Tata Motors saw the highest CV retail sales in September 2023 despite a YoY de-growth

Commercial Vehicle (CV) retail sales in September 2023 as released by Federation of Automobile Dealers Association (FADA) saw a 4.87 percent YoY growth. Reasons for its growth could be attributed to emphasis being shown by the Central Government in terms of infrastructure development while a boost in the tourism industry has also led to increased demand for buses. The e-commerce boom has also led to a surge in demand for both delivery vans and smaller commercial vehicles for quick and efficient distribution.

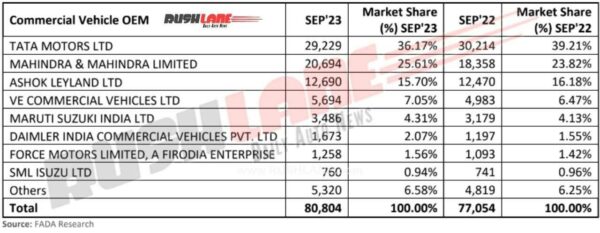

Commercial Vehicle Retail Sales September 2023

Total CV retail sales stood at 80,804 units in September 2023. This was a 4.87 percent YoY growth from 77,054 units sold in September 2022 while MoM sales improved by 7.32 percent over 75,294 units sold in August 2023. In this segment, LCV sales dipped by 1.76 percent to 46,213 units from 47,043 units YoY though it was a MoM growth of 5.20 percent from 43,929 units sold in August 2023.

The MCV segment saw a YoY growth of 8.45 percent to 5,623 units from 5,185 units though MoM sales dipped 4.61 percent. HVC sales have seen both YoY and MoM growth of 11.11 percent and 14 percent respectively to 25,237 units. Tata Motors was the highest-selling commercial vehicle manufacturer in September 2023 even as retail sales dipped to 29,229 units, down from 30,214 units sold in September 2022. Market share also fell to 36.17 percent from 39.21 percent YoY.

Besides Tata Motors, every other manufacturer has posted a YoY growth. At No. 2 was Mahindra with 20,694 unit retail sales last month. This was a growth of over 18,358 units sold in September 2022 with a market share going up to 25.61 percent from 23.82 percent YoY. Mahindra has seen outstanding demand for its Bolero Maxx Pick-up, sales of which touched the 1 lakh unit milestone in September 2023.

Mahindra had launched Bolero Maxx Pik-Up City on August 10th, 2022. Ashok Leyland has seen marginal growth in CV retail sales on a YoY basis. Sales increased to 12,690 units in August 2023 from 12,470 units sold in September 2022. To mark the company’s 75th anniversary event in Chennai, Ashok Leyland unveiled a hydrogen fuel cell bus. This is India’s first fuel cell bus that will commercially ply on country’s roads.

The company will be supplying around 10 such hydrogen fuel cell buses to NTPC, for use in Leh and Ladakh. VE Commercial Vehicles also saw a growth in retail sales to 5,694 units in September 2023 from 4,983 units sold in September 2022. Market share currently stands at 7.05 percent, up from 6.47 percent held in September 2022.

Maruti Suzuki, Daimler, Force Motors, SML Isuzu

Lower down the list was Maruti Suzuki with 3,486 unit sales in September 2023. This was a growth over 3,179 units sold in September 2022. A leading model in the company’s CV lineup is the Maruti Suzuki Super Carry. It is a mini truck available in petrol, and CNG variants used as a mini loading and pickup truck.

Retail sales of Daimler India also improved to 1,673 units with a 2.07 percent market share. This was against 1,197 unit retail sales in September 2022 when market share stood at 1.55 percent. It was followed by Force Motors with 1,258 unit sales last month, up from 1,093 units sold in September 2022.

SML Isuzu sales also increased to 760 units from 741 units on a YoY basis. There were others on the list that added 5,320 units to total CV retail sales last month to command a 6.58 percent market share. It related to a YoY growth of over 4,819 units sold in September 2022 when market share had stood at 6.25 percent.

Words from FADA President

Sept’23 showcased a resilient CV segment, observing a noticeable demand in coal, cement and general market load sectors, with the passenger carrier segment also experiencing a favourable uptick. This positive trend can be attributed to the adequate deployment of funds from the Central Government towards Infrastructure development, which fostered an environment for bulk deals, especially in Tippers and government sectors. Furthermore, there was a discernible improvement in market sentiment post-Covid, supporting healthy traction in HCVs, Buses and LCVs and signalling a revitalized tourism market.