Yamaha India reported growth in wholesale domestic dispatches and loss in exports in November 2020

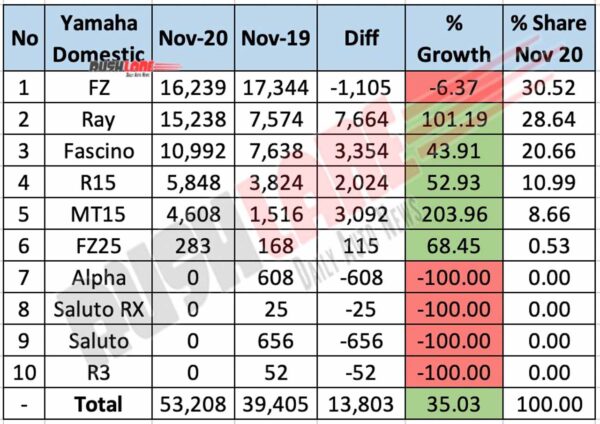

The recently concluded festive season saw most manufacturers report wholesale growth. And that’s true for Yamaha too. Dispatches were up at 53,208 units, up 35 percent from 39,405 units. Volume gain stood at 13,803 units.

In this case growth looks even more grand keeping in mind low base sales a year earlier. An improvement in December will further help strengthen Q4 2020 performance. For the most part, sales improvement for said period is expected going by sales in Oct and November.

Then again, December may just prove to worth everyone’s time considering the range of discounts available. With an expected price hike in January 2020, dealers are liberal with end of year discounts and deals. This proves to be a two-fold benefit for manufacturers. The discount itself, and the perceived gain considering new model year vehicles are always costlier.

Yamaha India portfolio

Yamaha FZ, the manufacturer’s top selling motorcycle saw dispatches reported at 16,239 units. Of the complete portfolio, FZ sales was the only one reported at a decline. Sales fell 6.37 percent, down to 16,239 units from 17,344 units at volume lost at just over 1.1k units. Consequently, FZ managed to retain lead to account for 30.52 percent share of all domestic dispatches for Yamaha.

Currently, the company only sells a handful of products. Ray scooter sales were next best for Yamaha at 28.64 percent share. Dispatches grew 101.19 percent. Up at 15,238 units from 7,574 units. Wholesales more than doubled at volume gain of 7,664 units. Fascino scooter sales surpassed the 10k unit mark. At 10,992 units dispatched, YoY growth stood at 43.91 percent. Volume gain was at 3,354 units, up from 7,638 units. Altogether, three of the top sellers account for almost 80 percent of brand sales.

R15 sales growth was healthy. Compare to last November, sales growth was 52.93 percent. Sales was reported at 5,848 units, up from 3,824 units. Dispatches grew by over 2k units. And though growth was positive, R15 fails to be a top seller at Yamaha. MT15 sales were even lower at 4,608 units. Although volume is low, it was the highest growth at 203.96 percent. A year earlier, sales was as low as 1,516 units. Volume gain stood at over 3k units. FZ25 dispatches were at a mere 283 units, at 68.45 percent YoY growth. Numbers for Nov 2019 stood at 168 units. While the majority of products sold gained ground, it’s left to be seen if Yamaha is capable of selling 50k units on a monthly basis in a consistent manner.

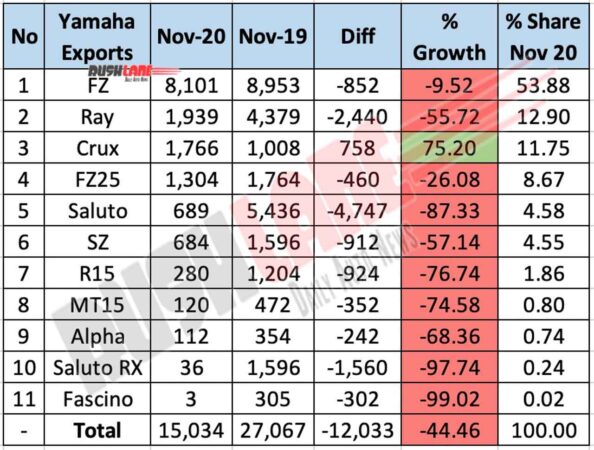

Yamaha India exports for November 2020

Notably, Yamaha FZ isn’t just a bestseller in the domestic market but also leads the export chart convincingly. Exports were reported at 8,101 units, down 9.52 percent. As can be seen, sales fell from 8,953 units. Ray exports fell to 1,939 units from 4,379 units at 55.72 percent YoY sales decline. Crix was the only export parameter that was in the green. FZ25 finds more takers overseas than here. Exports fell to 1,304 units from 1,764 units at 26 percent decline. Saluto numbers fell drastically at 87.33 percent, down to 689 units from 5,436 units. Here volume loss was at a high of 4,747 units.

SZ sales fell to 684 units from 1,596 units. YoY sales decline stood at 57.14 percent. Numbers fell by 912 units. In fact the remainder of the export list is just as low. R15 numbers fell to 280 units from 1,204 units. At 76.74 percent decline, volume contracted by 924 units. But export loss doesn’t end there. MT15 exports fell to a mere 120 units from 472 units.

Alpha exports were down at 112 units. Saluto RX exports were at a paltry 36 units, down from 1,596 units. And fashion same in last at 3 units. Given that most products exported saw numbers fall, overall exports are at a noticeable decline of 44.46 percent. Exports fell to 15,034 units from 27,067 units.