Tata Motors saw highest CV retail sales in February 2024 despite a very marginal YoY degrowth

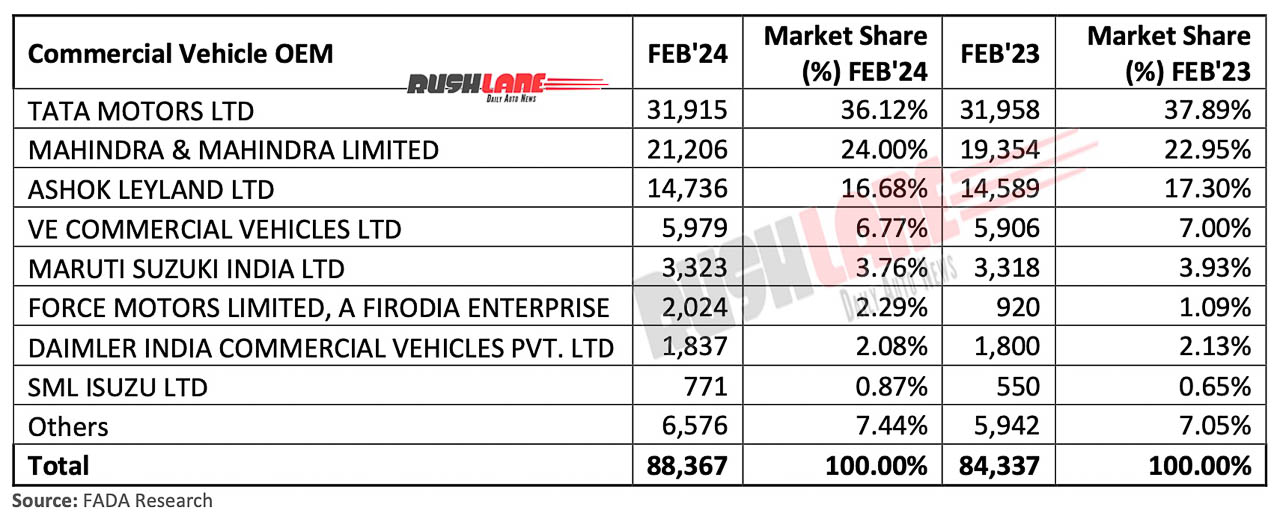

The commercial vehicle (CV) segment has shown off only marginal growth in February 2024 as YoY sales improved by just 4 percent. As per sales data released by Federation of Automobile Dealers Association (FADA), Tata Motors has reported YoY degrowth while every other CV manufacturer, with the exception of Mahindra and Force Motors, has seen only a slight improvement in sales.

Tata Motors Tops CV Sales List in February 2024

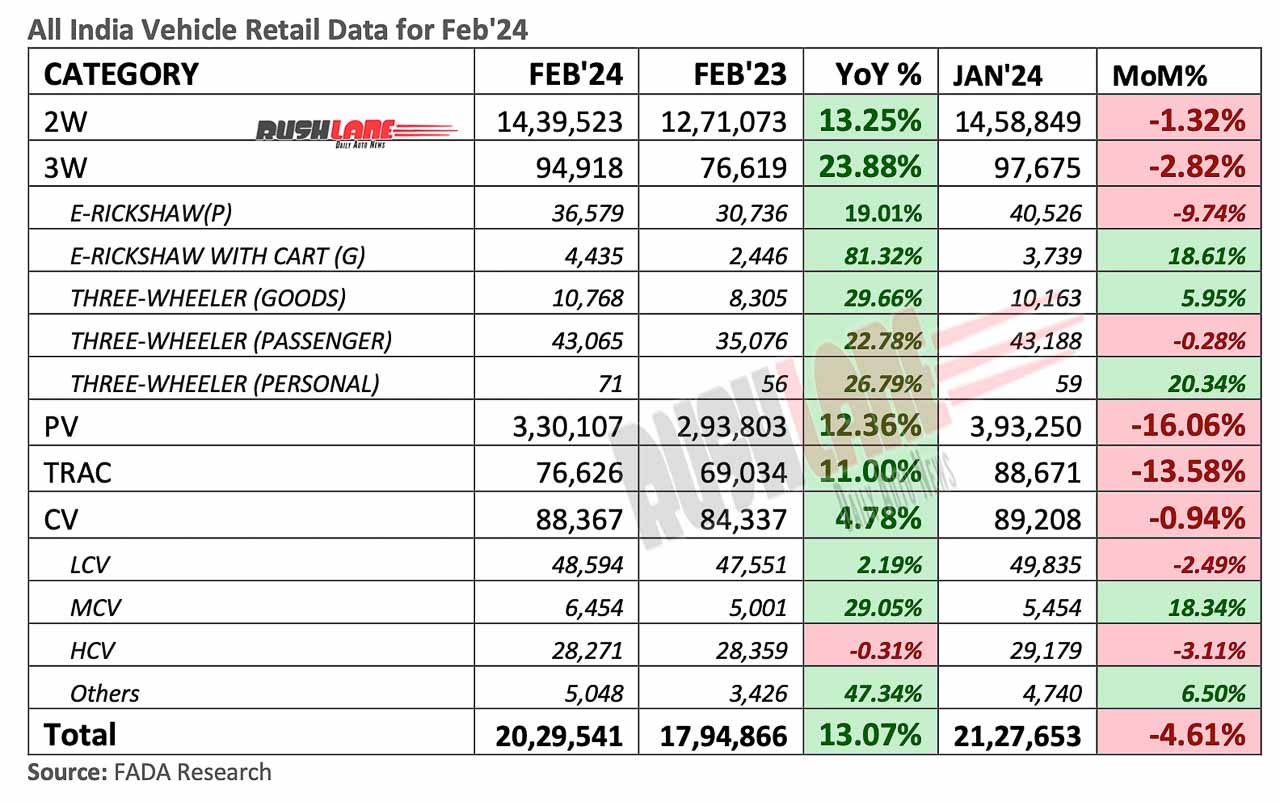

In February 2024, retail sales of commercial vehicles stood at 88,367 units, up just 4 percent from 84,337 units sold in February 2023. This was a YoY volume growth of 4,030 units. It was however a MoM de-growth over 89,208 units sold in January 2024.

The CV segment that includes light, medium and heavy commercial vehicles is influenced by factors such as e-commerce expansion, advancement in technology and Government of India initiatives, all of which combine to play a major role in its demand. The demand for electric commercial vehicles have also increased thanks to several Government incentives. Several Indian automakers, such as Tata Motors, Mahindra, Ashok Leyland and Eicher have been investing in electric commercial vehicle technology.

Tata Motors, India’s largest manufacturer of trucks and buses, has posted retail sales at 31,915 units in February 2024, down from 31,958 units sold in February 2024. The company currently commands a 36.12 percent market share. The company has the Prima series in the heavy duty truck segment while it has the Signa and Ace series in the medium and small CV segments that see most demand in the country. Late last year the company introduced the new Tata Intra V70, Intra V20 Gold and Ace HT+ along with Intra V50 and Ace Diesel range.

The only CV maker to report a significant YoY improvement in sales is Mahindra. With products such as the Bolero, Furio, Supro and Jeeto, saw its retail sales grow to 21,206 units in February 2024, up from 19,354 units sold in February 2023. These increased sales boosted market share to 24 percent from 22.95 percent on a YoY basis.

Maruti Suzuki, Force Motors, Daimler, SML Isuzu

Ashok Leyland was at No. 3 with 14,736 units last month, up from 14,589 units sold in February 2023. The Dost CV is among the company’s high in demand products and even as Ashok Leyland has not yet announced launch date yet, there is the electric Dost expected to be launched later this year. VE Commercial Vehicles also posted a marginal YoY growth to 5,979 units in February 2024 from 5,906 units sold in February 2023 while Maruti Suzuki CV retail sales grew to 3,323 units from 3,318 units on a YoY basis.

Force Motors, actively engaged in manufacturing light commercial vehicles, showed off substantial growth to 2,024 unit retail sales in February 2024 up from just 920 units sold in the same month last year. It was followed by Daimler India with 1,837 unit sales last month from 1,800 units sold in February 2023.

Next up is SML Isuzu with 771 unit retail sales, a growth of 221 units over 550 units sold in February 2023. There were other commercial vehicle makers in this segment that have contributed 6,576 units to total retail sales, up from 5,942 units sold in February 2023 to currently command a 7.44 percent market share.