The festive season unlocked great sales potential and top 10 two wheelers for the month October 2023 all registered positive YoY growth

India is one of the largest 2W markets in the world. Leading 2W manufacturers strive to outperform each other in this highly competitive market. For the month of October 2023, it was yet again, Hero Splendor, that took the crown as India’s highest selling two wheeler. The festive season favoured Splendor with 3,11,031 takers last month.

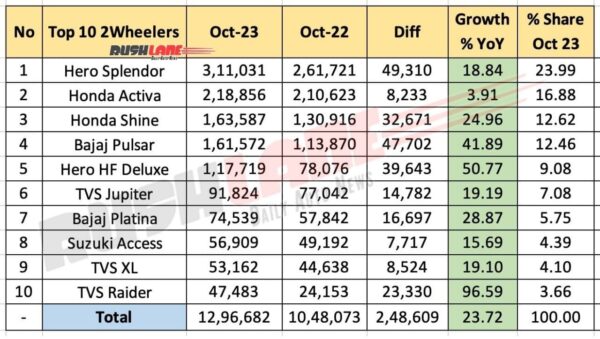

Top 10 Two Wheeler Sales October 2023

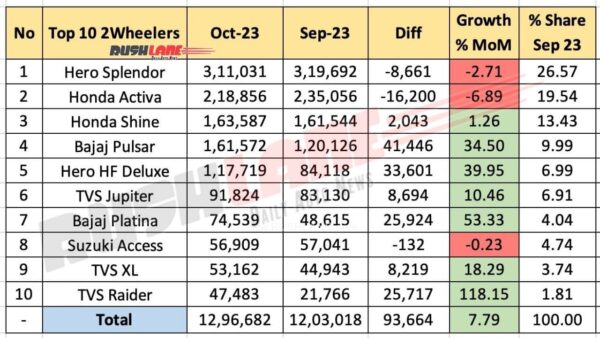

When compared to the 2,61,721 units sold in October 2022 and 3,19,692 units sold in September 2023, Hero Splendor saw 18.84% YoY growth with 49,310 units gain in volume and 2.71% MoM decline with 8,661 units loss in volume. In total, Splendor captivates 23.99% market share among the top 10 two wheeler list, down from 26.57% in September 2023.

Honda Activa is the highest-selling scooter in India like clockwork. During the festive season, Activa saw 2,18,856 takers. This yielded 3.91% YoY growth as opposed to 2,10,623 units sold a year ago and a 6.89% MoM decline compared to 2,35,056 units sold a month before. Activa gained 8,233 units in volume YoY and lost 16,200 units in volume MoM.

Activa’s market share dropped from 19.54% to 16.88% MoM. In 3rd place, we have Honda Shine with 1,63,587 units sold last month. Shine is Honda’s best-selling motorcycle range recording 24.96% YoY growth and 1.26% MoM growth as opposed to 1,30,916 units and 1,61,544 units respectively. Honda Shine holds a 12.62% market share of this list.

In 4th place, we have Bajaj’s popular Pulsar lineup clocking 1,61,572 units. 125cc Pulsars bring the most numbers and hence Bajaj is on the verge of introducing Pulsar P125 soon. With 41.89% YoY growth and 34.50% MoM growth, Bajaj gained 47,702 and 41,446 units in volume YoY and MoM respectively with 12.46% market share, up from 9.99%.

Yamaha missing from the list

Hero’s HF Deluxe took 5th place with 1,17,719 units clocked. Sales fell in the green completely with 50.77% YoY growth and 39.95% MoM growth, while gaining 39,643 and 33,601 units in volume respectively. TVS’ first entrant in this list is Jupiter lineup, making it the company’s best-seller with 91,824 units sold.

Jupiter registered 19.19% YoY growth and 10.46% MoM growth as opposed to 77,042 and 83,130 units sold respectively. Jupiter’s volume growth was 14,782 units YoY and 8,694 units MoM. Next in line is Bajaj Platina with 74,539 takers last month. Platina registered 28.87% YoY and 53.33% MoM growth gaining 16,697 and 25,924 units in volume respectively.

In 8th place, we have Suzuki Access, one of the popular 125cc scooters. With 56,909 buyers during festive season, Access saw 15.69% YoY growth and 0.23% MoM decline. The 9th and 10th spots were occupied by TVS, with XL 100 and Raider 125. This makes TVS the only company in this list to have three entrants.

Where XL sold 53,162 units, Raider sold 47,483 units. YoY growth was 19.10% and 96.59% along with MoM growth of 18.29% and 118.15% respectively. In total, top 10 two wheeler accounted for 12,96,682 units with 23.72% YoY growth and 7.79% MoM growth when compared to 10,48,073 and 12,03,018 units respectively. Volume growth was 2,48,609 units YoY and 93,664 units MoM.