Tata Motors has seen outstanding demand for its electric vehicle lineup which grew at the rate of 57 percent YoY in September 2023

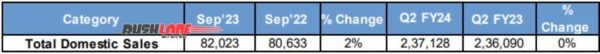

Tata Motors sales in September 2023 saw the company report a 3 percent de-growth in terms of passenger vehicles while its commercial vehicle segment posted a 4 percent increase in sales. Total domestic sales (PV+CV) stood at 82,023 units in September 2023 as compared to 80,633 in September 2022 relating to a 2 percent YoY growth. Tata Motors domestic sales in August 2023 had stood at 76,261 units. It was, however, a flat Q2 sales which had stood at 2,36,090 units in Q2 FY23 to increase only marginally to 2,37,128 units in Q2 FY23.

Tata Motors PV Sales September 2023

Taking passenger vehicles into account, Tata Motors sold 44,809 units in domestic markets in September 2023. This figure also included its electric vehicle lineup which currently includes the Tigor EV, Tiago EV, and Nexon EV while there are the four new SUVs coming by early next year. These include Nexon EV facelift, Punch EV, Harrier EV and Curvv EV.

PV domestic sales are related to a 6 percent YoY de-growth when compared to 47,654 units sold in September 2023. It was also a de-growth of 2.7 percent to 1,37,950 units in Q2 FY24 as against 1,42,325 units sold in Q2 FY23. Exports on the other hand improved by 142 percent YoY to 508 units from 210 units sold in September 2022 while Q2 exports were up 88 percent in the FY24 period to 989 units from 526 units shipped in the same period last year.

This took total PV sales to 45,317 units in September 2023, down 5 percent from 47,864 units sold in September 2022 with Q2 FY24 sales down 3 percent to 1,38,939 units from 1,42,851 units sold in Q2 FY23. Electric vehicle sales however did significantly better with 6,050 units sold in the past month, up 57 percent over 3,864 units sold in September 2023 while it also related to a 55 percent growth in Q2 FY 24 to 18,615 units from 12,041 units sold in Q2 FY23.

Tata Motors CV Sales September 2023

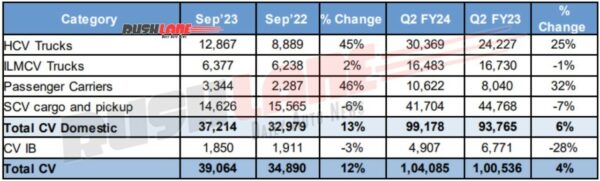

Sales performance across the commercial vehicle segment was somewhat better with the company reporting a 12 percent sales growth in total CVs. This stood at 39,064 units in September 2023, up from 34,890 units sold in September 2022 while Q2 FY24 sales grew 4 percent to 1,04,085 units from 1,00,536 units sold in Q2 FY23.

There was more demand for the company’s HCV trucks, sales of which improved to 12,867 units in the past month from 8,889 units sold in September 2022 while it also related to a 25 percent growth in Q2 FY24 to 30,369 units over sales of 24,227 units in the same period of FY23.

ILMCV sales saw a marginal 2 percent YoY growth to 6,377 units from 6,238 units sold in September 2022 while passenger carriers also saw higher demand with a 46 percent YoY growth to 3,344 units in September 2023 from 2,287 units sold in September 2022. Q2 FY24 sales also grew by 32 percent to 10,622 units from 8,040 units sold in the same period last year.

SCV cargo and pick-up sales dipped 6 percent YoY to 14,626 units in September 2023, while it was also a 7 percent decline in sales in Q2 FY24 to 41,704 units. This took total CV domestic sales up 13 percent to 37,214 units in September 2023 from 32,979 units sold in September 2022 while Q2 FY24 sales grew by 6 percent to 99,178 units from 93,765 units sold in the same period last year.

Exports on the other hand suffered a YoY de-growth of 3 percent to 1,850 units from 1,911 units shipped in September 2023 while Q2 sales were also lower in the FY24 period by 28 percent to 4,907 units.

Words from the manufacturer

Mr. Girish Wagh, Executive Director, Tata Motors Ltd. said, “Tata Motors Commercial Vehicles domestic sales stood at 99,178 in Q2 FY24, 6% higher than Q2 FY23. Our upgraded BS6 phase II product range continues to see good traction as our customers experience benefits of lower total cost of ownership, efficient powertrains, and

enhanced value-additions. M&HCV segment saw a strong growth of 24% over Q2 of FY23, fuelled by continued government infrastructure push, robust replacement demand, and growth in core sectors, along with sustained growth from the e-commerce sector.

We have scaled up our electric bus manufacturing to service orders won from various STUs under CESL’s Grand Challenge. Looking ahead, continuing infrastructure thrust by the Government and improving consumption auger well for the CV industry, while rural demand remains to be a key monitorable, as monsoon has been below average.”