased 5.60 percent allowing the company to command an 11.30 percent market share.

Total retails in Dec 20 stood at 1,60,912 units, up from 1,52,374 units sold in Dec 19 while MoM sales increased by 5.20 percent with 1,52,965 units sold in Nov 20. The year ended with Bajaj Auto becoming the first two wheeler company in the world to cross market capitalization of Rs.1 lakh crore.

Enfield, Suzuki, Yamaha, Piaggio

Royal Enfield at No.5 noted a 6.13 percent YoY sales growth with 51,003 units sold in the past month, up from 48,057 units sold in Dec 19. MoM sales also increased marginally by 4.34 percent with 48,881 units retailed in Nov 20. The Chennai-based two wheeler maker saw most demand for models such as the Bullet and Classic 350 while the recently launched Meteor 350 and the Himalayan, Interceptor 650 and Continental GT bikes also added good numbers.

YoY sales growth of 3.60 percent and market share of 3.14 percent was reported by Suzuki Motorcycle India. Total retails in the past month stood at 44,758 units, up from 43,201 units sold in Dec 19. MoM sales however dipped 12.57 percent with 51,194 units retailed in Nov 20. The company added new liveries to the Gixxer series and Bluetooth enabled Access 125 along with the Burgman Street. The new V-Strom 650 XT was added to the company lineup relating to increased sales during the festive season.

Yamaha was the only other two wheeler maker to have crossed 5 figure retail sales, despite posting 16.87 percent YoY and 9.17 percent MoM de-growth. Sales in Dec 20 stood at 42,881 units, down from 51,581 units sold in Dec 19 while Nov 20 sales had stood at 47,208 units.

Piaggio, Jawa, BMW

Piaggio, BMW and Jawa along with Kawasaki, Triumph, Harley Davidson and Ducati failed to cross the 10,000 unit mark retail sales figures in the past month. However, BMW and Triumph posted 75.22 percent growth and a 21.31 percent YoY growth respectively.