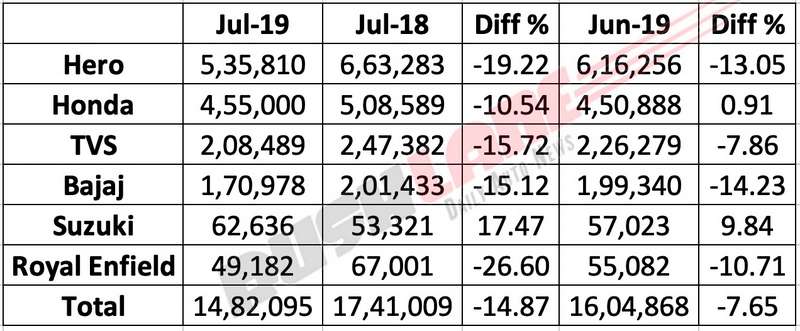

It’s challenging times for the auto sector in India, as sales continue to be sluggish across most segments. In the two-wheeler segment, most companies have registered negative growth in July, as compared to sales in the same period last year. Only exception is Suzuki Motor India that has registered 17.5% growth in July 2019.

Biggest loss in sales in July 2019 has come for Royal Enfield that has registered -26.6% de-growth in sales. Royal Enfield sales in July 2018 stood at 67,001 units, which came down to 49,182 units in July 2019.

Next on the list is India’s largest two-wheeler manufacturer Hero MotoCorp, which has registered -19.2% de-growth in sales. From 663,283 units in July ’18, sales reduced to 535,810 units in July ’19.

India’s third largest two-wheeler manufacturer TVS Motor Co has registered -15.7% de-growth in sales, down from 247,382 units in July 2018 to 208,489 units in July 2019. Motorcycle sales are down by -10.88% (from 121,434 to 108,210 units) whereas scooter sales have registered -11.60% de-growth (from 118,996 to 105,199 units).

Next is Bajaj Auto that has registered -15.1% de-growth in sales, down from 201,433 to 170,978 units. Bajaj has been doing well with some of its products such as Pulsar range and Platina, but that hasn’t helped the company to escape the on-going slowdown.

Honda Motorcycle & Scooter India (HMSI) has registered -10.5% de-growth in sales, down from 508,589 units in July 2018 to 455,000 units in July 2019. HMSI is the second largest two-wheeler manufacturer in India and one of its most popular products is Activa.

The company currently holds 26.80% marketshare and is working aggressively to improve this number. HMSI recently partnered with Cholamandalam Investment & Finance Co to provide two-wheeler finance options in rural and semi-urban areas. As urban centres have hit saturation levels, it’s the rural and semi-urban areas that will drive two-wheeler growth in the future.

While other two-wheeler manufacturers worry about falling sales, it’s time for celebrations at Suzuki Motor India. The company is the sole exception, as it has registered 17.5% growth, up from 53,321 units in July 2018 to 62,636 units in July 2019. New launches such as Suzuki Gixxer, Gixxer SF MotoGP Edition and Access 125 Special Edition have received good response from the market.

Things could improve in the coming months, as monsoon has gained in intensity across the country. Liquidity situation is also expected to improve with capital infusion in banks and NBFCs. Forthcoming festive season could be another factor that could turn out to be advantageous for two-wheeler manufacturers.