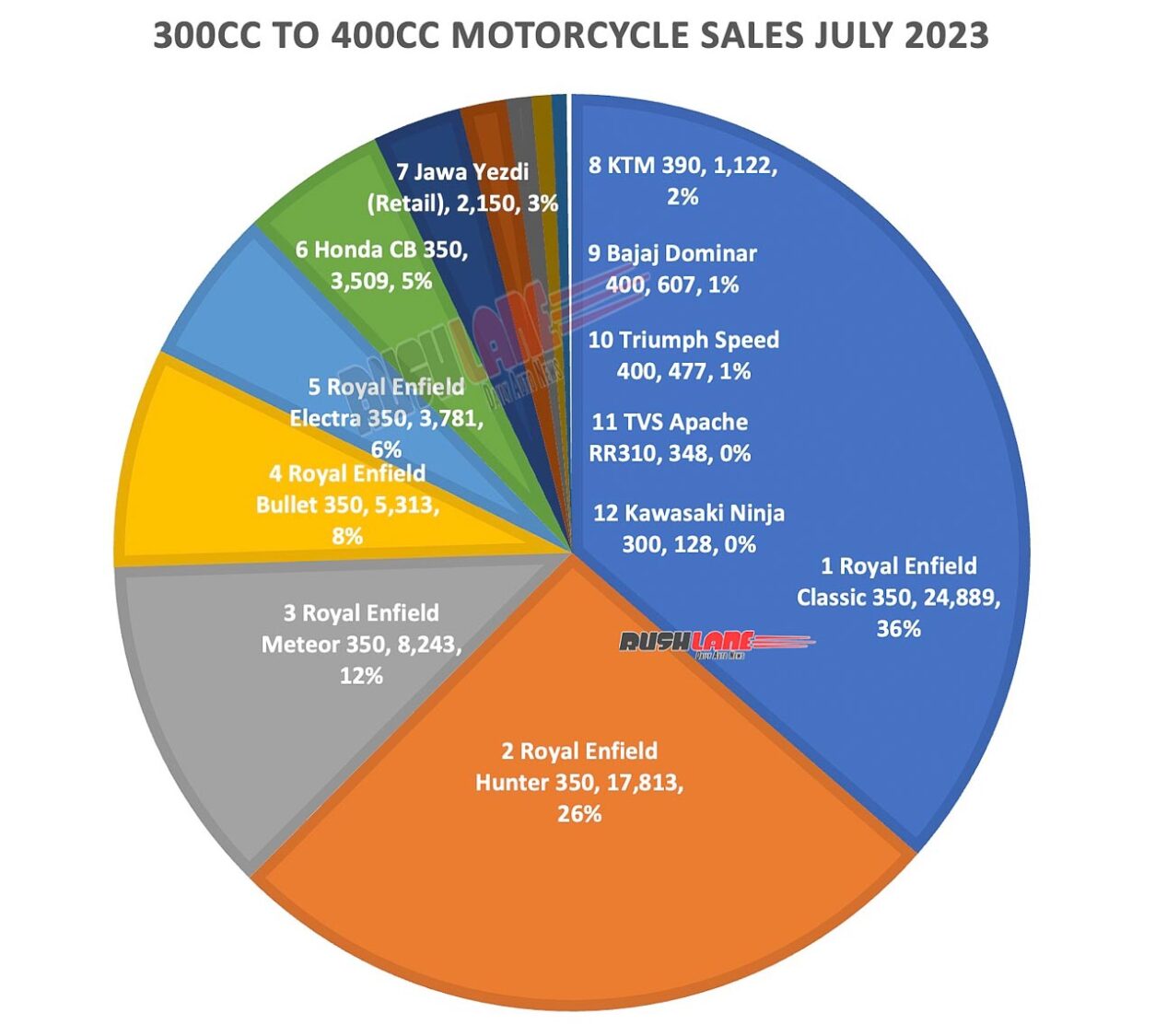

Royal Enfield maintains its stronghold in the segment with 87.8% market share in July 2023

The Indian motorcycle market has undergone a remarkable evolution, with mid-sized motorcycles in the 300cc to 400cc segment garnering significant attention. This category strikes a balance between power, affordability, and versatility, appealing to a wide range of riders.

Year-on-Year (YoY) Comparison: July 2023 vs. July 2022

In this blog, we present a comprehensive analysis of motorcycle sales in the 300cc to 400cc segment in India for July 2023. The month also highlights the arrival of new Triumph Speed 400 in the segment.

A year-on-year comparison between July 2023 and July 2022 reveals the robust growth trajectory of the 300cc to 400cc motorcycle segment. July 2023 witnessed total sales of 68,380 units, signifying an impressive 39.65% increase from the 48,964 units sold in July 2022. This substantial growth underscores the burgeoning demand for mid-sized motorcycles within the Indian market.

Key Insights:

Royal Enfield’s Prominence: Royal Enfield’s motorcycles continue to exert dominance in this segment, with the Classic 350 at the forefront. Boasting 24,889 units sold in July 2023, the Classic 350 achieved a notable 7.17% YoY growth, firmly securing its position as the segment leader.

New Entrant’s Impact: The Royal Enfield Hunter 350, a recent entrant to the market, made a considerable impact with 17,813 units sold. This newcomer played a pivotal role in the segment’s growth, capturing a substantial 26.05% market share.

Consistent Performers: Other Royal Enfield models, including the Meteor 350, Bullet 350, and Electra 350, maintained consistent sales figures. Modest fluctuations imply a steady and enduring demand for these models.

Emergence of Competitors: Honda’s CB 350 experienced an impressive 24.12% YoY growth, indicating a growing acceptance of brands beyond Royal Enfield in the segment. This demonstrates the evolving tastes of Indian consumers.

Challenges for Select Brands: Brands like Jawa Yezdi, Kawasaki, and TVS faced certain challenges in the year-on-year comparison, resulting in negative growth rates. However, the KTM 390 witnessed a remarkable 127.13% YoY growth, potentially due to its positioning as a performance-oriented motorcycle.

Month-on-Month (MoM) Comparison: July 2023 vs. June 2023

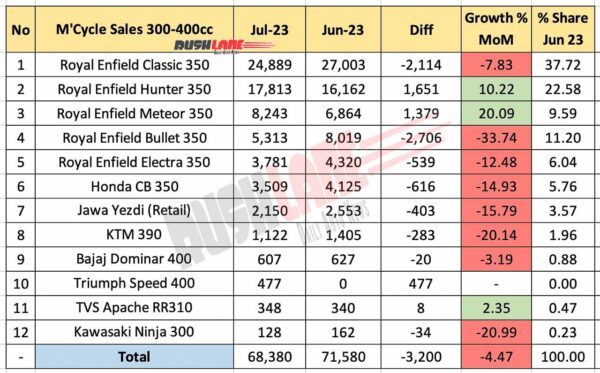

When comparing motorcycle sales from July 2023 to those from June 2023, a decline in overall sales becomes apparent. The aggregate sales for July 2023 amounted to 68,380 units, marking a 4.47% decrease in contrast to the 71,580 units sold in June 2023.

Key Observations:

Shifts in Sales: The Royal Enfield Classic 350, while still leading the pack, experienced a 7.83% decline in sales MoM, suggesting a fluctuating consumer preference.

Positive Spikes: The Royal Enfield Hunter 350 and the Meteor 350 both saw growth MoM, indicating sustained interest in these models. The Hunter 350, in particular, witnessed a 10.22% growth in sales.

Challenges for Dominar and KTM: The Bajaj Dominar 400 and KTM 390 faced negative MoM growth, possibly due to market saturation or competition from other models.

New Player on the Scene:

In July 2023, a notable addition to the segment was the Triumph Speed 400, making its debut in the Indian market. Recording 477 units in its very first month of sales, the Triumph Speed 400 brought diversity to the segment and further intensified competition.

Conclusion

The analysis of motorcycle sales in the 300cc to 400cc segment in India for July 2023, as compared to July 2022 and June 2023, offers insights into a dynamic and evolving market. While Royal Enfield maintains its stronghold, the influx of new models and the growth of alternative brands reflect shifting consumer preferences. Furthermore, the introduction of the Triumph Speed 400 and soon to be launched Scrambler 400, underscores the segment’s expansion and diversification. As these trends continue to shape the Indian motorcycle market, it will be fascinating to witness how manufacturers adapt and innovate to meet the evolving demands of consumers.