The commercial vehicle segment was impacted by several factors leading to a 1.82 percent decline in retail sales in November 2023

The commercial vehicle (CV) segment suffered a YoY setback in retail sales in November 2023. Several factors led to this de-growth. For starters, it was a poor market sentiment. Unseasonal rains, liquidity issues and delivery constraints also had an adverse effect on retail sales.

CV Retail Sales November 2023 – Tata Motors Tops List

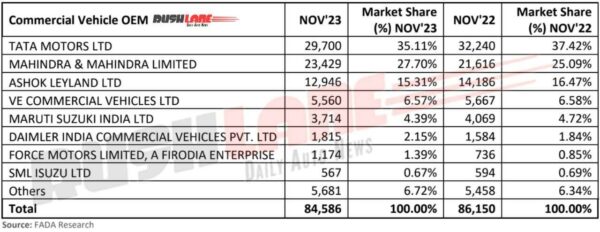

Total CV retail sales stood at 84,586 units in November 2023, down 1.82 percent when compared to 86,150 units sold in November 2022. It has also a MoM de-growth of 4.64 percent when compared to 88,699 units sold in October 2023. It was the LCV segment that brought down sales as it suffered a 6.28 percent YoY de-growth to 48,322 units in the past month from 51,560 units sold in November 2022.

The MCV segment has posted a 3.82 percent YoY growth to 5,276 units from 5,082 units sold in the same month last year while the HCV segment grew by 0.39 percent to 26,690 units last month from 26,585 units sold in November 2022. There were others in this segment that have posted a 47.04 percent YoY and 4.50 percent MoM growth to 4,198 units in November 2023.

Tata Motors led the CV segment with retail sales at 29,700 units down from 32,240 units sold in November 2022. Market share also dipped to 35.11 percent from 37.42 percent YoY. Tata Intra V70, Intra V20 Gold, Ace HT+ have been launched to cater to the demand for first and last mile transportation. Each of these CVs boast of higher payload and lower fuel consumption relating to better owner benefits.

Mahindra was the 2nd best-selling CV maker last month with 23,429 unit retail sales, up from 21,616 units sold in November 2022. Its market share also improved YoY to 27.70 percent from 25.09 percent held in November 2022. Ashok Leyland also reported a YoY de-growth to 12,946 units in November 2023 from 14,186 units sold in November 2022 while market share came down to 15.31 percent from 16.47 percent YoY.

Improved performance by Daimler and Force Motors

VE Commercial Vehicles posted a YoY de-growth in retail sales down to 5,560 units from 5,667 units sold in November 2022 and it was the same with Maruti Suzuki, CV retail sales of which dipped to 3,714 units in the past month from 4,069 units sold in November 2022. Market share dipped to 4.39 percent from 4.72 percent YoY.

Daimler CV retail sales grew to 1,815 units in November 2023, up from 1,584 units sold in November 2022. Market share also grew to 2.15 percent from 1.84 percent on a YoY basis. Force Motors also reported a YoY growth to 1,174 units in November 2023, a significant growth in retail sales over just 736 units sold in November 2022. Market share thus went up to 1.39 percent from 0.85 percent YoY.

There was also SML Isuzu on this list with 567 units sold in November 2023, down from 594 units sold in November 2022 while other OEMs contributed 5,681 units to total retail sales, a growth from 5,458 units sold in November 2022 to capture a 6.72 percent market share. Market estimates suggest that the CV segment could see some revival in sales particularly in view of renewed business activities post elections and improvement in cement and coal sectors.