Tata Motors continues its lead at the top as the country’s No 1 CV maker in June 2023

CV retail sales were boosted due to several factors in June 2023 – such as government’s infrastructural push and growth across the coal mining industry though conversely it also continued to face supply issues.

Federation of Automobile Dealers Associations (FADA), the apex national body of Automobile Retail Industry in India has released retail sales figures for June 2023. While we had earlier listed out two wheeler retail sales, we now draw attention to commercial vehicle retail sales in June 2023 which has improved by 9.57 percent YoY.

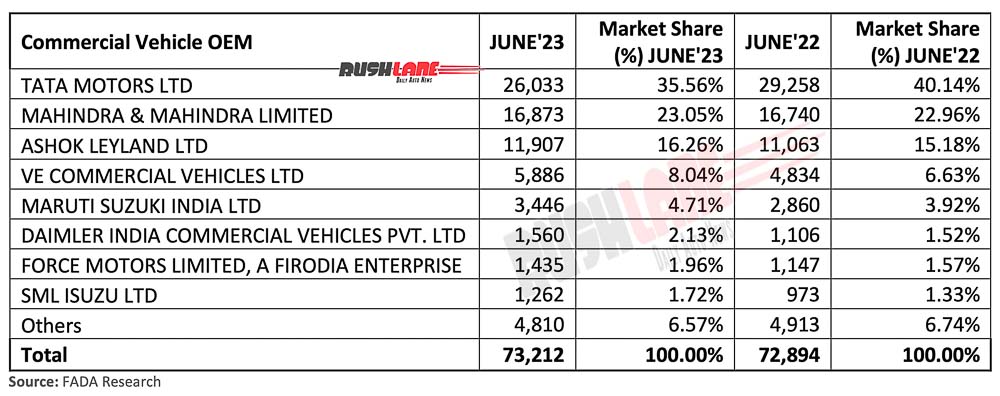

CV Retail Sales June 2023

CV retail sales in the past month grew marginally by 0.44 percent to 73,212 units in June 2023, up from 72,894 units sold in June 2022. It was however, a MoM de-growth from 77,135 units sold in May 2023. YoY growth was seen across the MCV and HCV segments while LCV sales dipped 4.58 percent to 41,975 units from 43,989 units sold in June 2022. MCV sales improved by 6.53 percent to 5,988 units while HCV sales were higher by 4.93 percent to 22,070 units. There were others in this segment that have posted a YoY growth of 41.29 percent to 3,179 units in June 2023.

Every CV maker on this list has posted a YoY growth except Tata Motors despite which, it topped the list with 26,033 unit retail sales in June 2023 with a 35.56 percent market share. This was a YoY decline from 29,258 units sold in June 2022

Retail sales of Mahindra CVs grew marginally to 16,873 units in the past month from 16,740 units sold in June 2022. In June 2023, the company entered the dual-fuel segment in the small commercial vehicle space with the launch of Supro CNG Duo. It is priced at Rs 6.32 lakh (ex-showroom), and can run on both petrol and CNG.

Ashok Leyland commercial vehicle retail sales were at 11,907 units in the past month, up from 11,063 units sold in June 2022. The company currently commands a 16.26 percent market share, up from 15.18 percent held in June 2022. It was followed by VW Commercial Vehicles at No. 4 with 5,886 units sold in June 2023, a YoY growth over 4,834 units sold in June 2022. This included sales of both the Eicher brand and Volvo brand.

Maruti Suzuki’s CV retail sales increased to 3,446 units in June 2023 up YoY from 2,860 units sold in June 2022 to command a 4.71 percent market share. It was followed by Daimler India with 1,560 units sold in the past month, up from 1,106 units sold in June 2022.

Daimler, Force Motors, SML Isuzu

Daimler India also posted a YoY growth in CV retail sales last month to 1,560 units, up from 1,106 units sold in June 2022. Daimler currently holds a 2.13 percent market share. Daimler plans to expand its production capacity at its plant in Oragadam, Chennai by 20-25 percent. From a current capacity of 36,000 units in two shifts, production is set to increase to 45,000-50,000 units in the future.

The list also included Force Motors with 1,435 units sold last month, up from 1,147 units sold in June 2023 while there was SML Isuzu with 1,262 units sold in June 2023 from 973 units sold in the same month last year. There were also others in this segment that contributed 4,810 units to total CV retail sales in June 2023, down from 4,913 units sold in June 2022.