FADA sales analysis showed off a 6.29 percent YoY and 2.14 percent MoM growth in two wheeler retail sales in August 2023

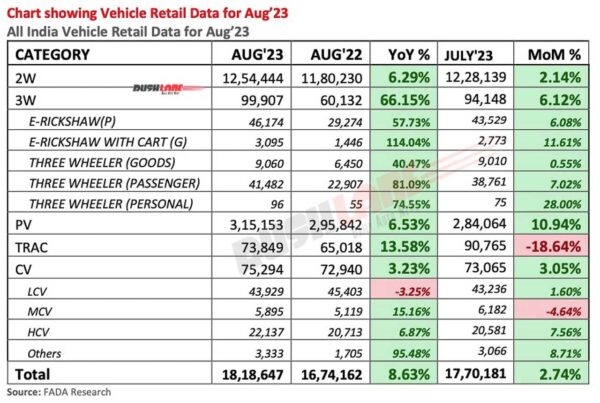

Outstanding sales growth was seen across the automotive sector in August 2023. Several favourable factors led to this and the trend is expected to continue through the upcoming festive season. On a Year-on-Year (YoY) basis, two wheeler retail sales improved by 6 percent while passenger vehicle retail sales were higher by 6.5 percent. CVs and three wheeler sales grew by 3 percent and 66 percent respectively.

Vehicle Retail Sales Aug 2023 – FADA

Speaking exclusively of two wheeler sales in the past month, total sales stood at 12,54,444 units, up 6.29 percent over 11,80,230 units sold in August 2022. MoM sales also improved by 2.14 percent from 12,28,139 units sold in July 2023.

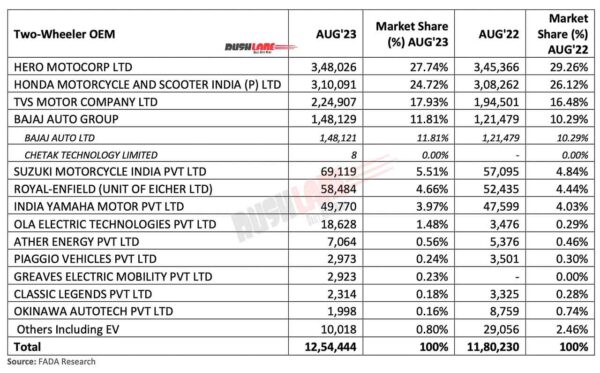

Hero MotoCorp took the lead with 3,48,026 unit retail sales last month, this was a growth over 3,45,366 units sold in August 2023. Market share however, dipped to 27.74 percent from 29.26 percent YoY. Taking MoM retail sales into account, the company reported a de-growth from 3,61,291 units sold in July 2023. At No. 2 on the retail sales list as released by FADA, Honda sales grew marginally to 3,10,091 units in August 2023, from 3,08,262 units sold in August 2022. Hero MotoCorp and Honda were the only two automakers in this segment to account for sales above the 3 lakh unit mark.

TVS Motor sales saw outstanding growth on a YoY basis to 2,24,907 units, up from 1,94,501 units sold in August 2022. It was the TVS iQube, the electric vehicle in the company lineup, which contributed heavily to these sales. Market share also improved to 17.93 percent from 16.48 percent YoY. Retail sales of Bajaj Auto Limited grew to 1,48,129 units in August 2023. This was over 1,21,479 units sold in August 2022. The company also saw a growth in market share to 11.81 percent from 10.29 percent YoY.

Suzuki and Royal Enfield Retail Sales Growth

Lower down the sales list was Suzuki with 69,119 units sold in the past month, up from 57,095 units sold in August 2022. Market share improved to 5.51 percent from 4.84 percent YoY. It was followed by Royal Enfield, a leader in the mid-size motorcycle segment, with 58,484 unit sales last month, a growth over 52,435 units sold in August 2022. It was the company’s diverse portfolio of bikes in the sub-350cc and above-350cc categories, which contributed to this growth.

India Yamaha Motors was up next, also reporting YoY growth in retail sales to 49,770 units in August 2023, up from 47,599 units sold in August 2022. Ola Electric and Ather, two electric two wheeler makers have both seen significant growth in retail sales in August 2023. Ola sales improved to 18,628 units, substantially higher when compared to 3,476 units sold in August 2022. Three new models S1 Air, the S1 Pro Gen2 and S1 were rolled out last month in three trim levels that will spearhead sales in the months ahead.

Ather Energy has also seen sales improve to 7,064 units from 5,376 units sold in August 2022. The company introduced 3 new scooters in August 2023 and gears up for Ather 450S to take on the OlaS1, Bajaj Chetak and TVS iQube.

Piaggio, Okinawa Sales Decline August 2023

Two wheeler retail sales declined for Piaggio to 2,973 units in August 2023 from 3,501 units sold in August 2022. Greaves Electric reported retail sales at 2,923 units while Classic Legends also saw its sales dip to 2,314 units in the past month from 3,325 units sold in August 2022. Okinawa Autotech also reported a significant YoY de-growth in retail sales which fell from 8,759 units sold in August 2022 to just 1,998 units in the past month. There were other electric two wheeler ORMs in this list that saw retail sales fall to 10,018 units in August 2023 from 29,056 units sold in August 2022.