Bajaj Pulsar has regained the No 1 position in the 150cc to 200cc motorcycle segment – Beating the likes of Apache and Unicorn

The Indian motorcycle industry’s 150cc to 200cc segment faced significant challenges in September 2023, with a year-on-year sales decline of 17.03%. The latest sales figures indicate shifting preferences among Indian motorcycle enthusiasts and the impact of economic factors on the market.

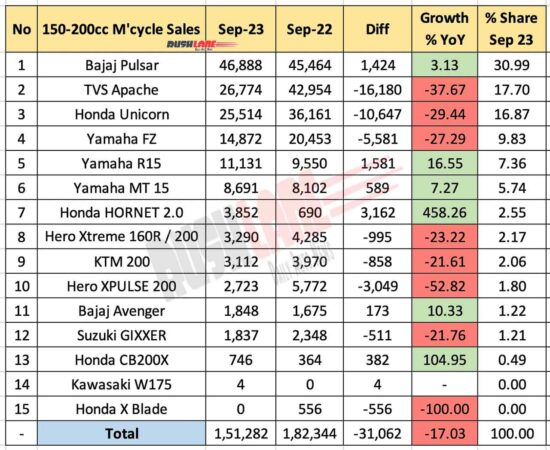

Top 10 Motorcycles 150cc to 200cc Sep 2023 – Bajaj Pulsar Tops the Charts

Bajaj Pulsar regained its leading position in the 150cc to 200cc segment, with 46,888 units sold in September 2023. While this represents a modest 3.13% year-on-year growth, it commands a 30.99% market share in the segment. Bajaj’s consistent performance can be attributed to its established reputation and diverse range of offerings in this segment.

TVS Apache and Honda Unicorn have both witnessed a significant drop in sales compared to September 2022. TVS Apache sales plummeted by 37.67% with 26,774 units sold, while Honda Unicorn recorded a 29.44% decline with 25,514 units sold. These numbers reflect the growing competition and changing consumer preferences that have affected these once-popular models.

Yamaha FZ and R15 Face Challenges

Yamaha’s FZ and R15 also faced challenges in September 2023. Yamaha FZ saw a 27.29% decrease in sales, with 14,872 units sold, while the R15 managed to grow by 16.55% year-on-year, selling 11,131 units. Despite the decline in FZ sales, the R15 showed resilience and maintained a 7.36% market share.

A surprising standout in the segment was Honda Hornet 2.0, which recorded an impressive 458.26% year-on-year growth, selling 3,852 units. This growth can be attributed to its competitive pricing and attractive features, making it a popular choice among budget-conscious buyers. Other notable players in the 150cc to 200cc segment include Hero Xtreme 160R / 200, KTM 200, Hero XPULSE 200, and Bajaj Avenger, all of which experienced varying degrees of decline in sales compared to the previous year.

Impact of Economic Factors and Looking Ahead

The decline in motorcycle sales within this segment can be partially attributed to economic factors, including rising fuel prices and inflation, which have put pressure on consumers’ purchasing power. Additionally, the ongoing global semiconductor shortage has disrupted production schedules for several manufacturers, leading to supply chain challenges.

The motorcycle industry is expected to face continued challenges in the 150cc to 200cc segment in the coming months. Manufacturers are likely to respond with innovative marketing strategies and product offerings to adapt to changing consumer preferences and the evolving economic landscape. Despite the current downturn, the Indian motorcycle market remains highly competitive, with manufacturers striving to create value for customers and maintain their market share. As the industry navigates these challenges, it will be interesting to see how the landscape evolves in the months to come.