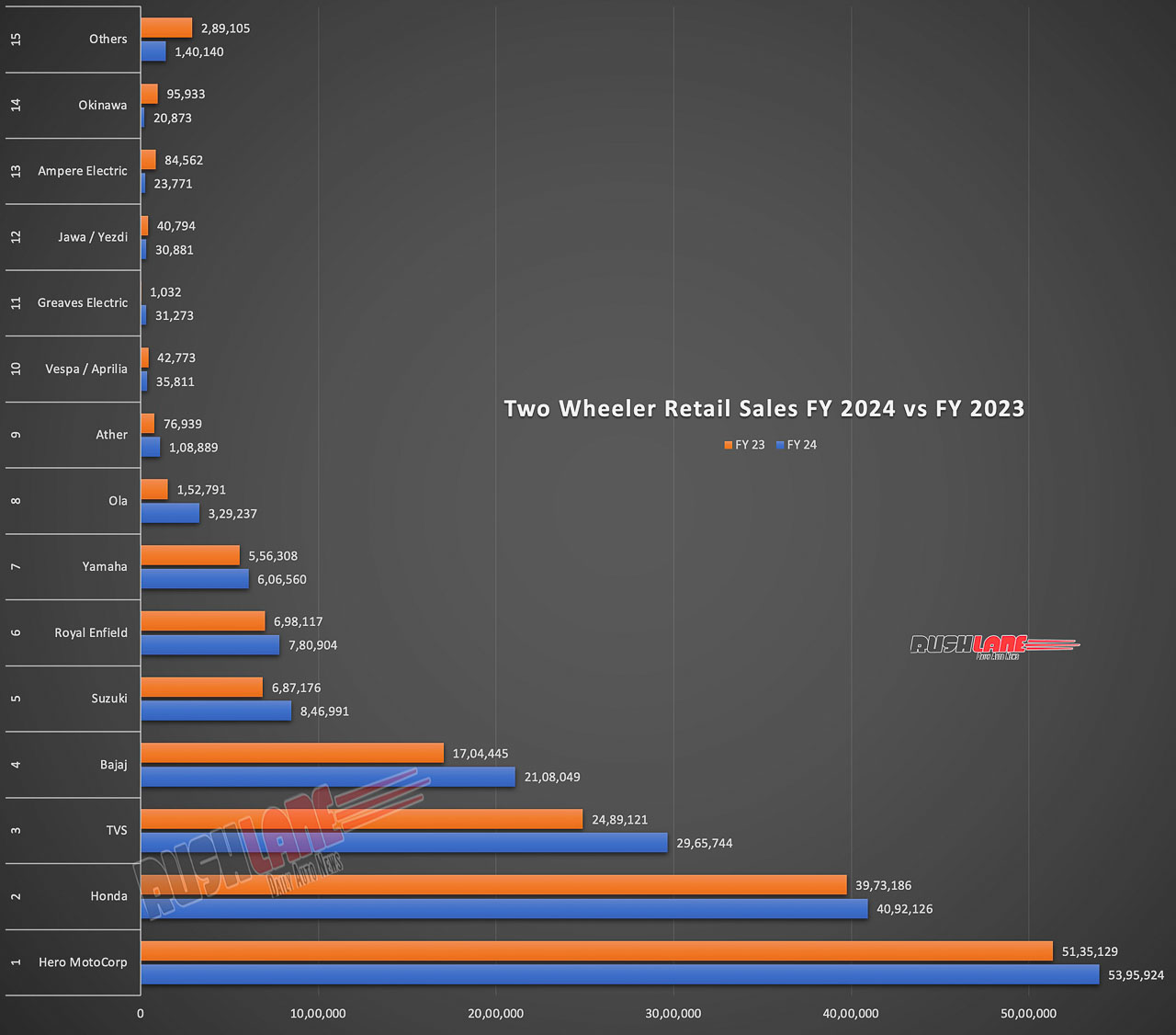

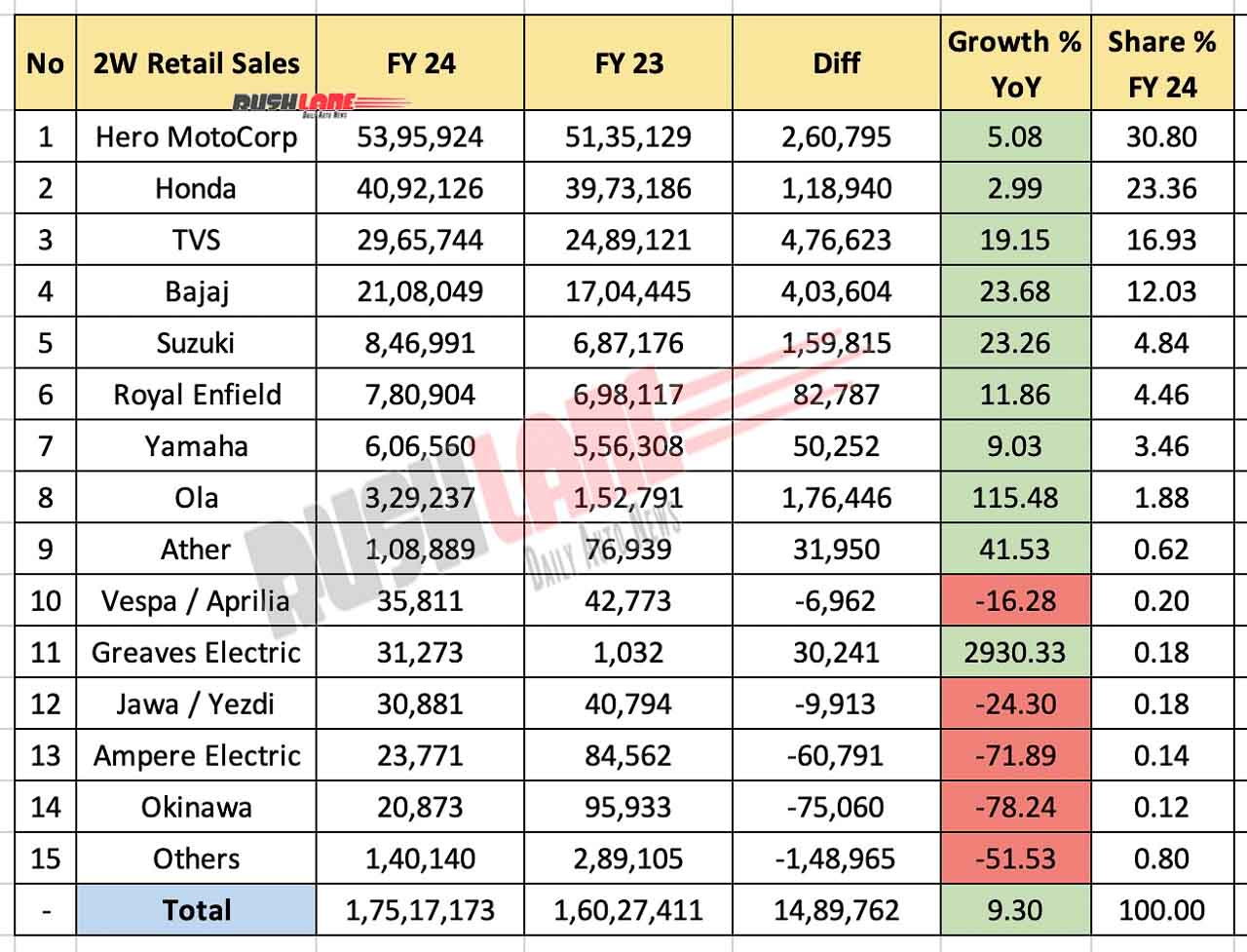

Two wheeler sales grew by 9.30% YoY in FY2024 as buyers showed particular preference towards electric models

Two wheeler sales in FY2024 as revealed by Federation of Automobile Dealers Associations (FADA) touched a total of 1,75,17,173 units. This was a significant growth over 1,60,27,411 units sold in FY2023. A close look at this table shows particular growth by electric two wheeler OEMs Ola and Ather along with Greaves Electric, the latter which sees sales increase several fold.

Two Wheeler Sales FY2024 – Led by Hero and Honda

With Hero and Honda commanding a combined market share of 55%, were at the helm of the two wheeler segment in FY2024. Hero MotoCorp sales improved to 53,95,924 units in FY2024, up from 51,35,129 units sold in FY2023. It was the company’s motorcycle segment that sold significantly higher units as compared to its scooter sales.

The second largest two-wheeler manufacturer and largest scooter maker, HMSI, also posted YoY growth with its sales at 40,92,126 units in FY2024, up from 39,73,186 units sold in FY2023. Honda Activa, India’s best-selling scooter, drove up these sales figures and the company ended the past financial year crossing the 6 crore domestic sales milestone ever since it went solo in 1999.

TVS Motor Company’s total sales for FY2024 stood at 29,65,744 units, a growth over 24,89,121 units sold in the same period of 2023. High demand for the Bajaj Pulsar range steered its maker Bajaj Auto Limited to record 21,08,049 unit sales in FY2024. This was a growth of 4,03,595 units over 17,04,445 units sold in FY2023. The company also has the Chetak in the electric segment that attracts a number of buyers. It competes with the Ola S 1 Air, TVS iQube and now the newly introduced Ather Rizta.

Japanese subsidiary Suzuki Motorcycle India (SMIPL) has also emerged with good figures in FY2024 with 8,46,991 units sold during the said period. This was a growth of over 6,87,176 units sold in FY2023. The company currently commands a 4.84 percent market share, up from 4.29 percent it held in FY2023.

Royal Enfield got good attention among buyers in India and led the company to register total sales of 7,80,904 units in FY2024. This was a significant growth over 6,98,117 units sold in FY2023, taking up market share to 4.460 percent YoY. Lower down the sale list was also India Yamaha Motors with 6,06,560 units sold in FY2024 relating to a growth of 50,252 units over 5,56,308 units sold in the same period last year.

2W Sales FY2023 -Electric Two Wheeler Growth

Electric two wheeler makers Ola Electric has seen outstanding growth in FY2024 when compared to that of FY2023. Sales of its e-scooters (S1 Pro, S1 Air and S1 X+) improved to 3,29,237 units from 1,52,791 units YoY taking up market share to 1.88 percent.

It was followed by Ather Energy with 1,08,889 unit sales in FY2024 from 1,52,791 units sold in FY2023. The new Rizta, a family oriented scooter, is set to take off with outstanding sales as it competes with Ola S1 Air, Bajaj Chetak Urbane and TVS iQube, scoring several points over its rivals especially in terms of range which is claimed at 123 kms.

Thereafter sales dipped for two wheeler makers Piaggio (Vespa / Aprilia 35,811 units), Classic Legends (Jawa / Yezdi 30,881 units), Ampere (23,771 units) and Okinawa (20,873 units) while Greaves saw significantly higher sales at 31,273 units in FY2024 over just 1,032 units sold in FY2023. Other OEMs which also included EV makers contributed 1,40,140 units to total sales in FY2024, down from 2,89,105 units sold in FY2023.