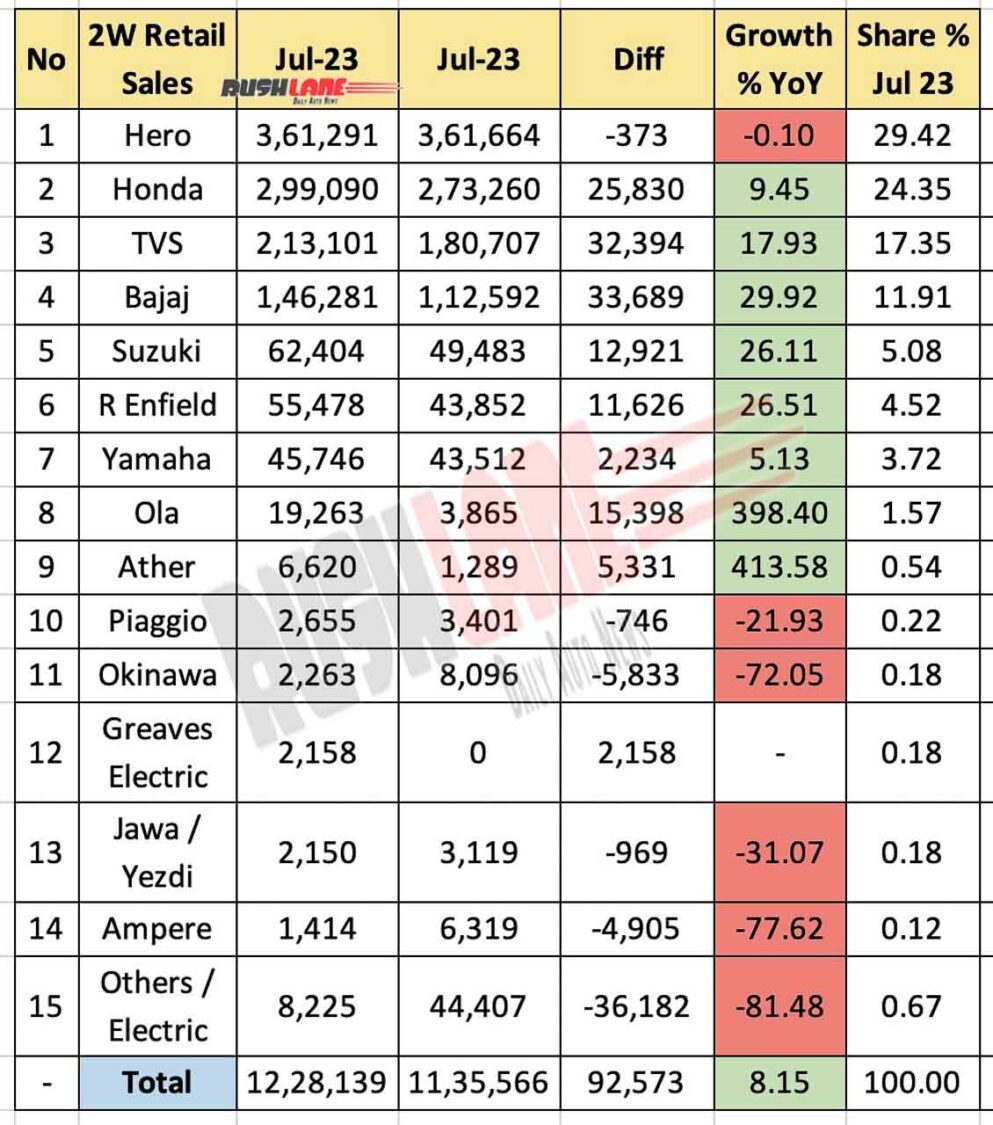

Two-Wheeler Retail Sales released by FADA: July 2023 Analysis

The Indian two-wheeler market witnessed a mixed bag of performance in the month of July 2023, with some manufacturers experiencing growth while others faced challenges. According to the latest data on two-wheeler retail sales, several prominent trends emerged in terms of sales volume, market share, and year-on-year growth.

Hero Maintains Leadership Despite Minor Decline

Hero MotoCorp, the largest two-wheeler manufacturer in India, retained its position at the top of the sales chart. However, the company reported a marginal decline of 0.10% in retail sales compared to the previous year, totaling 3,61,664 units in July 2023. This slight dip could be attributed to various factors, including supply chain disruptions and competition from newer players.

Honda’s Steady Growth Continues

Honda Motorcycle and Scooter India (HMSI) showcased a resilient performance in July 2023, registering a growth of 9.45% in retail sales as compared to the same period last year. The company sold 2,73,260 units, demonstrating the brand’s consistent popularity among Indian consumers.

TVS and Bajaj Show Strong Gains

TVS Motor Company and Bajaj Auto both exhibited impressive growth in July 2023. TVS reported retail sales of 1,80,707 units, marking a substantial increase of 17.93% from the previous year. Bajaj, on the other hand, recorded a remarkable growth rate of 29.92% with retail sales of 1,12,592 units. These figures highlight the demand for their diverse range of two-wheelers and effective marketing strategies.

Suzuki and Royal Enfield Sustain Momentum

Suzuki Motorcycle India and Royal Enfield continued to maintain their growth momentum in July 2023. Suzuki experienced a 26.11% increase in retail sales, selling 49,483 units. Royal Enfield reported sales of 43,852 units, reflecting a growth of 26.51%. Both manufacturers managed to attract consumers with their unique offerings and consistent quality.

Challenges Faced by Other Players

Several manufacturers faced challenges during this period. Yamaha, with retail sales of 43,512 units, reported a modest growth of 5.13%. Ola Electric and Ather Energy, two prominent electric vehicle manufacturers, exhibited impressive growth rates of 398.40% and 413.58%, respectively. However, other players such as Piaggio, Okinawa, Jawa/Yezdi, Ampere, and Greaves Electric experienced declines in retail sales, indicating the competitive nature of the market.

Electric Segment Faces Volatility

The electric two-wheeler market showed a mixed performance, with varying outcomes for different manufacturers. While Ola Electric and Ather Energy achieved significant growth, Ampere faced a significant decline of 77.62% in retail sales. The ‘Others/Electric’ category, which encompasses various electric vehicle brands, reported a substantial decline of 81.48%.

Conclusion

The Indian two-wheeler retail sales landscape in July 2023 reflects a diverse range of outcomes for manufacturers. While some giants like Hero and Honda faced minor challenges, others like TVS and Bajaj enjoyed strong growth. The electric segment continues to witness volatility, with some players achieving remarkable growth and others struggling to maintain sales volumes. Overall, the market’s performance signals the dynamic and competitive nature of India’s two-wheeler industry.