Two wheeler retail sales were at their lowest ever in December 2022 suffering a de-growth over sales in 2021, 2020 and 2019

Year 2022 was not so great for the two wheeler segment. In the earlier post, we took a look at the two wheeler wholesales (sales from company to dealers) for Dec 2022. In this post, we will take a look at the retail sales (sales from dealers to customers) in Dec 2022.

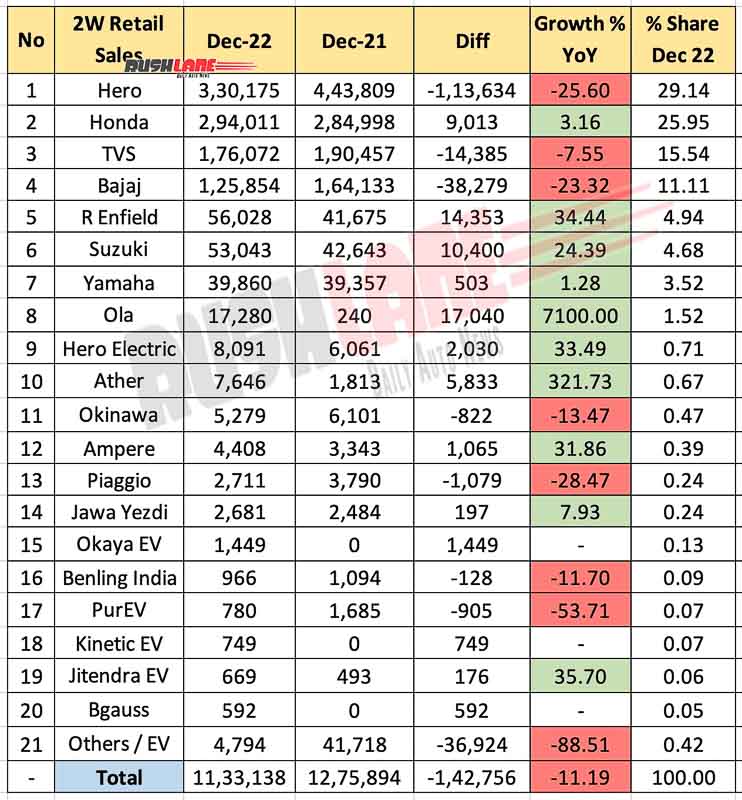

Retail sales were down to 11,33,138 units in Dec 2022. This was the lowest Dec 2022 2W retail sales since 2019. Sales in Dec 2021 had stood at 12,75,894 units relating to a 11.19 percent YoY decline while sales were also lower by 29.07 percent and 20.54 percent when compared to sales of 15,97,554 units and 14,25,994 units sold in December of 2020 and 2019. What brought about this de-growth? Could it be a rise in inflation, rising cost of ownership or a clear migration to electric vehicles?

However, taking sales during the calendar year of 2022 into account, sales increased to 1,53,88,062 units during the period Jan-Dec 2022 which was a 13.37 percent growth over 1,35,73,682 units sold in the same period of 2021. There was also a 10.50 percent improvement over 1,39,26,085 units sold in Dec 2020 but a decline of 15.47 percent from 1,82,04,593 units sold in Dec 2019, a pre-covid period.

Two Wheeler Retail Sales Dec 2022

Hero MotoCorp, the No. 1 two wheeler OEM has seen sales volumes dip by 1,13,634 units to 3,30,175 units in Dec 2022, down from 4,43,809 units sold in Dec 2021. Market share fell to 29.14 percent from 34.78 percent YoY. Honda two wheeler sales increased to 2,94,011 units from 2,84,998 units sold in Dec 2021 taking market share up to 25.95 percent from 22.34 percent YoY. Honda is set to enter the electric two wheeler segment with at least 10 electric bikes planned for launch by 2025.

TVS Motor was at No. 3 with retail sales of 1,76,072 units, down from 1,90,457 units sold in Dec 2021 while Bajaj Auto also suffered a YoY de-growth to 1,25,854 units in Dec 2022 from 1,64,133 unit retail sales in Dec 2021.

RE sales improved to 56,028 units in the past month from 41,675 units sold in Dec 2021 while sales of Suzuki also increased to 53,043 units in Dec 2022 from 42,643 units sold in Dec 2021. India Yamaha Motors ended the past month with 39,860 unit sales, a marginal growth of 39,357 units sold in Dec 2021.

Electric 2W Retail Sales Dec 2022

Outstanding sales were reported for those two wheeler OEMs with an electric lineup. Ola saw its sales zoom to 17,280 units from just 240 units sold in Dec 2021 taking up market share to 1.52 percent from 0.02 percent YoY. CEO Bhavish Aggarwal has stated on social media that he expects the Ola S1 lineup to become the best-selling scooter in India by August 2023 overtaking the Honda Activa.

Hero Electric also saw its sales increase to 8,091 units from 6,061 units on a YoY basis while Ather Energy sales increased to 7,646 units in Dec 2022 from 1,813 units sold in Dec 2021. The list also included Okinawa (5,279 units), Ampere (4,408 units), Piaggio (2,711 units), Classic Legends (2,681 units) and Okaya (1,449 units). Benling India sales dipped to 966 units last month from 1,094 units sold in Dec 2021 and PurEV sales fell to 780 units from 1685 units sold in Dec 2021. Kinetic Green (749 units), Jitendra (669 units) and Bgauss Auto (592 units) concluded this list while there were others in this segment that added 4,794 units to total retail sales.