Bus vs. Jimny: From Broken Pillars to Insurance Adjusters – What Comes Next?

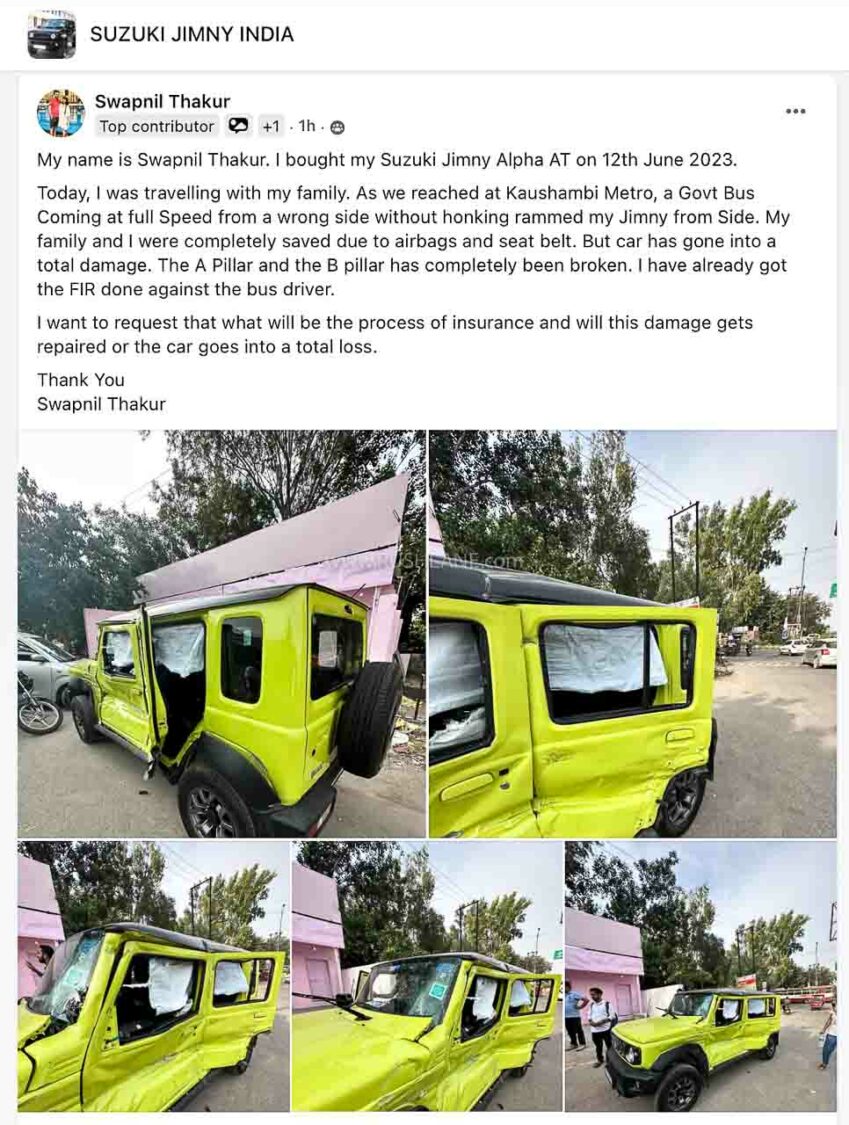

“I bought my Suzuki Jimny Alpha AT on 12th June 2023. Today, I was travelling with my family. As we reached at Kaushambi Metro, a Govt Bus Coming at full Speed from a wrong side without honking rammed my Jimny from Side. My family and I were completely saved due to airbags and seat belt. But car has gone into a total damage. The A Pillar and the B pillar has completely been broken. I have already got the FIR done against the bus driver,” said As said by Swapnil Thakur.

“I want to request that [sic] what will be the process of insurance and will this damage gets repaired or the car goes into a total loss.

Reviving the Roadworthy: How an Insurance Adjuster Directs a Car’s Return to Life

In the wake of Swapnil Thakur’s collision involving his Suzuki Jimny, questions about insurance claim process, vehicle assessment, repair feasibility evaluation, and potential total loss scenario arise. Grasping these complexities during an insurance claim can be daunting. Here’s an overview for car owners facing such circumstances.

The journey from a damaged vehicle to restoration hinges on meticulous evaluation by an insurance adjuster. Repair is a viable avenue if costs remain below about 75 percent of the car’s insured declared value (IDV) or market value. A thorough assessment scrutinises both mechanical and physical facets. The objective is to ascertain if the car can be safely restored to its pre-damaged condition.

Crunching Numbers, Ensuring Safety: The Repair Calculus of an Insurance Adjuster

Initial Appraisal: Evaluate damage extent, covering bodywork and vital components.

Cost Estimate: Estimated expenses encompass part replacements and labor charges.

Safety Check: Reinstate safe, roadworthy conditions.

Upon approval, adept mechanics meticulously restore the vehicle using authentic parts and adhering to manufacturer specifications.

Beyond Repairs, Bidding Farewell – Total Loss Verdict in Vehicle Damage

Alternatively, a “total loss” scenario surfaces if repair costs notably surpass the car’s value, generally exceeding 75 percent of IDV. In cases of severe collisions or significant structural impairment, a “constructive total loss” might transpire if repair expenses surpass the car’s value.

Within this context, Return to Invoice (RTI) coverage holds significance. For potential total loss scenarios, RTI ensures the insurance payout isn’t solely tied to depreciated IDV. Instead, it aligns with the original invoice price, offering substantial compensation in cases of irreparable damage or theft.