While two wheeler wholesales increased on a YoY basis, retail sales dipped 10.92 percent in July 2022

In the earlier post we discussed the wholesale numbers, which were units sold by manufacturer to dealers. In this post we will take a look at the retail numbers, which are two wheelers sold to consumers by dealers.

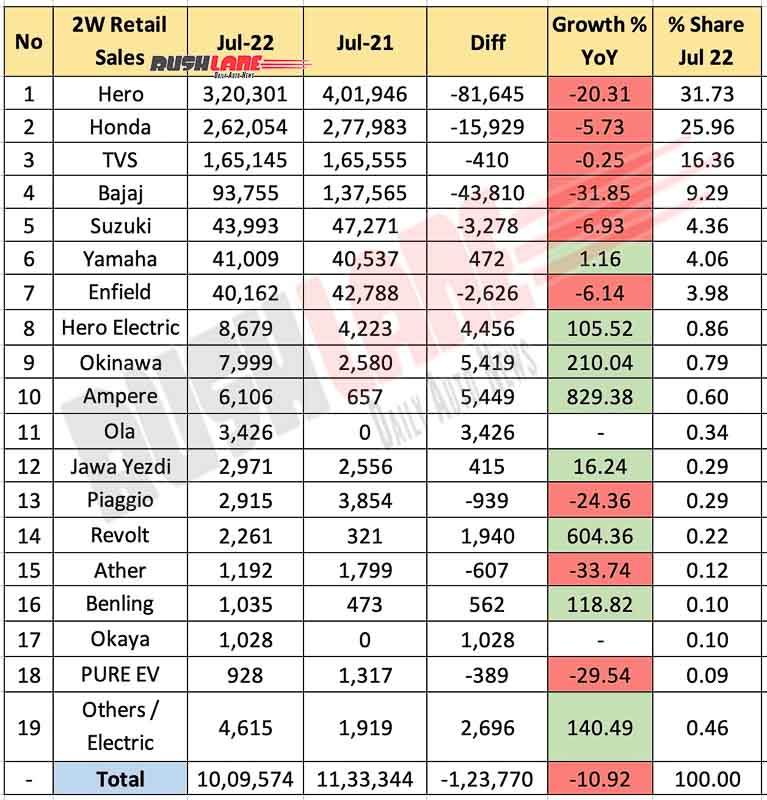

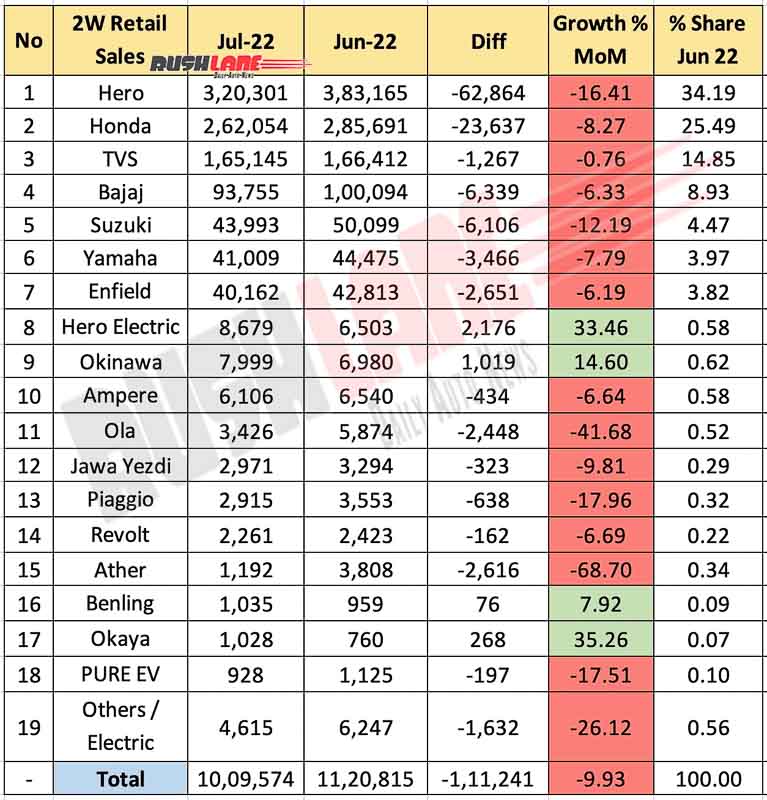

Retail sales of two wheelers as revealed by Federation of Automobile Dealers Associations (FADA), shows off a 10.92 percent YoY de-growth. Sales stood at 10,09,574 units in July 2022, down from 11,33,344 units sold in July 2021. It was however, a 13.70 percent growth over 8,87,942 units sold in July 2020 but a 27.86 percent de-growth as compared to 13,99,532 units sold in July 2019 (the pre-Covid period).

Two Wheeler Retail Sales July 2022

Hero MotoCorp stood at the top of this list with retail sales of 3,20,301 units in July 2022, down from 4,10,946 units sold in July 2021. Market share dipped to 31.73 percent from 35.47 percent held in July 2021. Rising prices as was announced by the company from July 2021, could have been a reason for this de-growth along with ever increasing fuel costs which has lowered buyer sentiments across all segments.

Honda two wheeler retail sales were at 2,62,054 units in July 2022, down from 2,77,983 units sold in July 2021. Market share however, increased to 25.96 percent from 24.53 percent YoY. At No. 3 was TVS Motor Company with retail sales of 1,65,145 units in July 2022. This was only a marginal de-growth over 1,65,555 units sold in July 2021 while market share improved to 16.36 percent from 14.61 percent held in July 2021.

Bajaj Auto and Suzuki also posted YoY de-growth. Bajaj retail sales dipped to 93,755 units in the past month from 1,37,565 units retailed in July 2021 while Suzuki sales fell to 43,993 units last month as against 47,271 units sold in July 2021. However, in the case of Suzuki, market share improved to 4.36 percent from 4.17 percent YoY.

The only ICE powered leading two wheeler maker to post a YoY growth was India Yamaha Motors. Sales increased to 41,009 units in July 2022, up from 40,537 units sold in July 2021. Market share also went up to 4.06 percent from 3.58 percent YoY. Royal Enfield has seen retail sales of 40,162 units in July 2022 down from 42,788 units sold in July 2021 but a marginal increase in market share to 3.98 percent from 3.78 percent YoY.

Electric Two Wheeler Sales Increase YoY

Added demand has been shown towards electric two wheelers in recent months with retail sales increasing several fold for some electric two wheeler makers. Hero Electric sales stood at 8,679 units in July 2022, up from 4,223 units sold in July 2021. Market share went up to 0.86 percent from 0.37 percent YoY.

Okinawa Autotech, which was ahead of Hero Electric in June 2022, saw retail sales of 7,999 units in July 2022, up from 2,580 units sold in July 2021. It was followed by Ampere Vehicles with 6,106 unit retail sales, a growth over 657 units sold in July 2021 bringing up market share to 0.60 percent from 0.06 percent YoY. Ola Electric two wheeler retails stood at 3,426 units in the past month commanding a market share of 0.34 percent.

Thereafter, the list also included Classic Legends (Jawa / Yezdi – 2,971 units) and Piaggio Vehicles (Vespa / Aprilia – 2,915 units) with Classic Legends reporting a YoY growth but Piaggio sales dipped from 3,454 units sold in July 2021. Revolt (2,261 units), Ather (1,192 units) and Benling India (1,035 units) were lower down the list along with Okaya EV (1,028 units) and PUR Energy (928 units). Other two wheeler retail sales, which also included electric two wheeler makers, posted sales of 4,615 units in July 2022 up from 1,919 units sold in July 2021.