Strong Growth in 300-500cc Motorcycle Segment Boosts India’s Two-Wheeler Market in December 2023

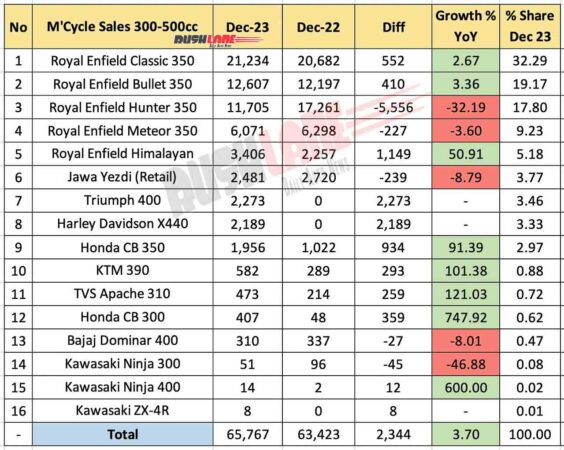

In a remarkable end to the year 2023, the 300-500cc motorcycle segment in India witnessed robust sales, contributing significantly to the country’s vibrant two-wheeler market. According to the latest sales data for December 2023, the sector experienced an overall growth of 3.70% compared to the same period in 2022.

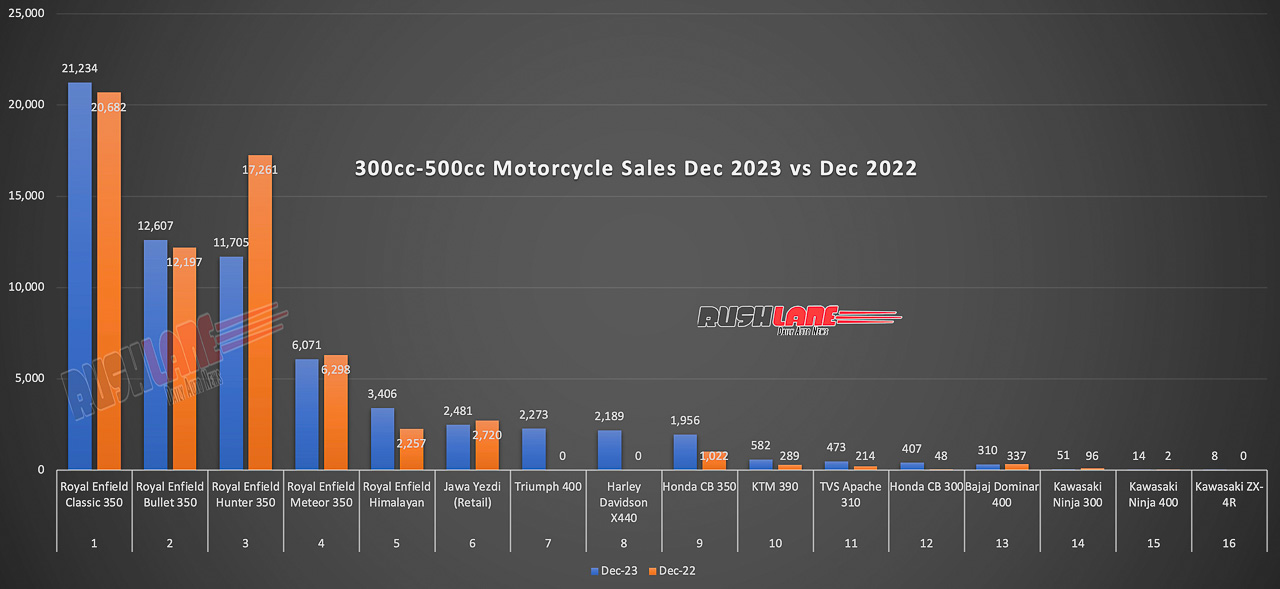

Motorcycle Sales 300cc to 500cc Dec 2023 – Royal Enfield Dominates

Royal Enfield emerged as the clear leader in the 300-500cc segment, with multiple models securing top positions. Classic 350 led the pack, recording sales of 21,234 units in December 2023, showcasing a growth of 2.67% compared to the previous year. Bullet 350 followed closely with 12,607 units sold, representing a growth of 3.36%. However, Hunter 350 experienced a dip in sales, with 11,705 units sold, reflecting a negative growth of -32.19%. Despite this, the brand maintained a dominant position in the market, capturing a substantial 17.80% share of the segment.

Royal Enfield Meteor 350 and Himalayan secured their spots with 6,071 and 3,406 units sold, respectively. The Himalayan demonstrated notable growth, boasting a 50.91% increase in sales compared to December 2022. Other notable players in the segment included Jawa Yezdi, Triumph 400, and Harley Davidson X440, each contributing to the diversity of options available to motorcycle enthusiasts. Triumph 400 and Harley Davidson X440 entered the market with strong performances, securing 3.46% and 3.33% of the segment share, respectively.

Honda’s CB 350 and CB 300 exhibited impressive sales figures, with 1,956 and 407 units sold, respectively. The CB 350 saw an outstanding growth rate of 91.39%, while the CB 300 experienced an extraordinary surge of 747.92%, showcasing the brand’s success in the highly competitive segment. KTM 390 also continued its upward trajectory with 582 units sold, indicating a growth rate of 101.38%. TVS Apache 310 and Bajaj Dominar 400 maintained their presence in the market, each contributing to the segment’s diverse range of offerings.

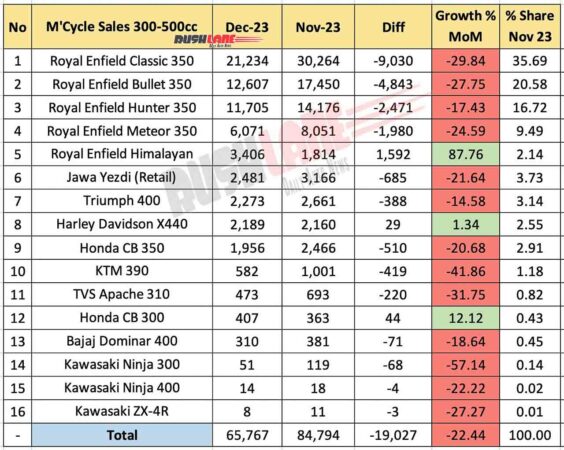

Month on Month performance

Royal Enfield Classic 350, which had enjoyed strong sales in November, witnessed a drastic decrease of 29.84%, with sales plummeting from 30,264 to 21,234 units. Similarly, Bullet 350 and Hunter 350 models experienced declines of 27.75% and 17.43%, respectively. Meteor 350 also faced a dip in sales, dropping by 24.59% from 8,051 to 6,071 units. However, Himalayan bucked the trend, showcasing an impressive 87.76% growth in sales, reaching 3,406 units from 1,814 units in November.

Jawa Yezdi, Triumph 400, and Harley Davidson X440 faced varying degrees of decline, highlighting the volatility in consumer preferences. The Honda CB 350 and CB 300 models also witnessed a dip in sales, with the former experiencing a 20.68% decrease and the latter facing a minor setback of 12.12%.

KTM 390 saw a substantial drop of 41.86% in sales, with the figure falling from 1,001 units in November to 582 units in December. TVS Apache 310, Bajaj Dominar 400, and Kawasaki models also contributed to the overall decline in the segment.

Kawasaki models faced notable setbacks, with the Ninja 300 and Ninja 400 recording declines of 57.14% and 22.22%, respectively. The Kawasaki ZX-4R experienced a marginal decrease of 27.27%, indicating a challenging month for the brand. New entrants like the Triumph 400 and Harley Davidson X440, which had shown promising performances in November, faced challenges in maintaining their momentum.